Gold displayed resilience against the improving market mood on Wednesday as unconfirmed reports of a coronavirus cure revived global risk sentiment.

Investors across the globe cheered news of a breakthrough in the race for a coronavirus vaccine. However, the World Health Organization (WHO) later dismissed optimistic reports by stating that “there are no known effective therapeutics against the 2019-nCoV virus”. A sense of caution and lingering uncertainty over the global economic outlook should support Gold ahead of the US jobs report on Friday.

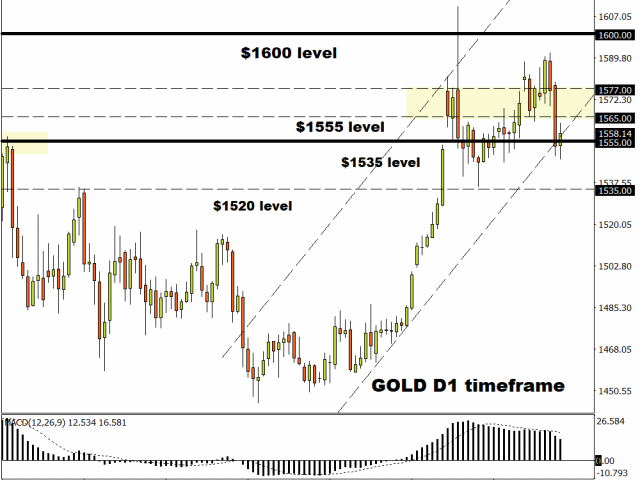

Focusing on the technical picture, Gold has appreciated roughly 0.30% today and gained almost 3$ since the start of 2020. The precious metal has the potential to rebound towards $1577 once a breakout above $1565 is achieved. Alternatively, the precious metal could test $1535 if a daily close below $1547 is secured.

Oil not out of the woods yet

It is hard to believe that Oil prices have depreciated over 15% since the start of 2020.

The coronavirus outbreak in China triggered shockwaves across the globe and rekindled fears over slowing global growth. Oil remains one of the biggest casualties of the virus outbreak based on the fact that China is the world’s largest energy consumer.

Fast forward to today, Oil jumped has more than 4% thanks to reports of a drug breakthrough against the virus outbreak. The commodity even offered a muted reaction to the EIA report on Wednesday afternoon which showed a weekly build in U.S crude-oil supplies.

Oil is certainly not out of the woods yet and could resume losses if the unconfirmed reports prove false.

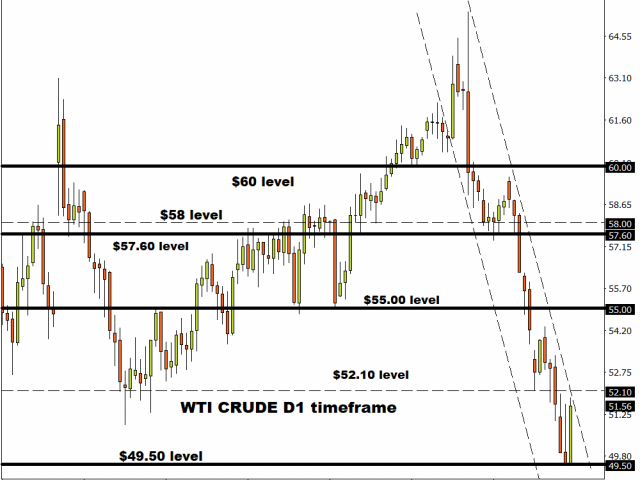

Focusing on the technical picture, WTI is heavily bearish on the daily charts. Sustained weakness below $52.10 should open a path back towards $49.50. If prices manage to break above $52.10, the next level of interest will be around $54.00.

MyFxtops 邁投 (www.myfxtops.com) -Reliable Forex Copy Trade community, follow the master for free to trade!

Disclaimer: This article is reproduced from the Internet. If there is any infringement, please contact us to delete it immediately. In addition: This article only represents the personal opinion of the author and has nothing to do with Mato Finance The originality and the text and content stated in this article have not been confirmed by this site. The authenticity, completeness and timeliness of this article and all or part of the content and text are not guaranteed or promised. Please refer to it for reference only Verify the content yourself.

Copyright belongs to the author.

For commercial reprints, please contact the author for authorization. For non-commercial reprints, please indicate the source.