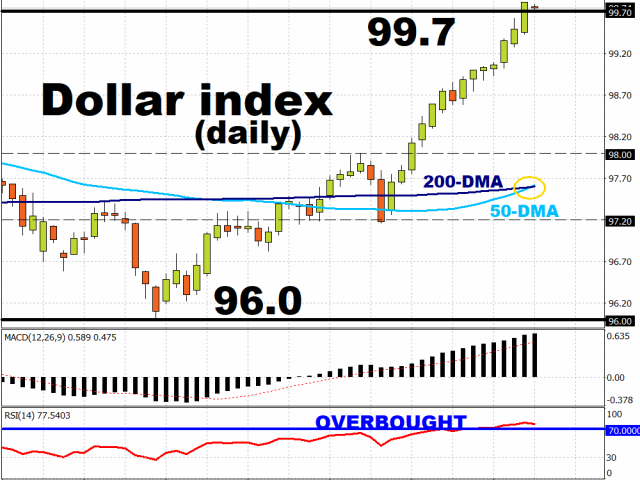

The Dollar index (DXY) is ever so close to the 100 mark; the last time it breached that psychologically-important mark was in April 2017. A break above 100 would crystalize the golden cross pattern, as its 50-day moving average climbs above its 200-day moving average, confirming the Dollar’s upward trend.

Driven by the risk-aversion in the markets due to the black swan event that is the coronavirus outbreak, coupled with the resilience demonstrated by the US economy, investors had strong reasons to cling to the safety of the Greenback during times of uncertainty.

However, with its 14-day RSI now rising into overbought domain, the DXY could be poised to moderate. Still, considering how tantalizingly close the 100 line is, the Greenback may just have enough fuel in their tank to reach that milestone before the month is over.

Dollar set to be data-driven over coming days

Dollar bulls will have a host of US economic indicators that could be used as stepping stones to send DXY higher over the coming days. Any positive surprises in the incoming figures on Q4 GDP, home sales, manufacturing, and consumer spending, could spur King Dollar onto greater heights.

More Dollar gains should spell more near-term pain for currencies across the G10 and emerging-markets complex. As the biggest component in the Dollar index, the Euro is currently offering little drag on the Dollar and poses little threat to DXY’s 3.5 percent advance so far in 2020.

MyFxtops 邁投 (www.myfxtops.com) -Reliable Forex Copy Trade community, follow the master for free to trade!

Disclaimer: This article is reproduced from the Internet. If there is any infringement, please contact us to delete it immediately. In addition: This article only represents the personal opinion of the author and has nothing to do with Mato Finance The originality and the text and content stated in this article have not been confirmed by this site. The authenticity, completeness and timeliness of this article and all or part of the content and text are not guaranteed or promised. Please refer to it for reference only Verify the content yourself.

Copyright belongs to the author.

For commercial reprints, please contact the author for authorization. For non-commercial reprints, please indicate the source.