- Asian stocks rebound as investors reassess US-Iran faceoff

- Oil surrenders gains as markets await Iran’s response

- US ISM non-manufacturing data in focus

- Gold retreats from six-year high

Asian shares jumped on Tuesday morning as investors re-evaluated the risk of a full-blown conflict between the United States and Iran.

A sense of optimism over the global economy coupled with US-China trade deal hopes is lifting the market mood while shaking off geopolitical concerns. However, the US-Iran faceoff will remain a geopolitical risk that presents unwelcome levels of uncertainty to financial markets. Heightened tensions in the Middle East are poised to fuel negative sentiment, ultimately denting appetite for riskier assets. Market players are likely to adopt a ‘wait and see’ approach until more clarity and direction is offered on this development.

Is the Oil rally built on shaky foundations?

Oil prices fell more than 1% on Tuesday as investors reconsidered the likelihood of Middle East supply disruptions amid the US-Iran faceoff.

WTI Crude and Brent have both gained over 3% year-to-date as the US-Iran tensions sparked fears over negative supply shocks in the markets. Given how the Middle East is home to major oil-producing countries, the threat of supply disruptions has offered a boost to oil in the near term.

However, geopolitical tensions may not be enough to keep oil prices elevated in the medium to longer term. Continued oil upside faces multiple obstacles in the form of rising US Shale production and weak oil demand growth in the face of renewed US-China trade tensions. Although geopolitical shocks could offer a short-term boost, developments revolving around US-China trade talks and global growth remain the primary drivers influencing Oil’s outlook.

Dollar steady ahead of ISM data

All eyes will be on the pending US ISM non-manufacturing data for December which is forecasted to print at 54.5.

A report that meets or exceeds expectations should boost optimism over the US economy, consequently supporting the Dollar. Technical traders will continue to closely observe how the Dollar Index trades around the 96.50 regions. A rebound towards 97.00 could be on the cards if 96.50 proves to be a reliable support level.

Commodity spotlight – Gold

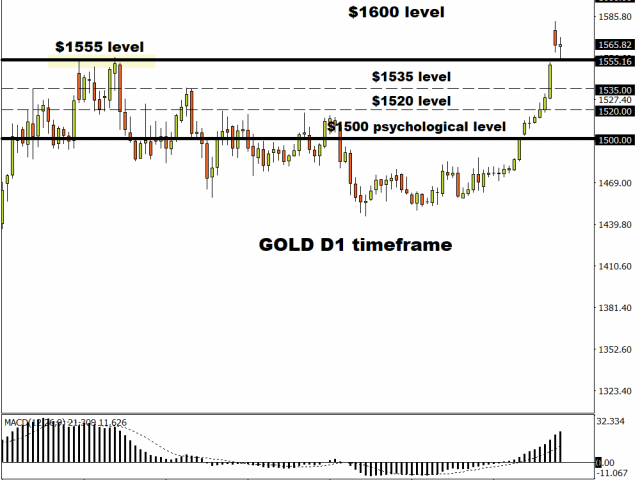

Gold pared some of its gains after hitting a six-year high on Monday, although its finding support at the $1560 psychological level for the time being.

Tensions in the Middle East are likely to stimulate risk aversion, consequently boosting investor’s appetite for Gold. Although prices have strong bullish momentum, further upside will depend on how prices react around $1555. The precious metal should trend higher towards $1600 as long as $1555 proves to be reliable support. Alternatively, a breakdown below this level may open the door towards $1535.

MyFxtops 邁投 (www.myfxtops.com) -Reliable Forex Copy Trade community, follow the master for free to trade!

Disclaimer: This article is reproduced from the Internet. If there is any infringement, please contact us to delete it immediately. In addition: This article only represents the personal opinion of the author and has nothing to do with Mato Finance The originality and the text and content stated in this article have not been confirmed by this site. The authenticity, completeness and timeliness of this article and all or part of the content and text are not guaranteed or promised. Please refer to it for reference only Verify the content yourself.

Copyright belongs to the author.

For commercial reprints, please contact the author for authorization. For non-commercial reprints, please indicate the source.