If horrendous job numbers are unable to faze King Dollar, then what can?

US non-farm payroll employment dropped by a staggering 701,000 in March, the worst in 11 years as the coronavirus outbreak swept through the United States like a crazy tornado. The unemployment rate jumped from 3.5% to 4.4%, its largest over-the-month increase since January 1975 while average hourly earnings rose 0.4% month-on-month.

This disappointing US jobs report continues to illustrate a very gloomy picture and highlights how badly the black swan event is impacting the largest economy in the world. Could this be a bitter appetiser of what to expect data-wise in the next few months? Time will tell.

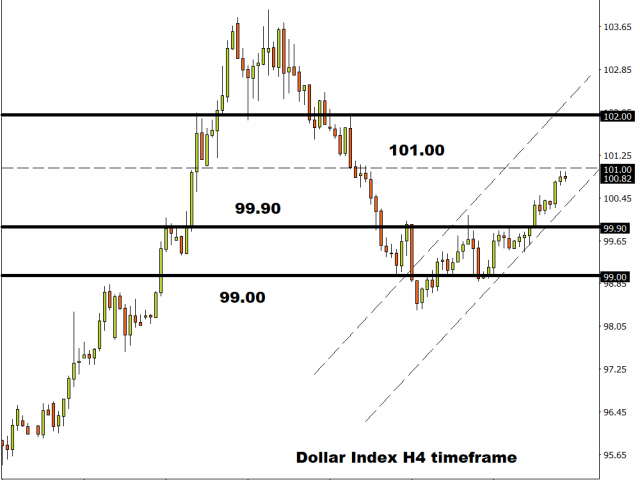

Focusing on the technical picture, the Dollar held steady despite the abysmal jobs report with the Dollar Index (DXY) trading around 100.80. It seems the dollar is still seen as a place of safety despite rising fears over the US economy and this continues to be reflected in price action. Even if economic conditions get really ugly in the United States, it may be able to weather the storm compared to other economies across the world.

MyFxtops 邁投 (www.myfxtops.com) -Reliable Forex Copy Trade community, follow the master for free to trade!

Disclaimer: This article is reproduced from the Internet. If there is any infringement, please contact us to delete it immediately. In addition: This article only represents the personal opinion of the author and has nothing to do with Mato Finance The originality and the text and content stated in this article have not been confirmed by this site. The authenticity, completeness and timeliness of this article and all or part of the content and text are not guaranteed or promised. Please refer to it for reference only Verify the content yourself.

Copyright belongs to the author.

For commercial reprints, please contact the author for authorization. For non-commercial reprints, please indicate the source.