Everyone wanted a piece of the British Pound on Thursday after the Bank of England left interest rates unchanged at 0.75%, in Mark Carney’s final meeting as governor.

The Pound jumped over 0.5% against the Dollar and appreciated against every single G10 currency as the central bank saved its monetary policy ammunition for another day. The 7-to-2 split vote suggests that the BoE may be waiting for more evidence of economic recovery before pulling the trigger on lower interest rates.

Overall, the tone of the policy statement was balanced as Monetary Policy Committee (MPC) members noted the rebound in sentiment since the general elections. However, GDP forecasts were cut for the next three years with estimates for growth in the fourth quarter of 2019 downgraded to zero. There was a strong focus on inflation which was projected to hit the central bank’s 2% goal by the end of 2021 – contingent to a rate cut in 2021.

All in all, it looks like the BoE will remain in ‘wait and see’ mode on rates but ready to act if Brexit uncertainty or external developments threaten the UK economy.

In regards to the technical picture, the GBPUSD jumped over 80 pips following the BoE rate decision with prices trading around 1.3090 as of writing. A solid daily close and breakout above 1.3100 should open the doors towards 1.3160. Alternatively, if 1.3100 proves to be reliable resistance, the currency pair could correct back towards the 1.3100 support level.

A classic breakout strategy still remains in play on the GBPUSD with 1.3160 acting as resistance and 1.3100 providing support.

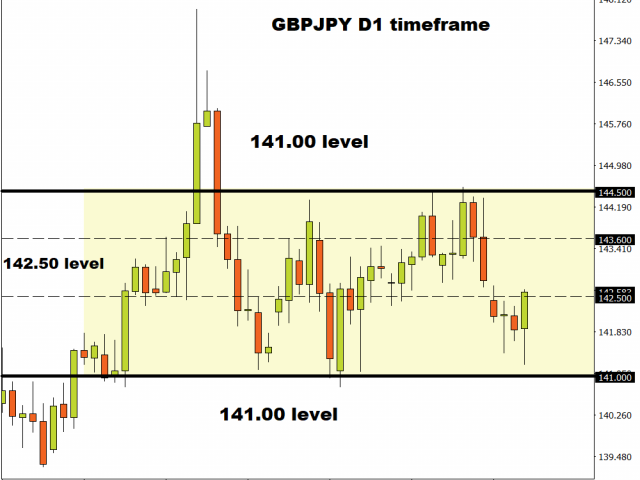

GBPJPY punches above 142.50

It was a similar story with the GBPJPY as prices jumped over 100 pips on the BoE rate decision.

The currency pair remains in a wide 350 pip range on the daily charts with support at 141.00 and resistance at 144.50. A daily close above 142.50 should open the doors towards 143.60 and possibly 144.50. If 142.50 proves to be a stubborn resistance, the GBPJPY could decline back towards 141.00.

EURGBP slips towards 0.8400

An appreciating Pound sent the EURGBP tumbling over 50 pips on Thursday with prices slipping towards 0.8400 as of writing.

A solid breakdown below this support should inspire bearish investors to target 0.8340 and 0.8000, respectively.

MyFxtops 邁投 (www.myfxtops.com) -Reliable Forex Copy Trade community, follow the master for free to trade!

Disclaimer: This article is reproduced from the Internet. If there is any infringement, please contact us to delete it immediately. In addition: This article only represents the personal opinion of the author and has nothing to do with Mato Finance The originality and the text and content stated in this article have not been confirmed by this site. The authenticity, completeness and timeliness of this article and all or part of the content and text are not guaranteed or promised. Please refer to it for reference only Verify the content yourself.

Copyright belongs to the author.

For commercial reprints, please contact the author for authorization. For non-commercial reprints, please indicate the source.