One would have expected Gold to aim for the stars and beyond amid the coronavirus induced market chaos.

However, the complete opposite was witnessed on Monday as prices plunged over 4% despite the explosive levels of risk aversion. Investors have clearly entered the trading week adopting a ‘sell what you can mentality’ to cover steep losses in stocks, throwing Gold into the direct firing line. With the precious metal’s fate tied to global equities, further losses will most likely be on the cards as equities plunge deeper into the abyss.

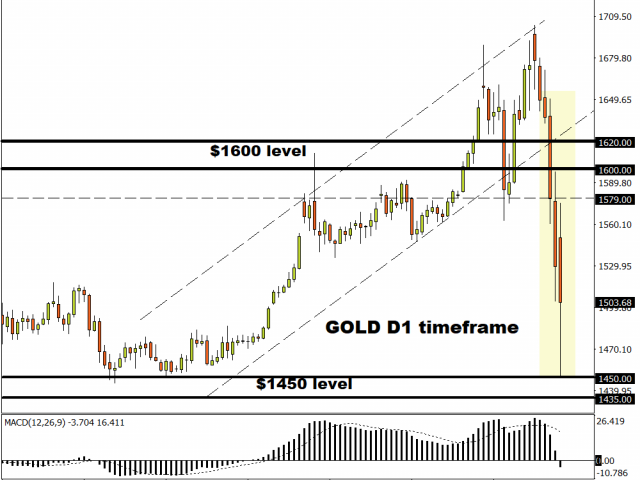

In regards to the technical picture, the precious metal is painfully bearish on the daily charts with sellers in the driving seat. A solid breakdown below $1450 could open the doors towards levels not seen since mid-2019 at $1435.

Crude Oil dips below $30

Oil prices tumbled below $30 on Monday as emergency rate cuts by the Federal Reserve and other major central banks failed to soothe fears around the coronavirus outbreak.

The raging price war between Saudi Arabia and Russia compounded to the pain with WTI trading around marginally below $30 as of writing. With the horrible combination of falling demand and oversupply concerns weighing heavily on Oil, the path of least resistance points south. Looking at the technical picture, a strong daily close below $30 may open the doors towards $25.

Pound tumbles towards 1.2200

Sterling has entered the trading week on the wrong side of the bed as coronavirus concerns and Brexit blunted appetite for the currency.

The British Pound has weakened over 4% against the Dollar since the start of March and could extend losses amid the growing uncertainty. Looking at the technical picture, the GBPUSD is under pressure on the daily charts. Sustained weakness below 1.2300 could open a path towards 1.2200.

Japanese Yen remains traders’ best friend

In times of uncertainty and chaos, the Japanese Yen remains a traders best friend.

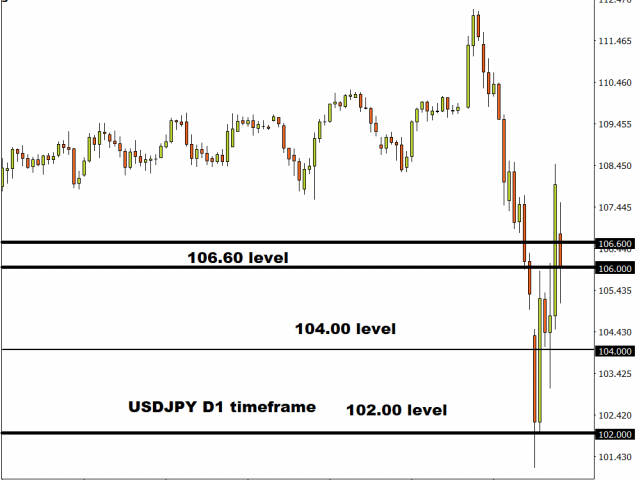

Appetite towards the Japanese Yen went through the roof this month as risk aversion sent investors sprinting towards destinations of safety. The Yen has appreciated against every single G10 currencies this month and gained almost 2% against the Dollar.

Looking at the technical picture, the USDJPY is under pressure on the daily charts. A breakdown below 106.00 could open a path towards 104.00.

MyFxtops 邁投 (www.myfxtops.com) -Reliable Forex Copy Trade community, follow the master for free to trade!

Disclaimer: This article is reproduced from the Internet. If there is any infringement, please contact us to delete it immediately. In addition: This article only represents the personal opinion of the author and has nothing to do with Mato Finance The originality and the text and content stated in this article have not been confirmed by this site. The authenticity, completeness and timeliness of this article and all or part of the content and text are not guaranteed or promised. Please refer to it for reference only Verify the content yourself.

Copyright belongs to the author.

For commercial reprints, please contact the author for authorization. For non-commercial reprints, please indicate the source.