It was another volatile week for financial markets as new coronavirus cases surged in China, parts of the United States and Japan.

The phenomenal market rally sustained by monetary and fiscal stimulus, suddenly appeared unsustainable with risk aversion sending investor sprinting towards Gold, the Japanese Yen and King Dollar.

When markets are down and feeling blue, trust the knight in shining armour to come to the rescue. Although the Fed’s tremendous support to the US economy lifted investor sentiment mid-week, this was overshadowed by coronavirus related concerns. On the bright side, it looks like US consumers have joined the party after retail sales came in more than double the estimate at 17.7% in May.

As the week slowly comes to an end, the question on the mind of many investors is whether the second wave of COVID-19 will end the current rally?

Dollar maintains grip on iron throne….

It has been a mixed week for the mighty Dollar thanks to the return of risk aversion and general caution.

Although the Dollar was able to steamroll the Pound, Euro and Swedish Krona other currencies like the Japanese Yen and Swiss France were able to fight back. Expect the Dollar to pressure G10 currencies in the week ahead as global growth concerns and coronavirus fears trigger another dash for cash.

Looking at the technical picture, the Dollar Index is experiencing a rebound on the daily charts. Although prices trading below the 20 Simple Moving Average, bulls seem to be eyeing 97.80. A breakout above this level may open the doors towards 98.50 and 99.00.

Alternatively, a breakdown below 97.15 may open the doors back towards 96.00.

Euro bulls wave flag of defeat

It has not been the best of trading weeks for the Euro which has weakened against almost every single G10 currency.

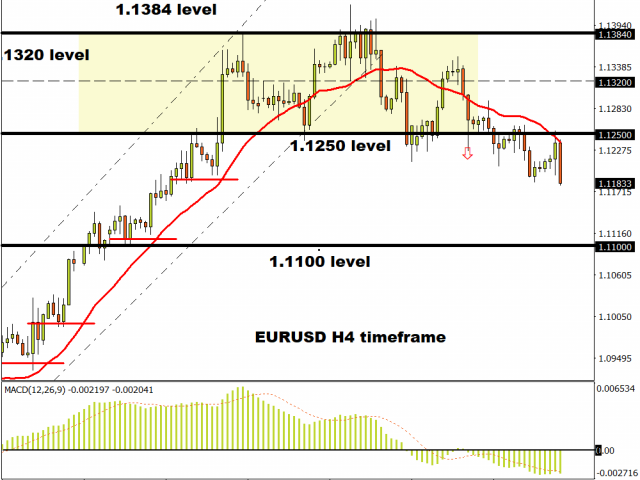

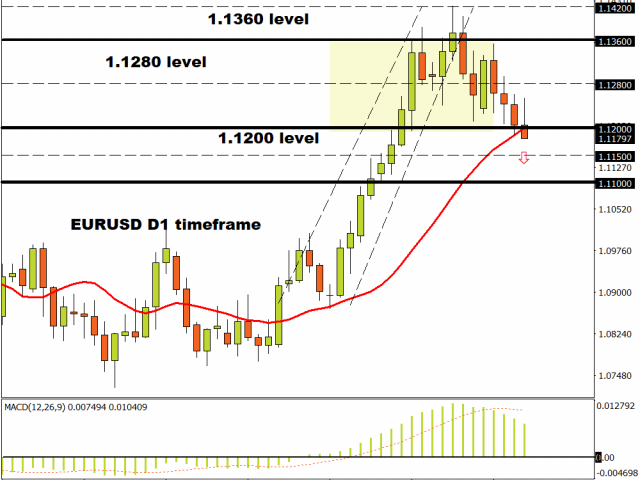

Earlier in the week, we discussed how the Euro was struggling against the Dollar with prices heading towards 1.1200. With this target reached, the next key point of interest for the EURUSD will be found around 1.1100.

A solid weekly close below the 1.1200 may confirm further down in the week ahead.

Pound pummelled and pounded

If you thought the Euro had it bad this week, take a look at the British Pound.

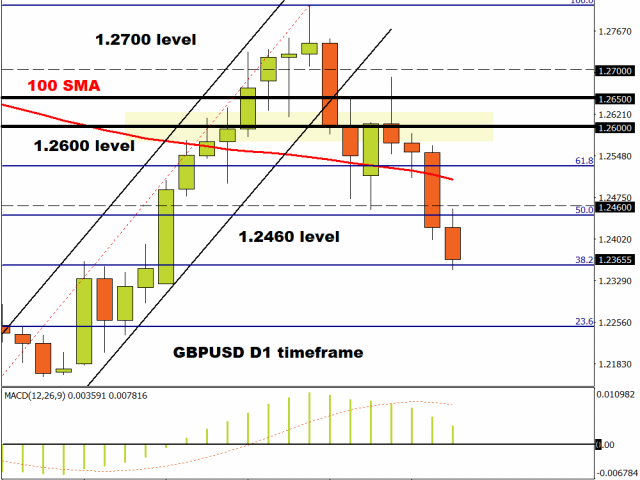

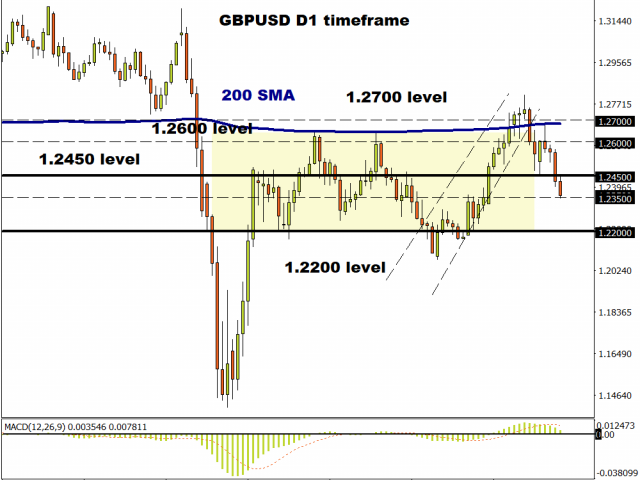

The GBPUSD has tumbled over 300 pips this week thanks to an appreciating Dollar and a central bank that seem to be saving its ammunition for a later date. The BOE was widely expected to leave interest rates left unchanged at 0.1% and increase purchases of government bonds by £100 billion but it seems investors were looking for more action.

Given how the coronavirus has swept through the UK economy like a crazy tornado, there was hope for the BoE to increase QE purchases by £150 – £200 billion. Such a move would lower the interest rates offered on loans and mortgages – ultimately encouraging consumption which remains an engine for growth in the United Kingdom.

Looking at the technical picture, the GBPUSD may tests 1.2200 if a weekly close below 1.2350 is achieved.

MyFxtops 邁投 (www.myfxtops.com) -Reliable Forex Copy Trade community, follow the master for free to trade!

Disclaimer: This article is reproduced from the Internet. If there is any infringement, please contact us to delete it immediately. In addition: This article only represents the personal opinion of the author and has nothing to do with Mato Finance The originality and the text and content stated in this article have not been confirmed by this site. The authenticity, completeness and timeliness of this article and all or part of the content and text are not guaranteed or promised. Please refer to it for reference only Verify the content yourself.

Copyright belongs to the author.

For commercial reprints, please contact the author for authorization. For non-commercial reprints, please indicate the source.