Most Asian assets are set to end the week on a risk-off note, with regional currencies now weaker against the US Dollar, while major stock indices tracked overnight losses on Wall Street. Chinese stocks are taking a breather from their rich vein of form of late, with the Shanghai Composite index and the CSI 300 unable to build on 8 consecutive days of advances. Still, the CSI 300 is trading around a 5-year high, while the Shanghai composite index remains at its highest levels since 2018. The two benchmarks have posted a month-to-date surge of around 15 percent respectively, which far exceeds the MSCI Asia Pacific index’s five percent climb so far in July. US futures are in the red at the time of writing.

While global equities have blissfully ignored the deteriorating economic conditions around the world in the previous quarter, the moment of reckoning could arrive when the US earnings season kicks off next week. The second-quarter results are set to lay bare the pandemic’s impact to a greater extent compared to the previous quarter’s figures, and could prove to be one of Wall Street’s worst. It remains to be seen whether market participants have the stomach to digest such despairing data.

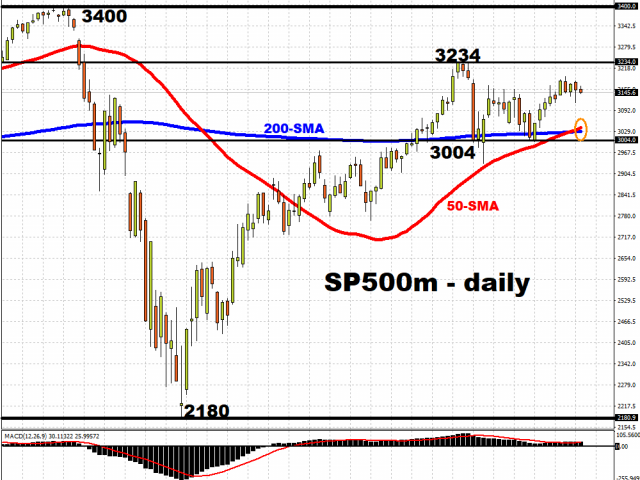

The forward guidance out of these companies however could have a more pivotal role in dictating the near-term market sentiment. After all, investors are desperate for further clarity, considering that four out of five S&P 500 listed companies withheld guidance during the last earnings season. That suggests that the 40 percent climb in the S&P 500 since March 23 has been largely fuelled by blind optimism.

Should greater clarity start feeding through over the coming weeks, that could be the catalyst to shake the S&P 500 out of its tight 230-point range that’s been adhered to since June. Still, given the unprecedented amount of stimulus measures already at work across major economies, one shouldn’t expect any pullback in risk assets to be overly drastic. On the flip side, should the upcoming earnings season bring with it greater optimism surrounding the post-pandemic recovery, that is set to give equity bulls the green light to chase further gains.

Gold remains at highest levels since 2011

Gold remains at highest levels since 2011

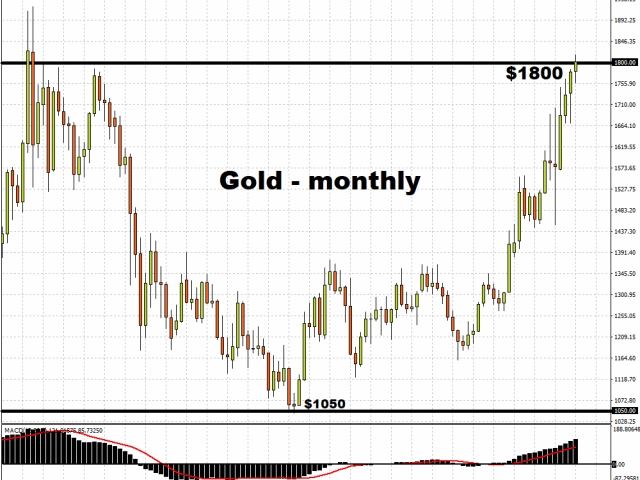

Meanwhile, investors are clearly hedging their exposures to risk, even though Gold prices have dipped below the psychologically-important $1800 level. With Gold on the cusp of five consecutive weeks of gains, the precious metal is reflecting the dynamics between hopes surrounding the global economic recovery and enduring concerns over the persistent nature of the pandemic.

Given the subdued US real yields and the stubborn risk aversion in the markets, this is clearly a supportive environment for Gold, with a repeat of the September 5, 2011 record closing price of $1900.20 in its sights.

Spot Gold could even set a new record high this year if another bolt of risk aversion courses through the markets, especially if the green shoots of the global economic recovery are snuffed out by another round of lockdowns across major economies, or if severe doubts are cast on global policymakers’ ability to support their respective economies. The threat of spiking geopolitical tensions is also lurking in the background, and if it materializes, could serve as another major tailwind for Bullion.

On the other hand, a vaccine would send the all-clear signal for risk assets at the expense of the yellow metal. More concrete signs that the global economy is set for a swifter-than-expected recovery could also pare some of Gold’s recent gains.

MyFxtops 邁投 (www.myfxtops.com) -Reliable Forex Copy Trade community, follow the master for free to trade!

Disclaimer: This article is reproduced from the Internet. If there is any infringement, please contact us to delete it immediately. In addition: This article only represents the personal opinion of the author and has nothing to do with Mato Finance The originality and the text and content stated in this article have not been confirmed by this site. The authenticity, completeness and timeliness of this article and all or part of the content and text are not guaranteed or promised. Please refer to it for reference only Verify the content yourself.

Copyright belongs to the author.

For commercial reprints, please contact the author for authorization. For non-commercial reprints, please indicate the source.