While the S&P 500 and Nasdaq have been busying themselves with new record highs, the Dollar index (DXY) and Gold have kept their heads down and laid low over recent sessions.

The DXY bounced off the 92.1 support level last week to now stay closer to the 93 psychological mark, as it maintains its month-to-date sideways trend.

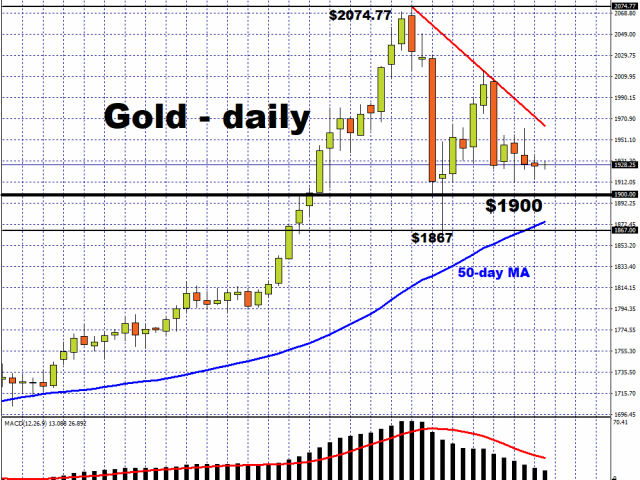

Meanwhile, Bullion prices have been contented staying in sub-$1950 levels, perhaps still reeling from the August 19th drop of 3.67 percent, as well as the 5.69 percent plunge on August 11th.

However, all this could drastically change tomorrow.

On Thursday, global investors will be paying close attention to Federal Reserve chair Jerome Powell’s speech at the virtual Jackson Hole Symposium, which is a key annual gathering of the world’s leading central bankers. Powell is expected to give markets a heads up on the Fed’s new approach to US inflation.

For context, the Fed embarked on a review of its monetary policy framework last year, which is focused on the central bank’s strategy on dealing with inflation. This could mean significant changes are afoot for the Fed’s two percent inflation target, which was first announced back in 2012; a target it has mostly missed in the years since.

So why is this important for Dollar and gold traders?

Keep in mind that the primary driver for the Greenback and Bullion of late has been the shift in expectations surrounding US inflation over the past couple of months. The narrative has been that the Fed would tolerate faster US inflation, which erodes the Dollar’s purchasing power, prompting investors to ditch the Greenback and swarm towards Gold, with the yellow metal traditionally being seen as a hedge against inflation.

On Thursday, markets expect Powell to at least suggest that the Fed is willing to aim for inflation that’s above its two percent target.

Should the Fed chair confirm such a notion during his speech on August 27th, that could shove the Dollar and Gold out of their respective sideways trends, with the former potentially resuming its decline while restoring the precious metal to its upwards trajectory. But if Powell were to disappoint investors with vague words on Thursday, it then sets up the September 15-16 FOMC meeting for when the Fed’s new strategy could be officially unveiled.

As and when such an announcement is made, it could still jolt not just the US Dollar and Gold, but global markets as well. After all, the Fed’s rhetoric matters greatly to the markets. We only need to look at how the Dollar and Gold responded to the July FOMC meeting minutes, which were released on August 19th.

MyFxtops 邁投 (www.myfxtops.com) -Reliable Forex Copy Trade community, follow the master for free to trade!

Disclaimer: This article is reproduced from the Internet. If there is any infringement, please contact us to delete it immediately. In addition: This article only represents the personal opinion of the author and has nothing to do with Mato Finance The originality and the text and content stated in this article have not been confirmed by this site. The authenticity, completeness and timeliness of this article and all or part of the content and text are not guaranteed or promised. Please refer to it for reference only Verify the content yourself.

Copyright belongs to the author.

For commercial reprints, please contact the author for authorization. For non-commercial reprints, please indicate the source.