Financial markets have entered the trading week on the wrong side of the bed as the coronavirus nightmare intensifies.

It was all gloom and doom across the board on Monday despite the Federal Reserve announcing a massive second wave of measures to shield the US economy from the coronavirus outbreak. With stock markets trading lower despite the Fed’s unlimited QE pledge, it suggests that investors remain on edge, cautious and hesitant to hold risk amid the unfavourable market conditions.

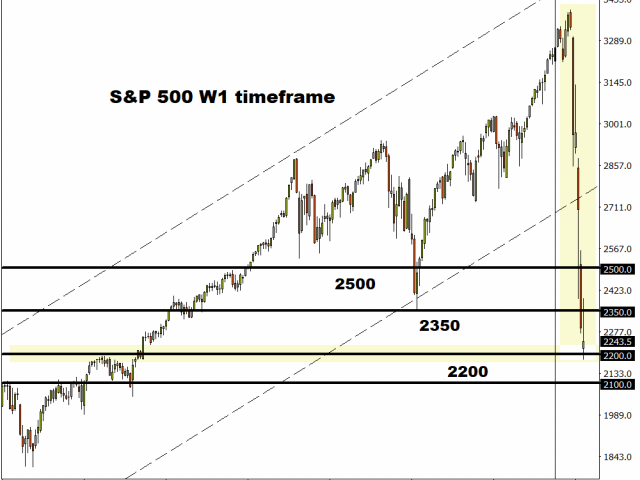

The S&P 500 is under pressure on the weekly charts with prices trading around 2243 as of writing. A solid weekly close below 2200 could open a path towards 2100 in the near term. Should 2200 prove to be reliable support, prices could rebound towards 2350.

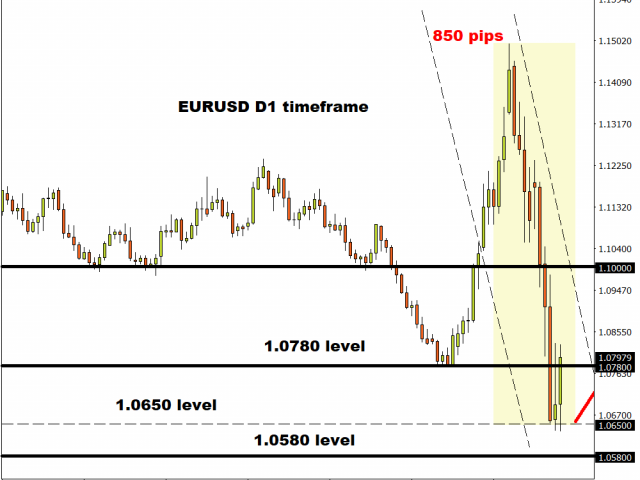

EURUSD stages technical rebound…but for how long?

It is hard to believe that the EURUSD has tumbled over 800 pips in the space of two weeks with prices trading around 1.0790 as of writing.

The currency pair is under pressure on the daily charts with resistance seen at 1.0780 and 1.1000. If 1.0780 proves to be an unreliable resistance, then prices could rebound towards 1.1000 before tumbling back towards 1.0650.

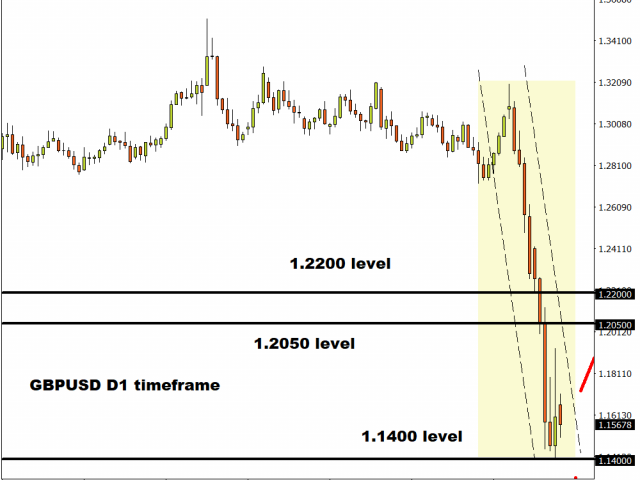

GBPUSD parity dream slowly becomes reality

A picture is worth 100 words. This can be said for the GBPUSD which has tumbled to levels not seen since 1985 against the Dollar.

The current outlook points to further downside with the first key level of interest at 1.1400. A breakdown below this level could open the flood gates towards 1.1300 and even lower.

GBPJPY breakout in the making

There have been consistently lower lows and lower highs on the GBPJPY. The currency is in a negative trend on the daily charts.

Sustained weakness below 130.50 could encourage a decline towards 125.00. Should 130.50 prove to be an unreliable resistance, the next key point of interest will be around 133.00.

Gold enters the week with a shine

Risk aversion sent investors rushing towards Gold’s safe embrace on Monday with prices jumping towards $1536 as of writing.

The precious metal could push higher if a daily close above $1545 is secured. Such a scenario should open the doors back towards $1600 in the medium term. If the Dollar continues to appreciate, Gold is seen sinking back towards $1500.

MyFxtops 邁投 (www.myfxtops.com) -Reliable Forex Copy Trade community, follow the master for free to trade!

Disclaimer: This article is reproduced from the Internet. If there is any infringement, please contact us to delete it immediately. In addition: This article only represents the personal opinion of the author and has nothing to do with Mato Finance The originality and the text and content stated in this article have not been confirmed by this site. The authenticity, completeness and timeliness of this article and all or part of the content and text are not guaranteed or promised. Please refer to it for reference only Verify the content yourself.

Copyright belongs to the author.

For commercial reprints, please contact the author for authorization. For non-commercial reprints, please indicate the source.