The Dollar weakened against every single G10 currency on Thursday after terrible US economic data fuelled concerns over the health of the largest economy in the world.

Nearly 3.3 million Americans applied for unemployment benefits last week which was more than triple the previous record set in 1982 amid the widespread economic shutdown caused by the pandemic. These figures are certainly a shocking reflecting of how badly the coronavirus has hit theeconomy with the pace of layoffs expected to jump as the United States sinks into a recession. Dollar weakness could become a short term theme if economic data continues to paint a gloomy picture, despite the efforts of the Federal Reserve and Senate to promote stability.

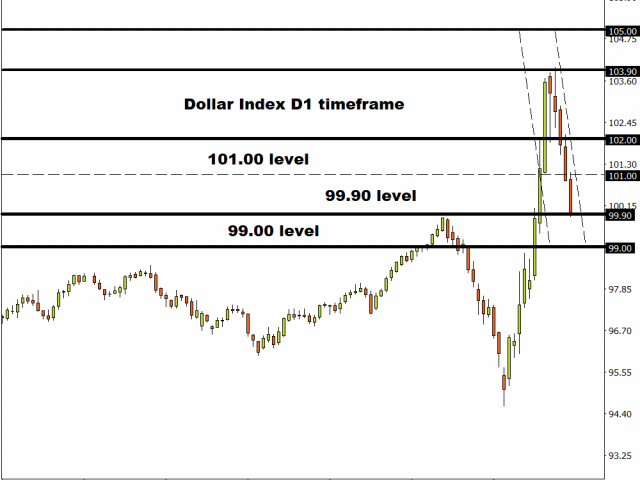

Looking at the technical picture, the Dollar Index is under intense pressure on the daily charts with prices trading around 99.90. A solid daily close below this level could open a path towards 99.00.

Commodity spotlight – Gold

Appetite for Gold improved on Thursday after disappointing US economic data weakened the Dollar and fanned fears around the largest economy in the world entering a recession.

The precious metal has appreciated almost 5% since the start of the week and is positioned to extend gains on risk aversion. Technical traders will continue to closely observe how prices behave around $1630. A solid daily close above this point should open a path back towards $1675.

MyFxtops 邁投 (www.myfxtops.com) -Reliable Forex Copy Trade community, follow the master for free to trade!

Disclaimer: This article is reproduced from the Internet. If there is any infringement, please contact us to delete it immediately. In addition: This article only represents the personal opinion of the author and has nothing to do with Mato Finance The originality and the text and content stated in this article have not been confirmed by this site. The authenticity, completeness and timeliness of this article and all or part of the content and text are not guaranteed or promised. Please refer to it for reference only Verify the content yourself.

Copyright belongs to the author.

For commercial reprints, please contact the author for authorization. For non-commercial reprints, please indicate the source.