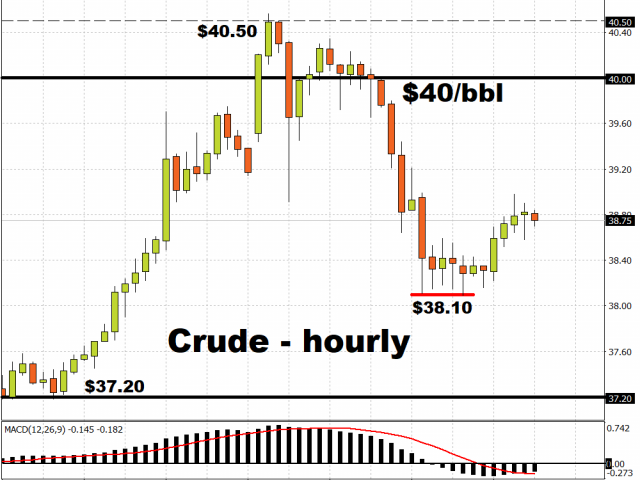

Crude Oil has fallen below the $40/bbl handle and is now trying to pare losses, after Saudi Arabia said it would stop its extra production cuts after this month.

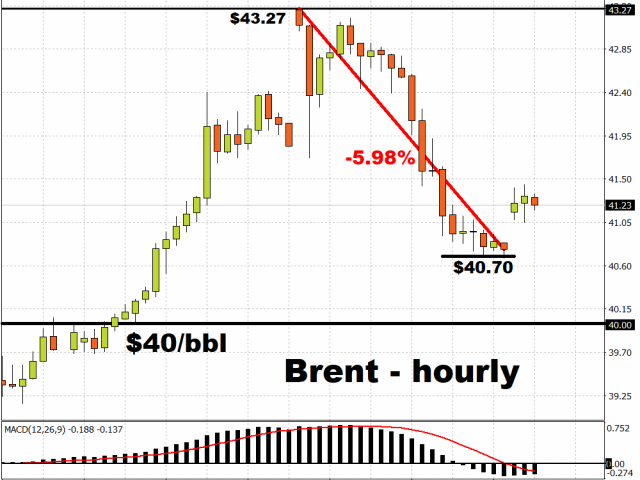

Brent, however, is trying to claw its way further away from the $40/bbl line, having been dragged closer to that psychological level after a six percent drop overnight.

Keeping track of all the twists and turns surrounding OPEC+ has been a tricky task, as investors try and ascertain whether Oil’s presence above $40/bbl remains justified.

Just to recap, on June 6, OPEC+ held a virtual meeting and agreed that its members would lower output by 9.6 million barrels per day in July. Under their previous deal sealed back in April, production levels lowered by 7.7 million barrels per day in July.

On top of the supply cuts agreed to in the April deal, Saudi Arabia and its allies in the Gulf further reduced their output by an extra 1.2 million barrels per day this month. However, on June 8, Saudi Arabia announced that those extra supply cuts will be halted at the end of this month.

In summary, the OPEC+ developments in recent days essentially means that its level of supply cuts will be tapered off beginning July.

Markets initially rejoiced at the thought of lower-for-longer Oil supplies and such prospects sent Oil prices on a rally last week, with Brent futures climbing 11.8 percent in the first trading week of June while WTI futures added 11.4 percent for the same weekly period. However, the announcements over recent days suggest that Oil’s upside appears limited, with Brent futures on Monday halting a run of seven straight days of gains, while WTI futures ended four consecutive daily gains.

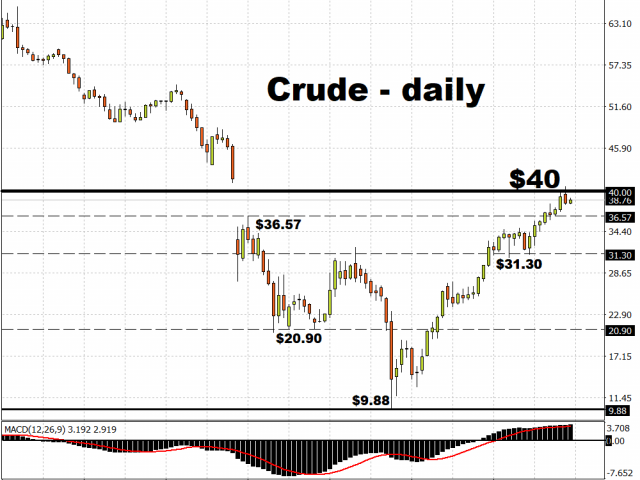

Considering Oil’s gains since May, higher prices could invites shale producers to re-enter the fray and increased global supply would exert more downward pressure on Oil prices. Yet even at these relatively elevated levels, Oil prices are still not high enough to finance the fiscal spending plans of many OPEC+ governments.

Such a conundrum suggests that Crude prices are likely to have a harder time pushing significantly past $40/bbl, and any slippage in the supply-demand dynamics should open the door for the unwinding of recent gains, with the immediate support level seen at $36.57 line.

MyFxtops 邁投 (www.myfxtops.com) -Reliable Forex Copy Trade community, follow the master for free to trade!

Disclaimer: This article is reproduced from the Internet. If there is any infringement, please contact us to delete it immediately. In addition: This article only represents the personal opinion of the author and has nothing to do with Mato Finance The originality and the text and content stated in this article have not been confirmed by this site. The authenticity, completeness and timeliness of this article and all or part of the content and text are not guaranteed or promised. Please refer to it for reference only Verify the content yourself.

Copyright belongs to the author.

For commercial reprints, please contact the author for authorization. For non-commercial reprints, please indicate the source.