Oil tumbled to levels not seen in more than 18 years below $20 after the International Energy Agency (IEA) warned that global oil demand will plunge a record 9.3 million barrels a day this year.

This gloomy forecast could not have come at a more critical time for Oil which is in a losing battle with oversupply concerns, slowing global growth and demand destruction from the coronavirus outbreak. With Oil demand in April expected to drop to a level last seen 25 years ago, the outlook for oil remains gloomy with the path of least resistance pointing south. Expect the commodity to remain highly sensitive to coronavirus and OPEC+ headlines with IEA inventory data adding to the volatility.

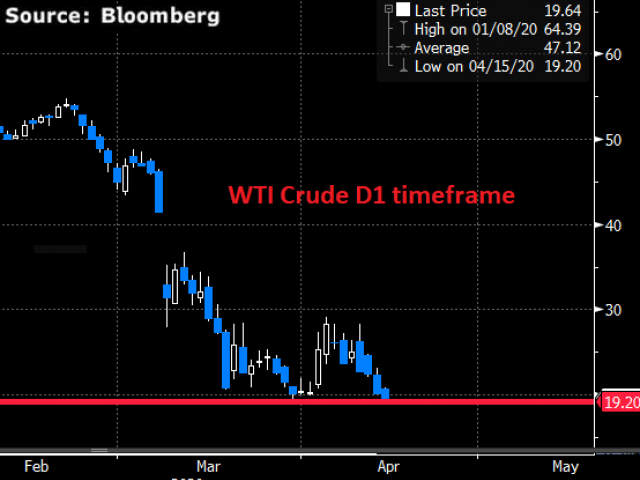

Looking at the technical picture, WTI Crude is under intense pressure on the daily charts. The commodity has weakened 2% today and over 65% year-to-date. Given the unfavourable global macroeconomic conditions and the International Monetary Funds (IMF) gloomy forecast that global growth could contract 3%, its lowest level since 1930, Oil is expected to remain depressed. Sustained weakness below $20 could open a path towards $15 in the medium to longer term.

Alternatively, a breakout above $20 may inspire a move towards $28.50 and $40.00.

Gold finds comfort above $1700

Gold should remain in fashion this week as global recession fears support the flight to safety.

Fears revolving around the coronavirus outbreak and negative impacts it will have on the global economy may foster risk aversion, ultimately blunting appetite for stocks and riskier currencies. If the Dollar depreciates on disappointing US economic data, Gold is positioned to extend gains beyond $1745.

Focusing on the technical picture, the precious metal is bullish on the daily timeframe with prices trading around $1720 as of writing. For as long as bulls can maintain control above $1700, prices could retest $1735 and beyond. Alternatively, a breakdown below $1700 could carve a path back towards $1675.

MyFxtops 邁投 (www.myfxtops.com) -Reliable Forex Copy Trade community, follow the master for free to trade!

Disclaimer: This article is reproduced from the Internet. If there is any infringement, please contact us to delete it immediately. In addition: This article only represents the personal opinion of the author and has nothing to do with Mato Finance The originality and the text and content stated in this article have not been confirmed by this site. The authenticity, completeness and timeliness of this article and all or part of the content and text are not guaranteed or promised. Please refer to it for reference only Verify the content yourself.

Copyright belongs to the author.

For commercial reprints, please contact the author for authorization. For non-commercial reprints, please indicate the source.