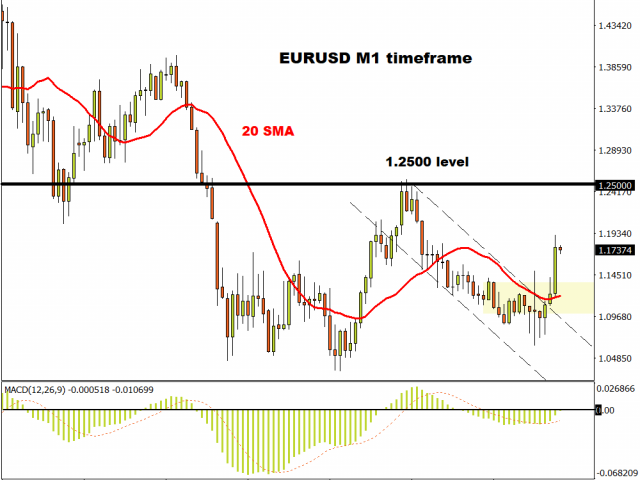

After appreciating more than 4% against the Dollar since the start of July, it looks like the Euro may be tired and ready for a well-deserved retracement over the next few days.

The Euro has stood its ground against most G10 currencies thanks to stabilizing economic fundamentals, falling number of reported coronavirus cases in Europe and EU leaders approving an unprecedented $2.1 trillion coronavirus relief budget. Given how the fundamentals are slightly favouring the Euro and the Dollar weakening to a growing list of negative factors, the medium to longer-term outlook for the EURUSD points north.

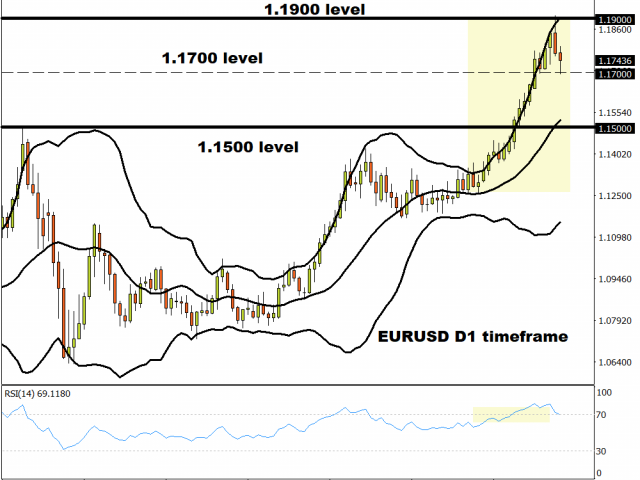

However, prices look heavily overbought in the short term with bears already making an appearance as August kicks off. The candlesticks are hugging the outer skin of the Bollinger bands while the Relative Strength Index is in overbought territory above 70.0. Where the EURUSD concludes this week will be heavily influenced by how prices behave around the 1.1700 support level.

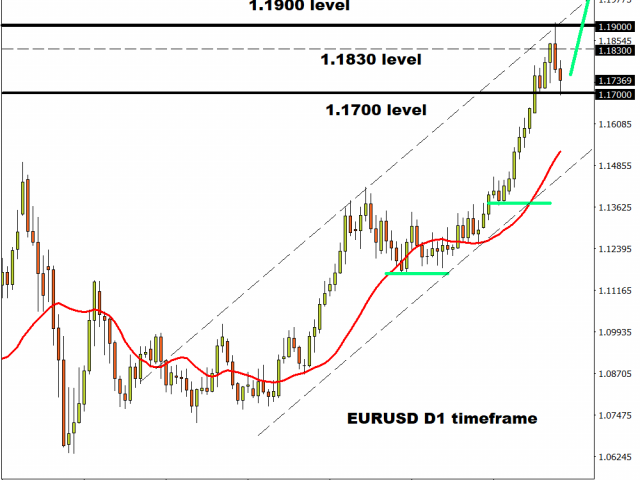

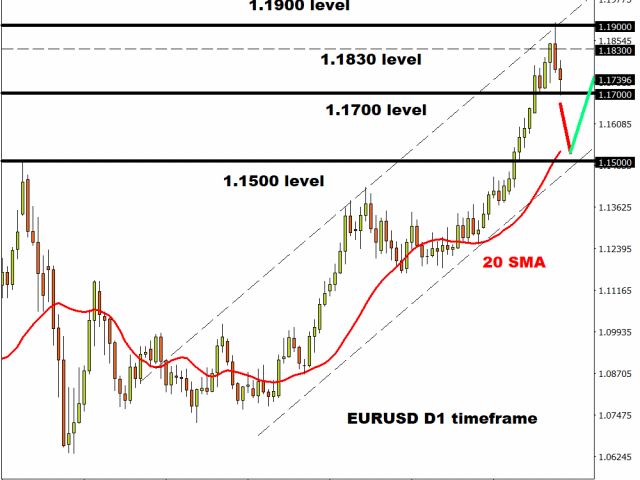

Should this level prove to be reliable support, bullish investors could be given the green light to propel the EURUSD back towards 1.1830 and beyond.

Alternatively, a breakdown below 1.1700 may trigger a steeper pullback towards 1.1500 before the EURUSD continues its journey north.

On the data front, keep a close eye on the ZEW Indicator of economic sentiment for the Euro Area scheduled for released on Tuesday morning. Euro Industrial production data on Wednesday and the second estimation of Q2 GDP which will be published on Friday. With the Euro still sensitive to economic data, the pending reports will certainly play a role in where the currency pair concludes this week.

MyFxtops 邁投 (www.myfxtops.com) -Reliable Forex Copy Trade community, follow the master for free to trade!

Disclaimer: This article is reproduced from the Internet. If there is any infringement, please contact us to delete it immediately. In addition: This article only represents the personal opinion of the author and has nothing to do with Mato Finance The originality and the text and content stated in this article have not been confirmed by this site. The authenticity, completeness and timeliness of this article and all or part of the content and text are not guaranteed or promised. Please refer to it for reference only Verify the content yourself.

Copyright belongs to the author.

For commercial reprints, please contact the author for authorization. For non-commercial reprints, please indicate the source.