It was not a bad start to the trading week for Sterling which appreciated across the board.

The Pound’s positive performance over the past few weeks has certainly defied expectations, especially when factoring how Brexit related uncertainty and shaky economic fundamental from the UK continue to weigh on sentiment.

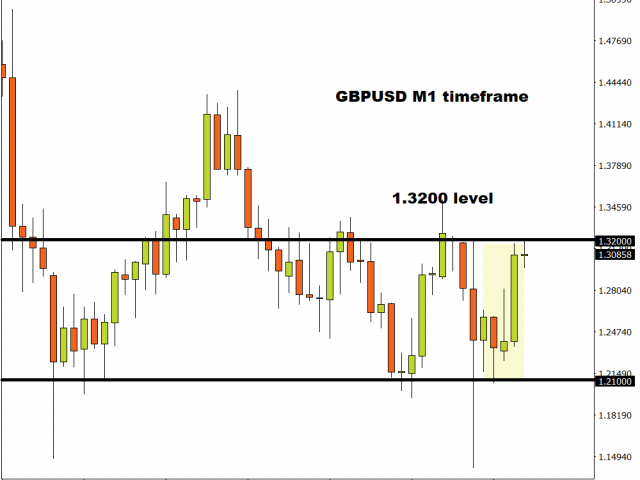

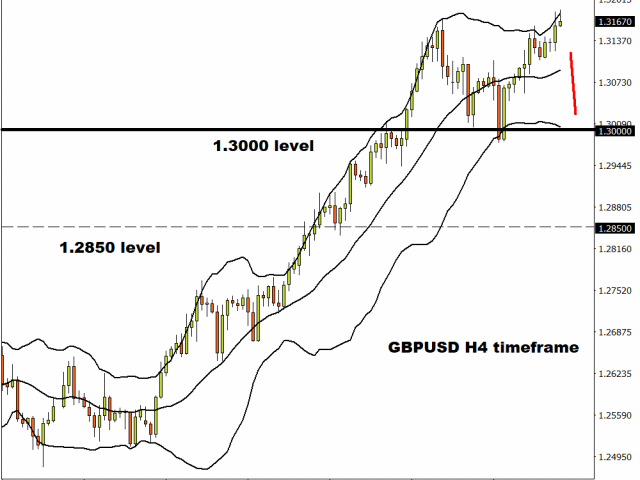

Expect the Pound to be heavily influenced by the upcoming jobs data on Tuesday especially when considering how the government’s £33.8 billion furlough scheme will be coming to an end in October. An increase in unemployment may force the Bank of England to fire its final rate cut bazooka sooner than expected in an effort to stimulate economic growth. Such a development may haunt investor attraction towards the Pound, resulting in the GBPUSD breaking below the 1.3000 support level with the first point of interest rate 1.2850.

Alternatively, a better than expected figure could rekindle buying sentiment towards the Pound with bulls eyeing 1.3200.

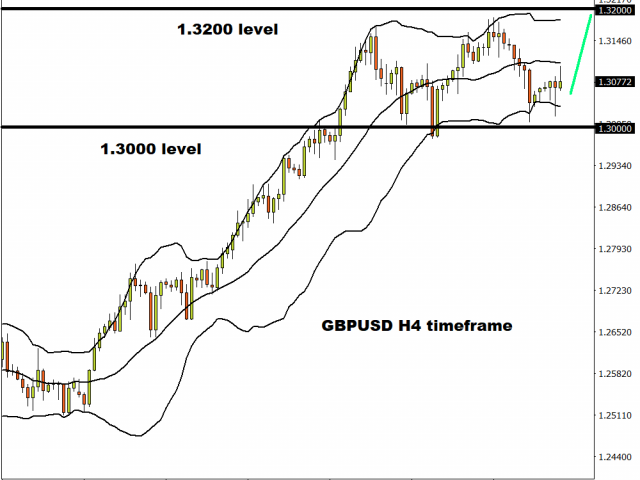

Looking deeper into the technical picture, the GBPUSD remains bullish on the daily charts as there have been consistently higher highs and higher lows. Prices are trading above 20 & 200 Simple Moving Average while the MACD trades to the upside.

A solid breakout above the 1.3200 will confirm that 1.3000 is the new higher low with 1.3300 acting as a medium-term goal for bulls.

MyFxtops 邁投 (www.myfxtops.com) -Reliable Forex Copy Trade community, follow the master for free to trade!

Disclaimer: This article is reproduced from the Internet. If there is any infringement, please contact us to delete it immediately. In addition: This article only represents the personal opinion of the author and has nothing to do with Mato Finance The originality and the text and content stated in this article have not been confirmed by this site. The authenticity, completeness and timeliness of this article and all or part of the content and text are not guaranteed or promised. Please refer to it for reference only Verify the content yourself.

Copyright belongs to the author.

For commercial reprints, please contact the author for authorization. For non-commercial reprints, please indicate the source.