One of the world’s largest e-commerce players is scheduled to release third quarter earnings before US markets open on Thursday.

There is a strong sense of optimism over the business outlook for Alibaba Group Holding Limited amid strong mobile growth, a firmer foothold in the digital and entertainment industry coupled with rising revenues from the cloud segment. However, the company’s domestics and international growth were probably impacted by US-China trade tensions during the third quarter of 2019, something that may hit profits. Nevertheless, Alibaba’s earnings could still surprise to the upside – especially when factoring how the e-commerce giant has a history of surpassing both earnings per shares and revenue estimates.

Alibaba is expected to report earnings of $2.25 per share on $22.68 billion in revenues. A positive earnings report could boost appetite for the company’s shares with prices rebounding towards 218.00 and potentially 226.15. Alternatively, if earnings disappoint this could drag shares back towards 200.00.

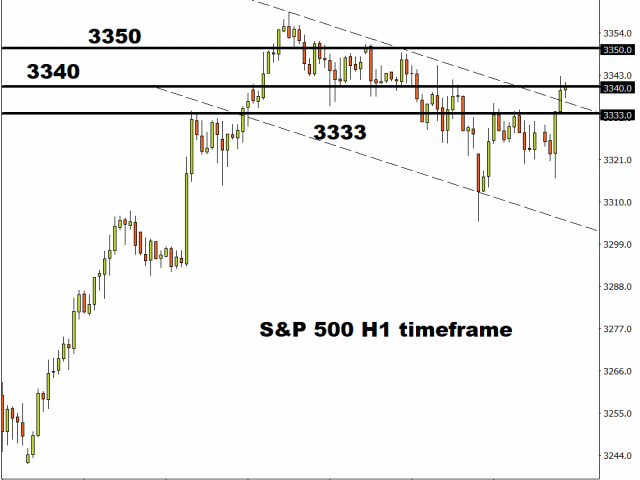

S&P 500 U turns despite virus concerns

The S&P 500 has entered the week on positive note, gaining roughly 0.3% as of writing despite coronavirus fears fuelling market uncertainty and risk aversion.

The Index is trading around 3340 and could push higher towards 3350 on speculation around central banks easing monetary policy in the face of slowing global growth. Focusing on the technical picture, bulls need to break above 3340 to open a path towards 3345 and 3350. Alternatively, sustained weakness below this level should encourage a decline towards 3333 and potentially lower.

MyFxtops 邁投 (www.myfxtops.com) -Reliable Forex Copy Trade community, follow the master for free to trade!

Disclaimer: This article is reproduced from the Internet. If there is any infringement, please contact us to delete it immediately. In addition: This article only represents the personal opinion of the author and has nothing to do with Mato Finance The originality and the text and content stated in this article have not been confirmed by this site. The authenticity, completeness and timeliness of this article and all or part of the content and text are not guaranteed or promised. Please refer to it for reference only Verify the content yourself.

Copyright belongs to the author.

For commercial reprints, please contact the author for authorization. For non-commercial reprints, please indicate the source.