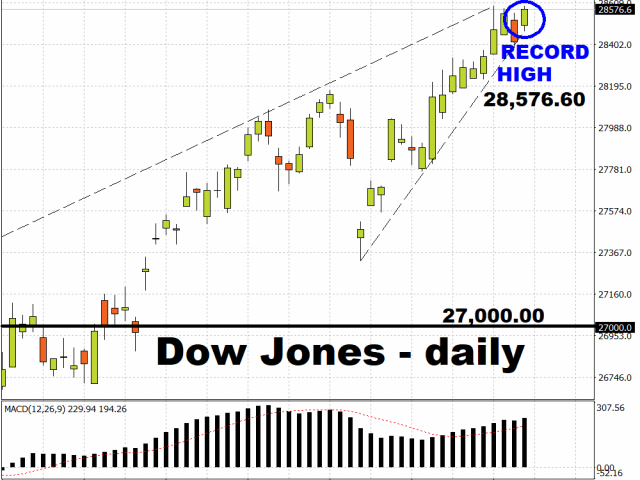

Asian stocks are mirroring the climb in US equities, after all three US benchmark indices posted fresh record highs. Investors are clearly in high spirits during this year-end season, with the 2020 global economic outlook turning brighter in anticipation of the US-China “phase one” trade deal. The buying momentum is likely to be sustained, amid expectations that the manufacturing sectors around the world as well as global trade conditions can take advantage of the expected rollback of tariffs, while major central banks persist with their accommodative stance.

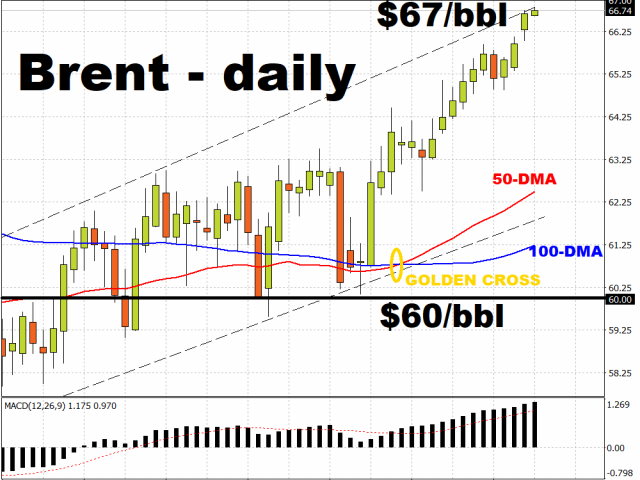

Brent trades at highest level since September

The risk-on mode is also clearly evident in Brent Oil, which is carving a path towards the psychologically-important $67/bbl mark. Investors will be closely eyeing the EIA US inventories data, due later today, to see whether Oil prices can be justified higher. With Brent’s 50-day moving average having already broken above its 100-day moving average earlier this month, Oil prices could climb another leg higher on signs that OPEC+ supply cuts will be extended past March 2020, falling US inventories, as well as evidence of demand-side improvements stemming from thawing global trade tensions.

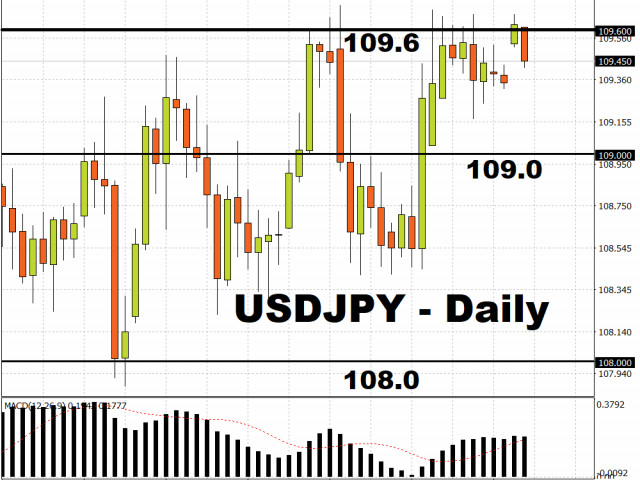

Risk appetite needs to kick into another gear for USDJPY to push higher

The current risk-on momentum however doesn’t appear enough for USDJPY to punch above the 109.6 level for the time being, with the currency pair adhereing to its low-volatility character. As long as risk appetite can hold up, the expected bias for USDJPY is to the upside through Q1 2020, as it carves out slow and steady steps towards the 111.0 level.

MyFxtops 邁投 (www.myfxtops.com) -Reliable Forex Copy Trade community, follow the master for free to trade!

Disclaimer: This article is reproduced from the Internet. If there is any infringement, please contact us to delete it immediately. In addition: This article only represents the personal opinion of the author and has nothing to do with Mato Finance The originality and the text and content stated in this article have not been confirmed by this site. The authenticity, completeness and timeliness of this article and all or part of the content and text are not guaranteed or promised. Please refer to it for reference only Verify the content yourself.

Copyright belongs to the author.

For commercial reprints, please contact the author for authorization. For non-commercial reprints, please indicate the source.