Investors will have a lot to digest today, with several key themes set to play out ahead of the weekend. Risk assets are taking a breather from recent gains, with Asian stocks and currencies mostly in the red, while US equity futures dipping into negative territory at the time of writing.

US lawmakers are battling against a self-imposed Friday deadline, and against one another, in a bid to pass the next stimulus package for the US economy. Geopolitical tensions have also been stoked by the Trump administration’s decision to reimpose 10 percent tariffs on some aluminium products imported from Canada beginning August 16, and his executive order to ban TikTok and WeChat in the US in 45 days from now. There’s also the keenly awaited July US non-farm payrolls, which is forecasted to show some 1.48 million jobs being added to the US economy last month.

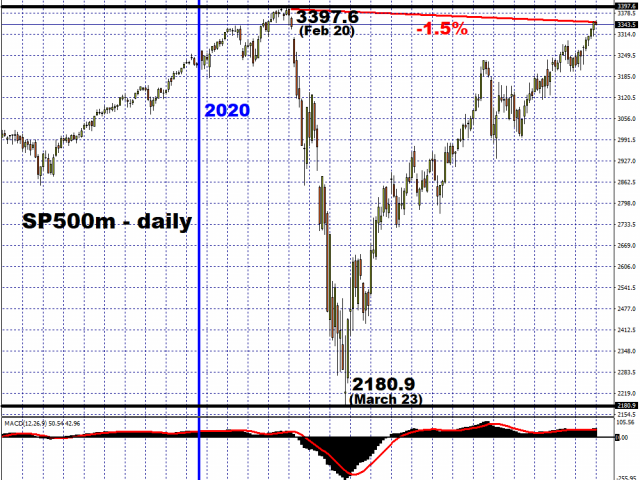

The S&P 500 is currently just over one percent away from its record high, due partly to the optimism that more fiscal stimulus can be agreed upon and passed, potentially by next week. Unemployed Americans could do with a fresh injection of financial support, given that jobless benefits under the previous package ended last month, in order to preserve hopes that the world’s largest economy can keep its still-fragile recovery intact. With President Trump threatening to bulldoze his own plan through, investors are gearing up for a matter of when, rather than if, the next round of fiscal stimulus comes pouring in, which should bode well for US equities.

The upcoming non-farm payrolls print may help shed light on how much more stimulus could be needed in the future. The July jobs figures is expected to unveil a marked slowdown in hiring compared to the two months prior, which may fuel concerns that the US recovery is losing its momentum.

Still, Thursday’s better-than-expected weekly jobless claims figure of 1.19 million, which is the lowest number of applications for US jobless benefits since March, offers hope that the US economy can continue moving into the post-pandemic era. If the US jobs market can stage a sustainable recovery from here on out, that could spur on more risk-on market activity while offering relief for the beleaguered Dollar.

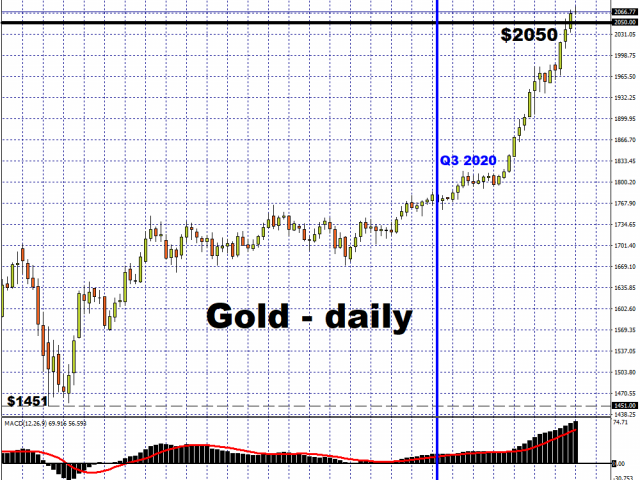

Gold should soon hit $2100

As things stand, the global investment landscape only spells more upside for Gold, which has been on a tear this quarter. The precious metal has surged by over 16 percent since June 30, with the $2100 psychological level within its near-term grasp.

Promises of more incoming stimulus speaks to the persistent economic frailties around the world, which should hearten Bullion bulls. Heightened geopolitical tensions only serve to fuel risk aversion, while Gold prices are ever willing to take full advantage of the weakening Dollar. The precious metal is expected to face little resistance in exploring new record highs in the mid-$2000 region over the coming months.

MyFxtops 邁投 (www.myfxtops.com) -Reliable Forex Copy Trade community, follow the master for free to trade!

Disclaimer: This article is reproduced from the Internet. If there is any infringement, please contact us to delete it immediately. In addition: This article only represents the personal opinion of the author and has nothing to do with Mato Finance The originality and the text and content stated in this article have not been confirmed by this site. The authenticity, completeness and timeliness of this article and all or part of the content and text are not guaranteed or promised. Please refer to it for reference only Verify the content yourself.

Copyright belongs to the author.

For commercial reprints, please contact the author for authorization. For non-commercial reprints, please indicate the source.