- Equity bulls powered by vaccine hopes

- OPEC+ expected to taper production cuts

- Gold firms above $1800

The sentiment pendulum is positioned to swing deeper into ‘risk-on’ territory as markets take heart from vaccine hopes and expectations of further stimulus for pandemic-hit economies.

Wednesday’s trading session has commenced on a positive note, with Asian shares edging higher following news that Moderna’s attempt to produce a coronavirus vaccine was declared safe and produced antibodies in all patients tested in the safety trial. The positive vibe from Asian markets and renewed appetite for risk may power equity bulls in Europe later this morning. With coronavirus vaccine hopes, speculation around more stimulus measures and rebounding growth optimism is likely to keep this party alive, the question is for how long can it be sustained? Given how Q2 earnings are expected to disappoint and coronavirus cases in the United States are now topping 3.5 million, things could get ugly for equity markets. The risk pendulum may then swing back in favour of bears if negative themes in the form of trade uncertainty, geopolitical tensions and fears around global growth trigger a fresh wave of risk aversion.

Will OPEC+ surprise markets?

All eyes will be on the OPEC+ meeting today, as the oil producers are expected to decide on whether to extend the record production cuts of 9.6 million barrels per day (bpd) or taper to 7.7 million bpd starting in August.

In the face of global instability and the uncertainty wrought by the coronavirus pandemic, the cartel enforced record production cuts back in April as the demand for crude evaporated. Initially, the production cuts were planned to run until the end of June, but they were eventually extended to July. Now the question on the mind of many investors is what impact tapering the cuts will have on Oil prices, which appreciated over 30% during the second quarter of 2020. Although the demand for crude has jumped in recent weeks, rising coronavirus cases in the United States along with some cities in other major economies reimposing shutdowns have the potential to hit demand.

Markets seem to be pricing in a taper of production cuts by OPEC+ starting gradually from August. However, should the cartel move ahead with extending the record cuts of 9.6 million bpd beyond this month, this could inject WTI Oil bulls with enough fuel to truly conquer the $40 resistance level.

Commodity spotlight – Gold

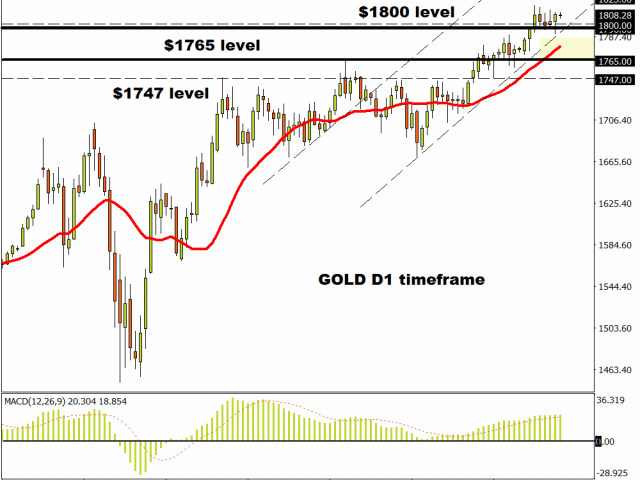

Gold continues to shine above $1800 despite vaccine hopes heightening market optimism and boosting risk sentiment.

It looks like the precious metal is deriving its strength from a weaker Dollar and this could remain a recurrent theme this week.

The technical picture remains heavily bullish on the daily charts as there have been consistently higher highs and higher lows. Prices are trading within a bullish channel, the candlesticks are above the 20-day Simple Moving Average, while the Moving Average Convergence Divergence has crossed to the upside. As long as prices remain above the $1800 level, Gold has the potential to test $1815 and a fresh multiyear high at $1825, respectively. Should $1800 prove to be unreliable support, the precious metal may experience a technical correction back towards the $1765-$1780 region before bulls gather fresh momentum on risk aversion.

MyFxtops 邁投 (www.myfxtops.com) -Reliable Forex Copy Trade community, follow the master for free to trade!

Disclaimer: This article is reproduced from the Internet. If there is any infringement, please contact us to delete it immediately. In addition: This article only represents the personal opinion of the author and has nothing to do with Mato Finance The originality and the text and content stated in this article have not been confirmed by this site. The authenticity, completeness and timeliness of this article and all or part of the content and text are not guaranteed or promised. Please refer to it for reference only Verify the content yourself.

Copyright belongs to the author.

For commercial reprints, please contact the author for authorization. For non-commercial reprints, please indicate the source.