Words fails to describe the shocking string of events this week!

From global coronavirus cases topping 34 million, to a chaotic presidential debate, EU launching legal actions against the UK and Donald Trump being tested positive for COVID-19. The past few weeks have been wild, surreal and just plain unpredictable with the cocktail of themes placing investors on an emotional rollercoaster ride.

It is just interesting how the risk sentiment pendulum has swung between two extremes this week. On Monday, China’s continued recovery boosted global sentiment and elevated equities across the world!

In the currency markets, the British Pound had 99 problems but negative rates weren’t one after BoE deputy governor Dave Ramsden brushed aside talks of going subzero. After appreciating against every single G10 currency, Sterling was later dragged back to reality after the European Union launched legal action against the United Kingdom over plans to violate last year’s Brexit withdrawal agreement.

Market players hoping for fresh clarity on US policies from President Trump and Democrat rival Joe Biden were disappointed as the debate turned into a fierce verbal cage match. Not only did the debate fail to yield a clear winner but it even ramped up fears over a potentially delayed outcome to the 2020 presidential election.

The mood across markets turned cautious mid-week following the raucous presidential debate with investors redirecting their attention back towards key economic reports.

As the final quarter of 2020 kicked off, we identified a couple of key risk events ranging from the US presidential elections, Brexit related drama and developments surround the global pandemic.

On the fiscal front, optimism returned over the Administration and Democrats bridging the gap between their respective $1.62trn and $2.2trln new stimulus offers.

It was all about the US jobs report on Friday…..until a wave of risk aversion swept through market following reports that US President Donald Trump First Lady Melania Trump have both tested positive for Covid-19. This development adds another element of uncertainty into the equation and questions the likelihood of the next presidential debate in two weeks taking place.

To end the week, the highly anticipated US jobs report was a mixed bag. Nonfarm payrolls rose by 661,00 in September compared to the 800,000 estimates while unemployment rate beat forecast by dropping 7.9%, better than the 8.2% projection. Although the pace of job growth slowed in September, the disappointment was slightly countered by an upward revision of the August reading. Given how this is the final jobs report before the November election, it may set the tone for the next few weeks.

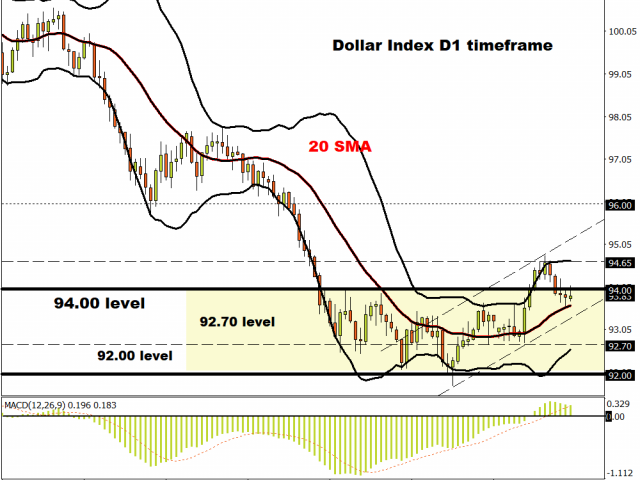

Dollar unfazed by NFP

There is just something about the 94.00 level on the Dollar Index (DXY). Dollar bulls were missing in action this week despite the shocking developments that rocked financial markets. Looking at the technicals, sustained weakness below 94.00 could open the doors towards 92.70 and 92.00.

Japanese Yen boosted by risk-off mood

As risk aversion engulfed financial markets, investors rushed towards the Japanese Yen which appreciated every single G10 currency. Looking at the USDJPY, a weekly close below 105.250 could trigger a decline towards 104.80 and possibly 104.00.

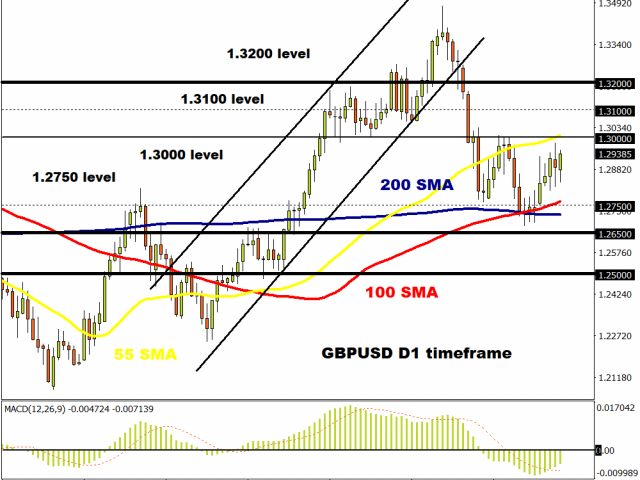

GBPUSD remains in wide range

A classic breakout/down setup is in play on the GBPUSD with support around 1.2650 and resistance around 1.3000. If the Brexit uncertainty haunts investor attraction towards Sterling in the week ahead, prices may slip back towards 1.2750. Alternatively, a breakout above 1.3000 could open the doors towards 1.3100 and 1.3200, respectively.

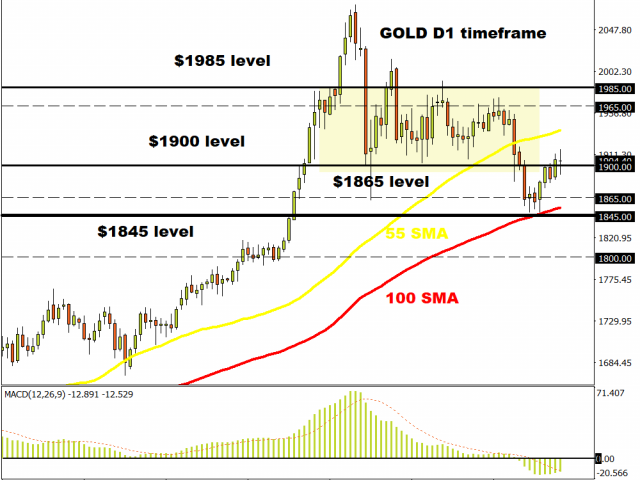

Gold balances above $1900

Gold is route to concluding the week slightly higher as risk aversion grips markets. A weekly close above $1900 may open the doors towards $1930 and $1965, respectively. Should $1900 prove to be unreliable support, the next key level of interest will be found around $1865.

MyFxtops 邁投 (www.myfxtops.com) -Reliable Forex Copy Trade community, follow the master for free to trade!

Disclaimer: This article is reproduced from the Internet. If there is any infringement, please contact us to delete it immediately. In addition: This article only represents the personal opinion of the author and has nothing to do with Mato Finance The originality and the text and content stated in this article have not been confirmed by this site. The authenticity, completeness and timeliness of this article and all or part of the content and text are not guaranteed or promised. Please refer to it for reference only Verify the content yourself.

Copyright belongs to the author.

For commercial reprints, please contact the author for authorization. For non-commercial reprints, please indicate the source.