Explosive levels of market volatility are becoming the new normal, as conflicting themes force the sentiment pendulum to swing between extremes.

This phenomenon has been witnessed throughout the trading week, as coronavirus fears clashed constantly with hopes for new global monetary and fiscal measures. Risk aversion made an unwelcome return on Friday, as Asian shares fell deep into the red, tracking steep losses from Wall Street overnight. Disruptions to global businesses from the coronavirus outbreak are becoming more apparent, and this is fueling fears of a virus-driven global economic slowdown. The negative mood is likely to hit European markets as investors avoid riskier assets in favour of safe-haven instruments like the Japanese Yen and Gold.

Will February’s US jobs report rescue the Dollar?

The Greenback is struggling to nurse deep wounds inflicted by the Federal Reserve’s emergency 50 basis point rate cut on Tuesday.

Mounting expectations over the world’s most powerful central bank cutting interest rates again at its March 17-18 meeting has added insult to injury, and this continues to be reflected in the Dollar’s poor performance this week. Friday’s potential market shaker will be the monthly US jobs report for February, which should offer crucial insights into the health of the US labour market and whether the coronavirus is having an impact. The US economy is projected to have created 175k jobs in February with average earnings up by 0.3%, while the unemployment rate is expected to remain unchanged at 3.6%.

Given how the CME’s Fed tool currently shows a 100% probability of a US interest rate cut at the meeting later this month, a question on the mind of many investors is whether a blockbuster jobs report will sway the Fed from pulling the trigger.

Focusing on the technical picture, the Dollar Index is under pressure on the daily charts, with a breakdown below 96.50 opening the door to 95.90.

Oil shaky ahead of OPEC + meetings

A sense of uncertainty over whether Russia will commit to OPEC’s proposal for deeper production cuts is weighing on Oil prices this morning.

OPEC ministers agreed that Oil production should be cut by 1.5 million barrels per day (bbl/d), with OPEC members cutting one million bbl/d and non-OPEC allies, led by Russia, cutting half a million bbl/d. However, Russia has yet to make a decision, which could make things very interesting when crunch talks with non-OPEC members kick-off later today.

If negotiations run smoothly and conclude with both sides committing to deeper cuts, this could support Oil prices in the short term. However, the medium to longer term outlook will remain heavily influenced by coronavirus fears and the negative impacts it will have on fuel demand.

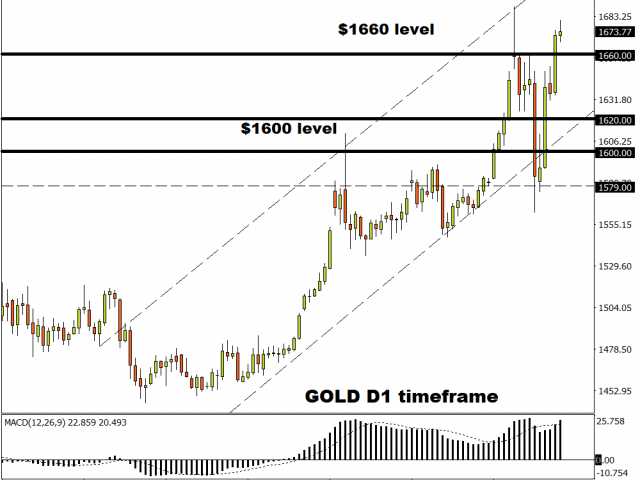

Gold bulls are back in town

Gold has gained over 5% this week thanks to coronavirus fears, speculation around central bank easing, global growth concerns and a weakening Dollar.

The general uncertainty and current risk aversion should support the precious metal due to its safe-haven nature. Going forward, with the Dollar set to weaken on Fed rate cut bets, prices could re-test $1700 if $1681 is breached.

MyFxtops 邁投 (www.myfxtops.com) -Reliable Forex Copy Trade community, follow the master for free to trade!

Disclaimer: This article is reproduced from the Internet. If there is any infringement, please contact us to delete it immediately. In addition: This article only represents the personal opinion of the author and has nothing to do with Mato Finance The originality and the text and content stated in this article have not been confirmed by this site. The authenticity, completeness and timeliness of this article and all or part of the content and text are not guaranteed or promised. Please refer to it for reference only Verify the content yourself.

Copyright belongs to the author.

For commercial reprints, please contact the author for authorization. For non-commercial reprints, please indicate the source.