Stocks in Asia struggled for direction on Thursday a day after Christmas, as markets in Hong Kong and Europe remained closed for the holiday.

The movements across global currency markets were also muted amid thin trading volumes with investors finding comfort on the side lines. Given how the economic calendar on Thursday is void of any Tier 1 economic releases, global equity and currency markets will trade in tight ranges.

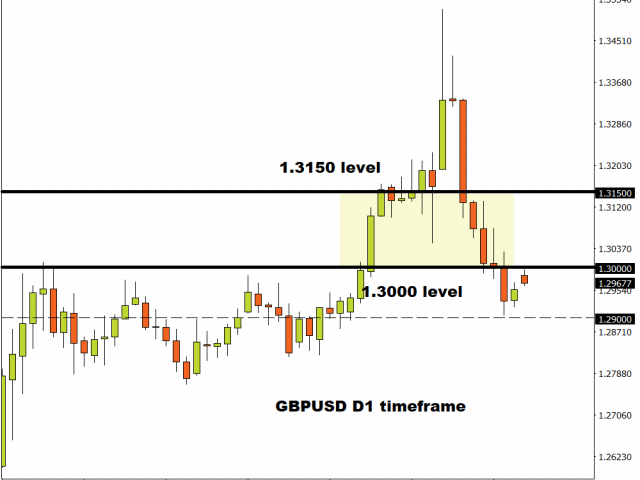

Pound trapped below 1.30?

The past few days have certainly not been kind to the British Pound which trading below 1.30 as of writing.

Concerns over the United Kingdom leaving the European Union without a Brexit deal by the end of 2020 continue to haunt investor attraction towards the Pound. The GBPUSD is under intense pressure on the daily charts. Sustained weakness below 1.30 should open a path towards 1.29 in the near term.

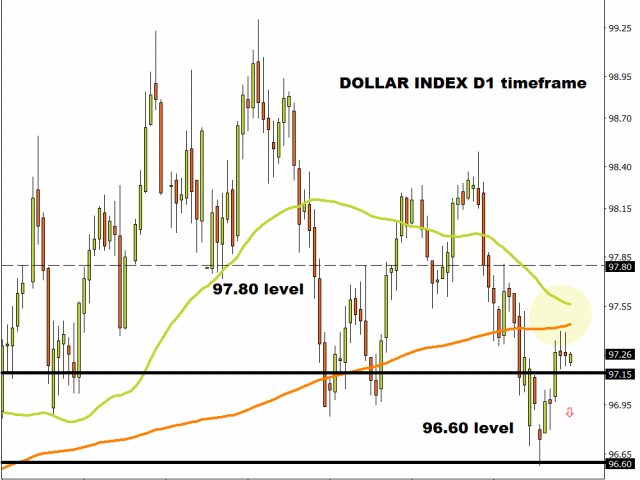

Dollar Index eyes 97.00

Appetite towards the Dollar remains influenced by US-China trade developments, global risk sentiment and monetary policy speculation.

The Dollar is positioned to weaken against a basket of major currencies if trade optimism reduces appetite for safe-haven assets. Focusing on the technical picture, the Dollar Index is under pressure on the daily charts. A breakdown below 97.00 should open a path towards 96.60.

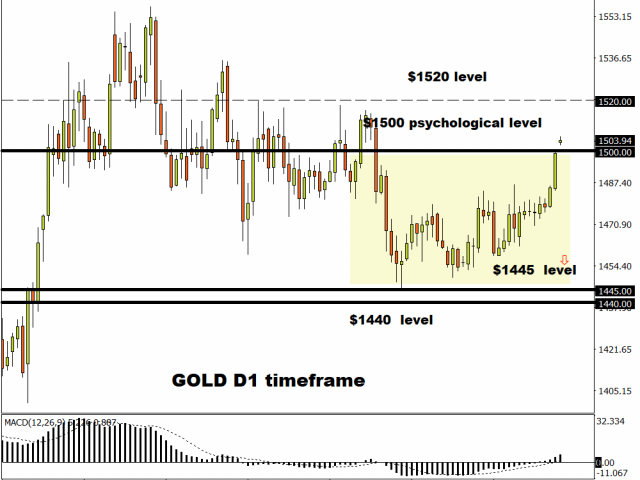

Gold shines despite market optimism

Gold is on route to concluding 2019 on an incredibly positive note, gaining over 17% since the start of the year.

It will be interesting to see whether the precious metal will be able to shine through the trade optimism and easing fears over slowing global growth. The improving market mood may limit the metals upside potential.

From a technical standpoint, Gold is trading above the psychological $1500 level. A solid daily close above this point should encourage an incline towards $1520.

MyFxtops 邁投 (www.myfxtops.com) -Reliable Forex Copy Trade community, follow the master for free to trade!

Disclaimer: This article is reproduced from the Internet. If there is any infringement, please contact us to delete it immediately. In addition: This article only represents the personal opinion of the author and has nothing to do with Mato Finance The originality and the text and content stated in this article have not been confirmed by this site. The authenticity, completeness and timeliness of this article and all or part of the content and text are not guaranteed or promised. Please refer to it for reference only Verify the content yourself.

Copyright belongs to the author.

For commercial reprints, please contact the author for authorization. For non-commercial reprints, please indicate the source.