This week could be unofficially declared as the seller’s market as global equities, currencies and commodities all encountered heavily selling momentum as coronavirus fears showed no sign of easing.

Even Gold which is considered as a safe-haven asset was caught in the rapid crossfire, depreciating over 3.3% on Friday and on path to concluding the week shedding more than 4% in value.

Intensifying concerns over the coronavirus outbreak and negative consequences it will have on the global economy is fostering a sense of unease, uncertainty and dread. With more than 83,000 people in at least 53 countries infected and the death toll surpassing 2800, finanicial markets are poised to remain on high alert in the week ahead.

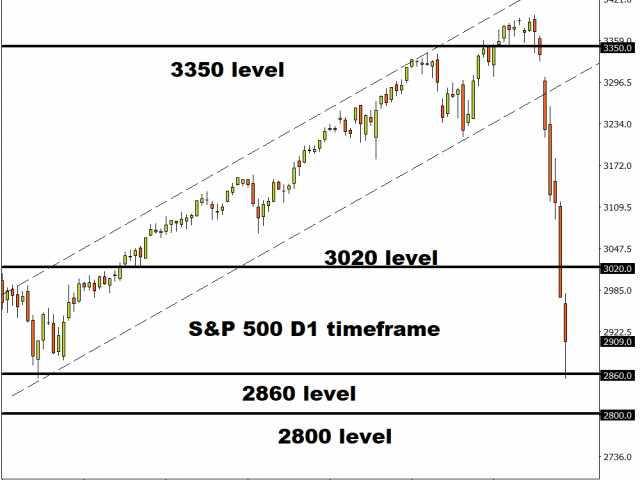

The S&P 500 staged its biggest drop at opening bell since Monday, highlighting the unease and caution gripping market players on Wall Street and across the globe. Prices have tumbled over 1.5% today and almost 10% since the start of the trading week. The Index is incredibly bearish on the daily charts with a daily close below 2860 opening the doors towards 2800.

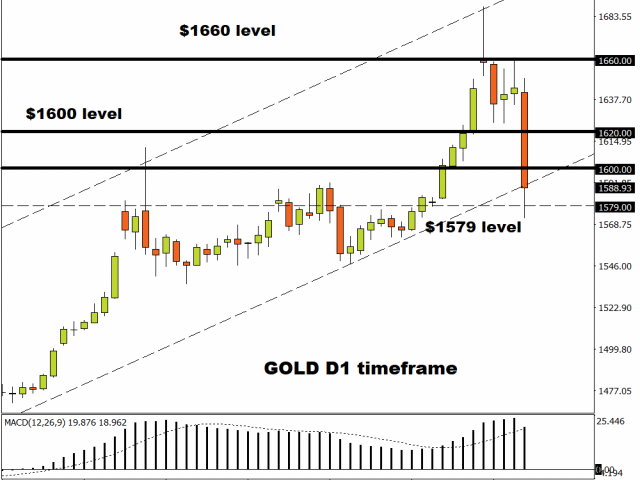

Gold crumbles despite uncertainty

Gold completely failed to exploit the coronavirus fuelled risk aversion with prices tumbling over 3% on Friday, dipping below $1580.

The metal’s decline could be the product of an aggressive wave of profit-taking ahead of the weekend. Nevertheless, uncertainty is still a major market theme and expectations are mounting over central banks easing monetary policy. Gold still has the ability to shine through the market mayhem as risk-off remains the name of the game.

Technically, prices turned bearish after the sharp breakdown below $1600. A weekly close below this point may open the doors towards $1550.

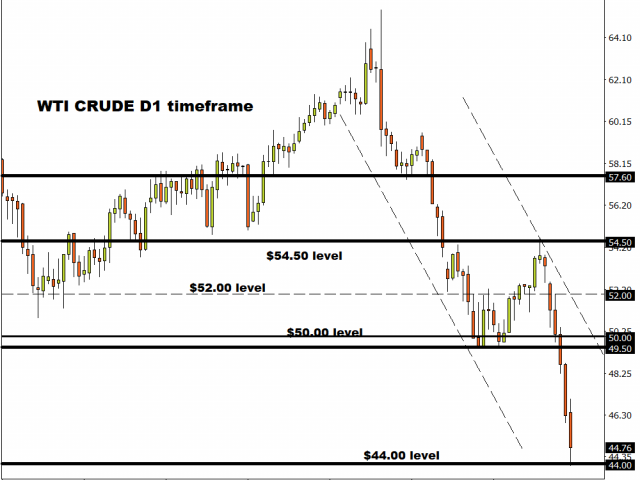

Another painful week for Oil

WTI Crude and Brent both tumbled more than 2% today as investors became increasingly jittery over the widening virus crises and negative consequences to global growth.

OPEC and its allies may move ahead with deeper production cuts when they meet next week. This move would cushion Oil’s downside losses. However, the path of least resistance for Oil will point south as long as demand is missing from the equation.

WTI Crude is bearish on the daily charts with prices trading around $44.70 as of writing. With Oil already trading at levels not seen since 2018, more downside could be on the cards towards $44 and lower.

MyFxtops 邁投 (www.myfxtops.com) -Reliable Forex Copy Trade community, follow the master for free to trade!

Disclaimer: This article is reproduced from the Internet. If there is any infringement, please contact us to delete it immediately. In addition: This article only represents the personal opinion of the author and has nothing to do with Mato Finance The originality and the text and content stated in this article have not been confirmed by this site. The authenticity, completeness and timeliness of this article and all or part of the content and text are not guaranteed or promised. Please refer to it for reference only Verify the content yourself.

Copyright belongs to the author.

For commercial reprints, please contact the author for authorization. For non-commercial reprints, please indicate the source.