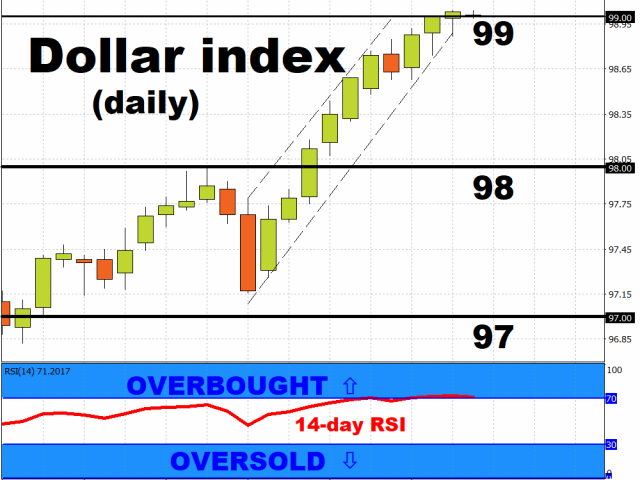

The US Dollar is now weaker against most Asian and G10 currencies, softening after having recently broken past the 99 psychological level. The Dollar index has posted a 2.84 percent year-to-date gain through February 14, having recorded just one full-week’s decline so far in 2020.

With its 14-day RSI having tipped into overbought territory, the DXY’s upward momentum is set to wane over the near-term, perhaps allowing currencies across the emerging-markets and G10 spectrum some measure of relief. However, considering the still-cautious mood in the markets stemming from the Covid-19 outbreak, the Greenback should remain well bid in the interim.

Fed’s policy bias in focus

Investors will be combing through the minutes from late-January FOMC meeting on Wednesday in ascertaining whether the Dollar deserves to be pushed even higher over the coming days. Although the Fed funds futures are now pricing in at least one Fed rate hike in the second half of the year, should the Covid-19 outbreak feed negatively into the US economy, that could prompt the US central bank to cut rates sooner than unexpected.

Such a scenario though appears unlikely at this point in time, considering the resilience of the world’s largest economy. Retail sales in the US grew for four consecutive months in January, indicating that US consumers can be relied on to keep US economic growth momentum chugging along.

MyFxtops 邁投 (www.myfxtops.com) -Reliable Forex Copy Trade community, follow the master for free to trade!

Disclaimer: This article is reproduced from the Internet. If there is any infringement, please contact us to delete it immediately. In addition: This article only represents the personal opinion of the author and has nothing to do with Mato Finance The originality and the text and content stated in this article have not been confirmed by this site. The authenticity, completeness and timeliness of this article and all or part of the content and text are not guaranteed or promised. Please refer to it for reference only Verify the content yourself.

Copyright belongs to the author.

For commercial reprints, please contact the author for authorization. For non-commercial reprints, please indicate the source.