Oil prices collapsed to fresh multi-month lows on Monday as concerns intensified over China’s coronavirus outbreak hitting demand for fuel.

WTI Crude and Brent crude both tumbled more than 3% amid the market unease with investors becoming increasingly anxious about the widening crisis and ramifications to global growth. China is the world’s largest economy consumer, so a slowdown in demand could bruise and de-stabilize oil markets. It remains unknown how badly the virus has affected consumer spending and business confidence in China. However, tourism revenues will be in the direct firing line, which could weigh heavily on the world’s second-largest economy. This will be another rough week for WTI and Brent, especially if fears mount over the virus spreading further.

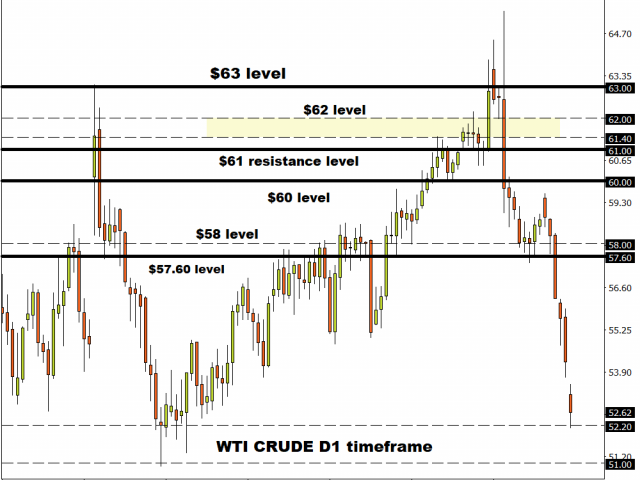

The technical picture paints a heavily bearish setup for the WTI Oil with prices trading around $52.60 as of writing. A solid daily close above $52.20 may open the doors towards $51.00 and $49.50.

Gold glows through market chaos

Gold has entered the week on a positive note, jumping roughly 0.7% amid the market caution.

Investors are maintaining a safe-distance from riskier assets with hotspots like Gold, Dollar and the Japanese Yen becoming prime destinations of safety. Gold is positioned to appreciate further this week with market uncertainty opening the gates towards $1600. A solid daily close above $1580 should encourage a move towards $1589 and $1600, respectively.

Should $1580 prove to be unreliable support, prices could journey back towards $1555.

Currency spotlight – EURUSD

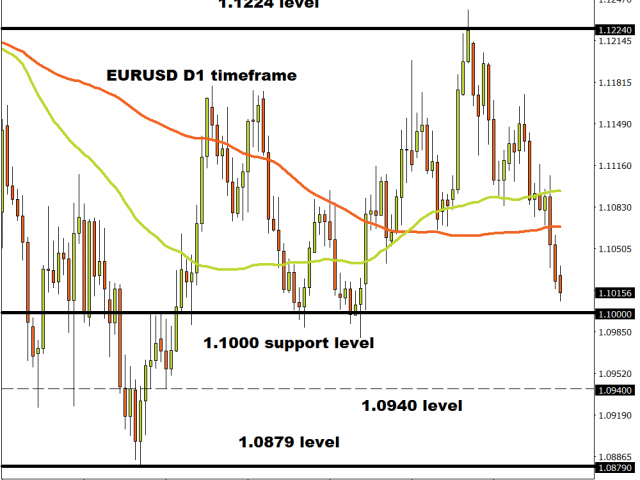

There is a classic breakdown strategy forming on the EURUSD with 1.10 acting as the trigger point.

A solid breakdown and daily close below this support level may signal a move lower with 1.0940 and 1.0879 acting as significant points of interest. If bears are unable to conquer the 1.10 level, a rebound back towards 1.1090 could be on the cards.

MyFxtops 邁投 (www.myfxtops.com) -Reliable Forex Copy Trade community, follow the master for free to trade!

Disclaimer: This article is reproduced from the Internet. If there is any infringement, please contact us to delete it immediately. In addition: This article only represents the personal opinion of the author and has nothing to do with Mato Finance The originality and the text and content stated in this article have not been confirmed by this site. The authenticity, completeness and timeliness of this article and all or part of the content and text are not guaranteed or promised. Please refer to it for reference only Verify the content yourself.

Copyright belongs to the author.

For commercial reprints, please contact the author for authorization. For non-commercial reprints, please indicate the source.