Equities are set to continue hogging the limelight over the week ahead, as investors will be wondering if the correction in stocks may eventually give way to a bear market. Given that a fair amount of the coronavirus-related pessimism has been discounted over recent sessions, the selloff from here on out however may not imitate the same ferocious pace that we saw last week. At the time of writing, most Asian stocks are in the green while Dow Jones futures are positive.

Human toll from coronavirus outbreak to cloud economic outlook

The PMI readings from around the world are not expected to provide enough resistance to stem the tide of risk aversion in the markets. The human toll from Covid-19 is set to compound the murky global economic outlook, considering that new countries have reported their first coronavirus deaths over the weekend.

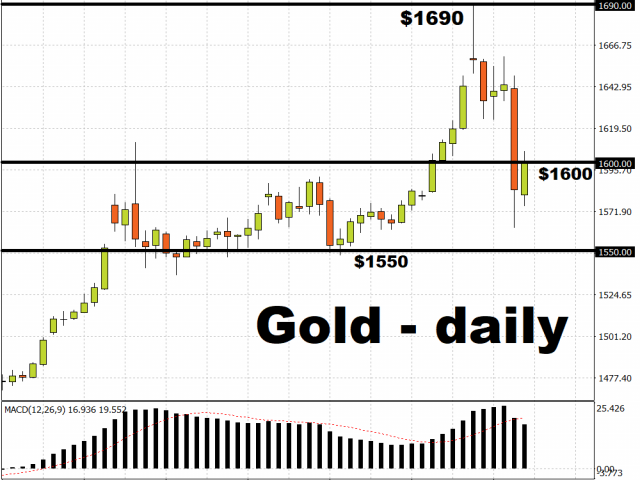

With Gold now making its way back towards the psychologically-important $1600 level, the risk-off theme is expected to remain dominant over investor sentiment, until the coronavirus outbreak can show material signs of stabilising.

Resilient US data could help restore US Dollar

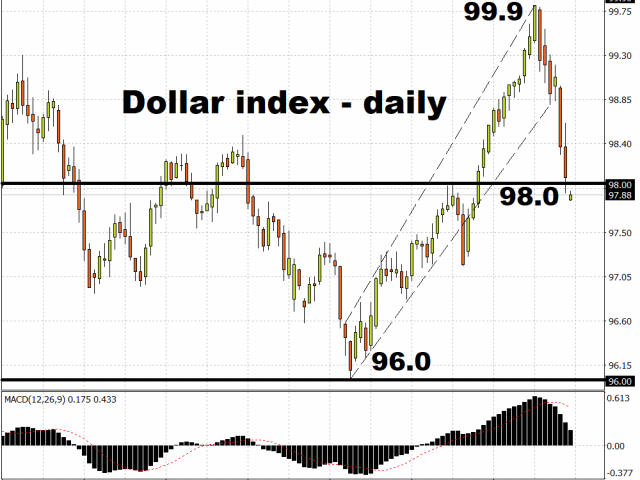

The Dollar index has weakened below the 98 psychological level, as investors drastically shifted their expectations for the number of Fed rate cuts in 2020. The Fed funds futures now price in three 25-basis point cuts to US interest rates by the end of the year. Still, given the menu of February US data due out this week, from the ISM manufacturing figures later today to Friday’s non-farm payrolls data, a resilient showing in any of these economic indicators could prompt the Dollar index to recover some of its recent losses.

MyFxtops 邁投 (www.myfxtops.com) -Reliable Forex Copy Trade community, follow the master for free to trade!

Disclaimer: This article is reproduced from the Internet. If there is any infringement, please contact us to delete it immediately. In addition: This article only represents the personal opinion of the author and has nothing to do with Mato Finance The originality and the text and content stated in this article have not been confirmed by this site. The authenticity, completeness and timeliness of this article and all or part of the content and text are not guaranteed or promised. Please refer to it for reference only Verify the content yourself.

Copyright belongs to the author.

For commercial reprints, please contact the author for authorization. For non-commercial reprints, please indicate the source.