• Wall Street races to fresh record highs on trade hopes

• MPs prepare to vote on Boris Johnson’s Brexit deal

• US GDP data under the spotlight

Stocks across Asia were mixed on Friday morning following another record high on Wall Street overnight.

Investors cheered more positive news on the trade front after US Treasury Secretary Steven Mnuchin stated that the United States and China would sign their phase one deal in early January.

Global risk appetite remains unfazed by President Donald Trump’s impeachment, as the Republican controlled US senate is widely expected to vote against removing him from office. European shares are set to open in a mixed fashion as caution kicks in ahead of the US GDP data scheduled for release on Friday afternoon.

Pound bruised by hard Brexit fears

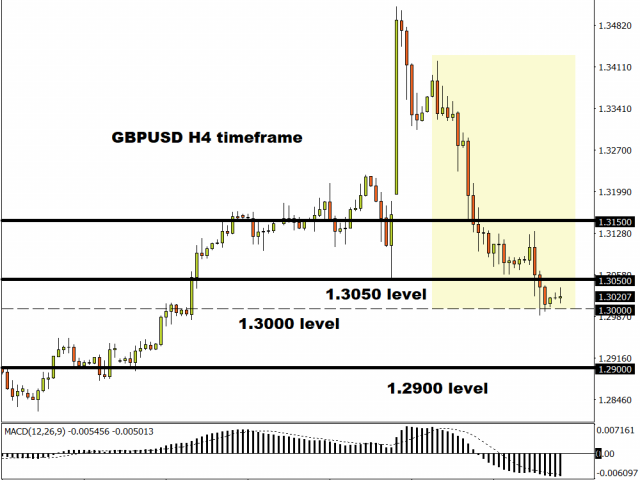

The past few days have certainly not been kind to the British Pound thanks to renewed concerns over a hard Brexit, after Boris Johnson pledged to outlaw an extension of the Brexit transition period at the end of next year. Sterling is now on track for its worst week of the year, after shedding more than 2% versus the Dollar to trade around 1.3020 as of writing.

Members of Parliament will vote on the revised Brexit bill for the first time in the new Parliament on Friday. Given how the Conservatives won an 80-seat majority at the recent general election, Johnson’s Brexit bill is expected to pass today.

With regard to the technical picture, GBPUSD is under pressure on the H4 charts. A breakdown below 1.30 should encourage a decline towards 1.29.

Dollar steady ahead of revised US GDP

The Dollar is holding steady against a basket of major currencies ahead of the final revision of Q3 GDP due later today. Given how markets are forecasting GDP will remain steady at 2.1%, the impact on the greenback should be muted. A major theme influencing the Dollar for the rest of 2019 will be US-China trade developments. Technically, the Dollar Index is seen pushing higher if a breakout above 97.50 is seen.

Commodity spotlight – Gold

Gold could creep higher as investors await further details on the expected US-China trade deal.

Anticipation ahead of the US GDP report and possible Dollar weakness are likely offer additional support to the precious metal in the near term. Given how prices are trading around $1477.50 as of writing, the next key point of interest will be around $1480. A breakout above this level should open a path towards $1500. Alternatively, a breakdown below $1475 may inspire a decline towards $1470.

MyFxtops 邁投 (www.myfxtops.com) -Reliable Forex Copy Trade community, follow the master for free to trade!

Disclaimer: This article is reproduced from the Internet. If there is any infringement, please contact us to delete it immediately. In addition: This article only represents the personal opinion of the author and has nothing to do with Mato Finance The originality and the text and content stated in this article have not been confirmed by this site. The authenticity, completeness and timeliness of this article and all or part of the content and text are not guaranteed or promised. Please refer to it for reference only Verify the content yourself.

Copyright belongs to the author.

For commercial reprints, please contact the author for authorization. For non-commercial reprints, please indicate the source.