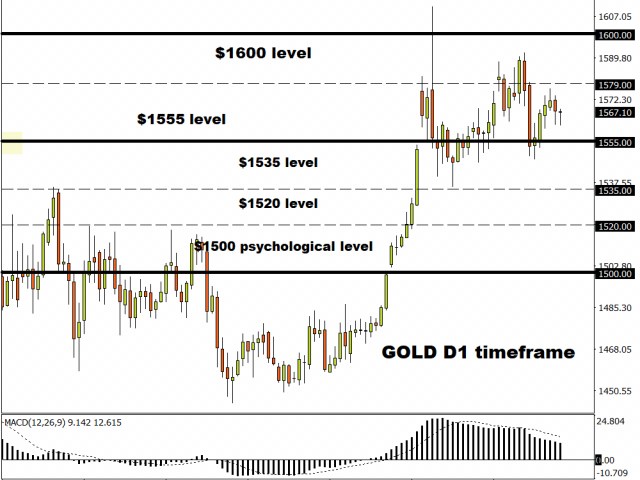

Gold struggled to shine on Wednesday as demand for safe-haven assets dropped on signs the spread of the coronavirus outbreak in China may be slowing.

A sense of optimism and hope that the worst of the virus outbreak may have passed is boosting global sentiment, with the pendulum swinging in favour of risk. The improving market mood should dim Gold’s allure with $1555 acting as the next key level of interest.

If bears can conquer $1555, the precious metal is likely to test $1535. Alternatively, should $1555 prove to be reliable support, Gold could stage a rebound back towards $1579.

Sterling struggles to clear 1.3000

Sterling took a shot at clearing the 1.3000 level on Wednesday with pricing peaking around 1.2990 before quickly retreating down.

In the absence of any negative Brexit-related headlines, Sterling will be driven by the Dollar’s valuation, UK fundamentals and price action. The GBPUSD remains bearish on the daily charts with strong resistance at 1.3000. Sustained weakness below this level should trigger a decline back towards 1.2900 and 1.2830.

If bulls can conquer 1.3000, the GBPUSD could rally towards 1.3150.

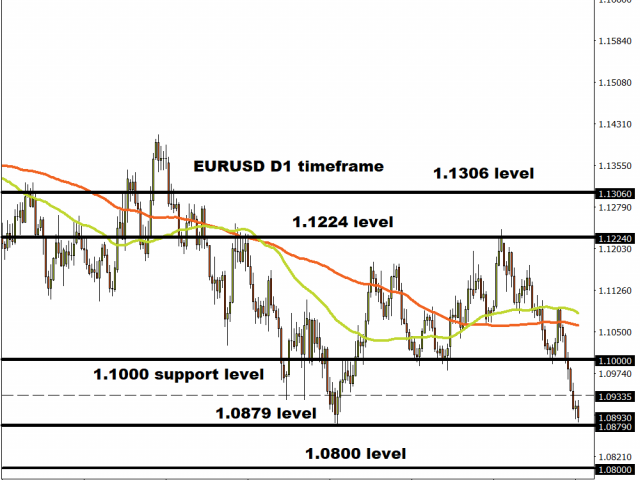

EURUSD sinks towards 1.0879

The Euro has weakened against every single G10 currency today thanks to disappointing economic from Europe.

Investors who were looking for a clean opportunity to attack the Euro were handed the opportunity on a golden platter after Industrial production in the Euro Area plunged 4.1 percent from a year earlier in December 2019. The Euro has weakened over 0.3% against the Dollar today with prices trading around 1.0885 as of writing. A breakdown below the 1.0879 support level should signal a steeper decline with 1.0800 acting as the next key support level.

MyFxtops 邁投 (www.myfxtops.com) -Reliable Forex Copy Trade community, follow the master for free to trade!

Disclaimer: This article is reproduced from the Internet. If there is any infringement, please contact us to delete it immediately. In addition: This article only represents the personal opinion of the author and has nothing to do with Mato Finance The originality and the text and content stated in this article have not been confirmed by this site. The authenticity, completeness and timeliness of this article and all or part of the content and text are not guaranteed or promised. Please refer to it for reference only Verify the content yourself.

Copyright belongs to the author.

For commercial reprints, please contact the author for authorization. For non-commercial reprints, please indicate the source.