Sterling weakened against the Dollar and most G10 currencies on Tuesday morning after UK economic growth figures massively undershot expectations by increasing a tepid 1.8% in May versus the 5% forecast.

This disappointing rebound from the painful -20.4% contraction witnessed in April reveals that the UK economy is recovering much slower than expected, despite the reopening of construction and manufacturing sectors. Any talks of a V-shaped recovery may be swept under the carpet for the time being, especially if data continues to miss market expectations.

On the bright side, there is a sense of optimism around growth in June and July experiencing a sharper rebound due to the re-opening of non-essential shops, leisure and hospitality sector. Regardless, the cost of coronavirus in the UK has been painfully expensive with the economy contracting 25% during March and April. Any signs of rising coronavirus cases in the United Kingdom could trigger fears of renewed lockdowns, ultimately hitting sentiment and threatening growth.

Appetite towards the British Pound is likely to fall further in the near term, as disappointing growth adds to the negative list of negative themes haunting investor attraction.

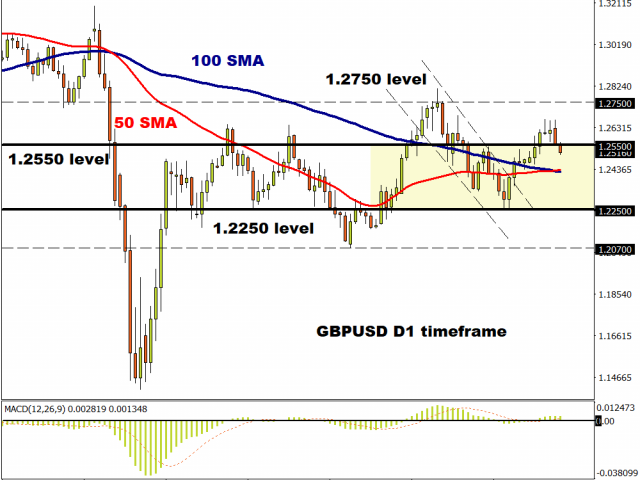

Looking at the technical picture, the GBPUSD is under pressure on the daily charts with prices trading below 1.2550 as of writing. Sustained weakness below this level may open a path towards 1.2400 and 1.2250.

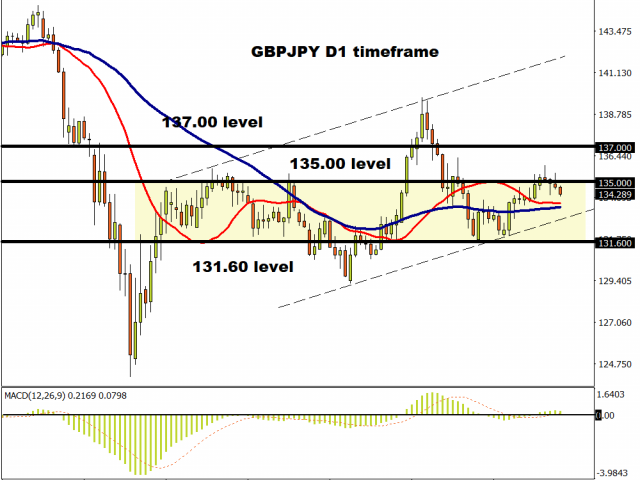

GBPJPY approaches 134.00.

Expect the GBPJPY to trend lower in the short to medium term, especially after UK economic growth disappointed in May.

The currency pair is under pressure on the daily charts with prices approaching the 50 SMA. A solid breakdown below 134.00 may trigger a decline towards the 131.60 support. If prices can break back above 135.00, the GBPJPY has the potential to test 137.00.

EURGBP approaches 0.9100.

Prices seem to be pushing towards the 0.9100 resistance level. A clean break above this point could trigger a move higher towards 0.9100 in the short term.

MyFxtops 邁投 (www.myfxtops.com) -Reliable Forex Copy Trade community, follow the master for free to trade!

Disclaimer: This article is reproduced from the Internet. If there is any infringement, please contact us to delete it immediately. In addition: This article only represents the personal opinion of the author and has nothing to do with Mato Finance The originality and the text and content stated in this article have not been confirmed by this site. The authenticity, completeness and timeliness of this article and all or part of the content and text are not guaranteed or promised. Please refer to it for reference only Verify the content yourself.

Copyright belongs to the author.

For commercial reprints, please contact the author for authorization. For non-commercial reprints, please indicate the source.