It was a complete bloodbath across stock markets on Monday, despite more stimulus measures from the Federal Reserve over the weekend, including another emergency interest rate cut.

Markets are becoming increasingly concerned that central banks are running out of precious ammunition to counter the coronavirus pandemic, with investors clearly adopting a ‘sell what you can mentality’. No prisoners were taken as Asian, European and US markets experienced gut-wrenching declines amid the explosion of risk aversion. On Wall Street, the S&P 500 collapsed 12%, while the Dow Jones dropped nearly 13% marking its largest single-day point drop in history. Although central banks are bringing out their big bazookas and sparing no ammunition, the focus is shifting to fiscal measures which are seen as sharper tools in the battle to stabilise economic conditions.

In the meantime, global equity bears remain on a mission to sow utter chaos across stock markets as concerns surrounding the coronavirus outbreak reach new heights.

Dollar edges higher ahead of retail sales

The US dollar is consolidating its recent gains over its major peers, despite the Federal Reserve cutting interest rates twice over the past two weeks to near zero.

Investors still consider the Dollar as a prime destination of safety amid the market chaos and this should continue supporting appetite for the currency moving forward. The main risk event for the Greenback will be the latest retail sales figures for February which should provide some clues on the health of the US consumer before the coronavirus outbreak rattled the global economy. The Dollar will most likely offer a muted response to the economic data as investors direct their attention towards fiscal policy responses to the coronavirus outbreak.

Commodity spotlight – Gold

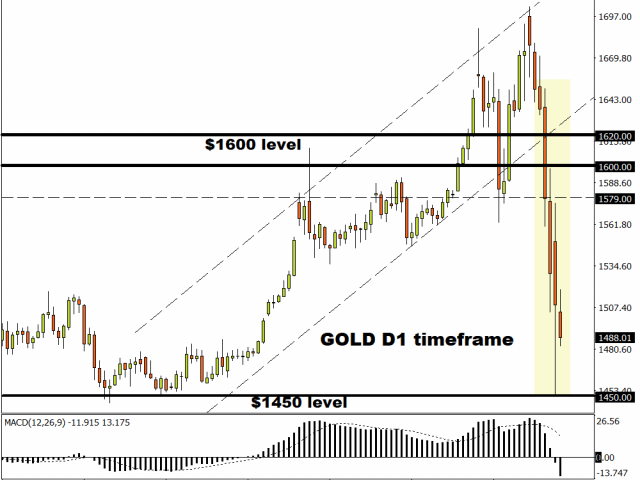

One would have expected Gold to shine through the coronavirus-induced market chaos. However, the complete opposite has been seen with bullion down five straight days and prices fell another 4% yesterday, despite the wave of risk aversion sweeping through markets. Investors have clearly entered the trading week adopting a ‘sell what you can mentality’ to cover steep losses in stocks, throwing Gold directly into the firing line. With the precious metal heavily influenced by global equities, further losses will most likely be on the cards as stock markets plunge deeper into the abyss.

Regarding the technical picture, the precious metal is bearish on the daily chart. A solid breakdown below $1480 could open a path towards $1450 and $1435, a level not seen since mid-2019.

MyFxtops 邁投 (www.myfxtops.com) -Reliable Forex Copy Trade community, follow the master for free to trade!

Disclaimer: This article is reproduced from the Internet. If there is any infringement, please contact us to delete it immediately. In addition: This article only represents the personal opinion of the author and has nothing to do with Mato Finance The originality and the text and content stated in this article have not been confirmed by this site. The authenticity, completeness and timeliness of this article and all or part of the content and text are not guaranteed or promised. Please refer to it for reference only Verify the content yourself.

Copyright belongs to the author.

For commercial reprints, please contact the author for authorization. For non-commercial reprints, please indicate the source.