Who would have envisioned that nearly six months after COVID-19 immobilised the global economy and hammered financial markets, US stocks would rise to fresh record highs?

This has been another phenomenal trading week for global markets with US equity bulls stealing the show by propelling the S&P 500 to all-time highs on Wednesday. The tech-heavy Nasdaq joined the party overnight, making a record despite growing signs of economic weakness. Shares in Asia have already rebounded during early trade while European equity futures are climbing thanks to the tech-inspired highs on Wall Street.

Traditionally, rising stock markets are good news and create a sense of confidence over the direction of the economy. However, conditions in the United States over the past few months have not been anything to cheer about with the rebound above 1 million in new US claims for unemployment benefits fueling a sense of pessimism.

With fundamentals being swept under the carpet, equity bulls could seek inspiration from hopes of a possible breakthrough in deadlocked US stimulus talks. Positive vaccine news may also help to boost risk sentiment.

Dollar sulks into the weekend

In currency markets, the US dollar just can’t shake off the blues. The burst of confidence king Dollar displayed following the Federal Reserve minutes on Wednesday is nowhere to be found with the currency on path for its ninth consecutive weekly loss against G10 currencies. There seems to be no love for the Greenback as coronavirus cases rise in the United States, while jitters ahead of November’s presidential elections and the Federal Reserves’ unprecedented level of quantitative easing compound downside pressures.

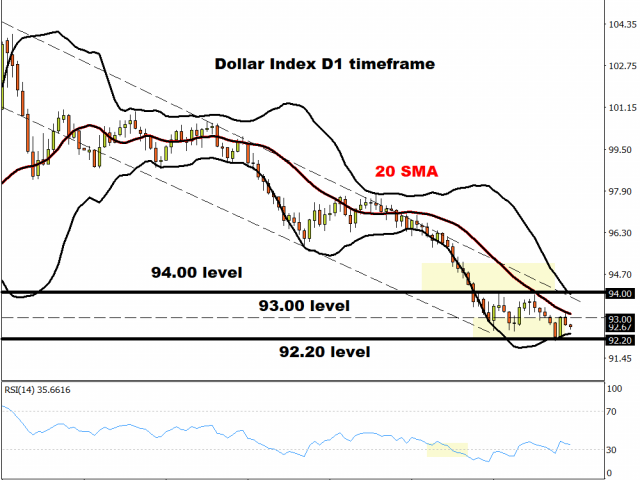

Looking at the technical picture, the Dollar Index is under pressure on the daily charts. Sustained weakness below 93.00 could encourage a decline towards 92.20 in the near term. A breakdown below this level may open a path towards 90.00.

Commodity spotlight – Gold

Gold bulls have been missing in action this week as investors digested the latest Fed minutes which temporarily injected life into the Dollar.

Regardless of recent losses, the fundamentals remain in favour of higher Gold prices with a potential rebound on the cards. A broadly weaker Dollar, negative US yields, pre-election jitters and rising coronavirus cases in the United States are likely to keep Gold shining in the medium to long term.

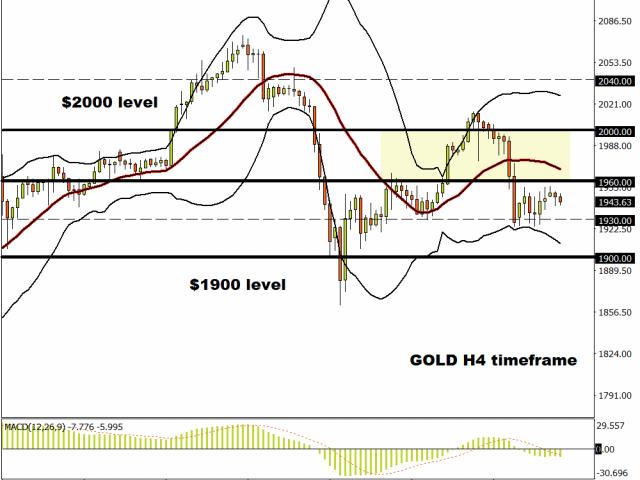

Looking at the charts, prices could edge lower on the four-hourly timeframe. Sustained weakness below $1960 may open a path towards $1930 in the short term. If $1930 proves to be unreliable support, then prices may sink back towards the psychological $1900 level before bulls try to re-enter the scene.

MyFxtops 邁投 (www.myfxtops.com) -Reliable Forex Copy Trade community, follow the master for free to trade!

Disclaimer: This article is reproduced from the Internet. If there is any infringement, please contact us to delete it immediately. In addition: This article only represents the personal opinion of the author and has nothing to do with Mato Finance The originality and the text and content stated in this article have not been confirmed by this site. The authenticity, completeness and timeliness of this article and all or part of the content and text are not guaranteed or promised. Please refer to it for reference only Verify the content yourself.

Copyright belongs to the author.

For commercial reprints, please contact the author for authorization. For non-commercial reprints, please indicate the source.