As more cracks form in the largest economy in the world, the mighty Dollar seems unmoved and unfazed.

Over 5 million Americans applied for unemployment benefits last week, bringing the total to 22 million in the four weeks since President Trump declared a national emergency. The coronavirus outbreak remains a significant threat to the US economy with the pace of layoffs expected to jump amid the widespread shutdowns and disruption. Although the Dollar remains a destination of safety, this could be questioned if US economic fundamentals continue to deteriorate througout the second quarter of 2020.

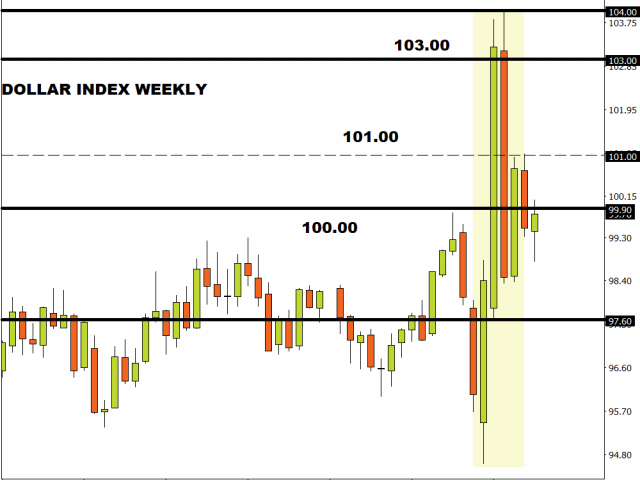

Focusing on the technical picture, the Dollar Index is trading within a wide range on the daily and weekly charts with support at 98.50 and resistance at 101.00. Given the Dollar’s resilience against disappointing economic data, the path of least resistance points north in the short to medium term. An intraday breakout above 100.00 should open a path towards 101.00.

GBPUSD wobbles above 1.2500

Over the past few days, Sterling has performed relatatively well against most G10 currencies excluding the Japanese Yen. It seems no news is good news for the Pound and this sentiment could support the currency in the short term.

Looking at the longer-term picture, the Pound remains haunted by recession fears and uncertainty revolving around Brexit. Such themes may prevent the Pound from gaining ground against the Dollar and other G10 currencies in 2020.

In regards to the technical picture, all eyes will be on the 1.2500 level. A breakout above this point could trigger a move higher towards 1.2750. Sustained weakness below 1.2500 may open the doors back towards 1.2200.

Commodity spotlight – Gold

Gold has gained roughly 0.5% today and over 13.5% since the start of 2020 as coronavirus chaos sweeps across the globe.

Lower interest rates, global recession fears and general uncertainty among many other themes should support appetite for Gold. With the technical and fundamentals aligned, the precious metal has the potential to break above $1750 and beyond.

Technical traders will continue to observe how prices behave above $1700. Should this level prove to be reliable support, the first point of interest will most likely be around $1750. A breakdown below $ 1700 could open the path back towards $1675.

MyFxtops 邁投 (www.myfxtops.com) -Reliable Forex Copy Trade community, follow the master for free to trade!

Disclaimer: This article is reproduced from the Internet. If there is any infringement, please contact us to delete it immediately. In addition: This article only represents the personal opinion of the author and has nothing to do with Mato Finance The originality and the text and content stated in this article have not been confirmed by this site. The authenticity, completeness and timeliness of this article and all or part of the content and text are not guaranteed or promised. Please refer to it for reference only Verify the content yourself.

Copyright belongs to the author.

For commercial reprints, please contact the author for authorization. For non-commercial reprints, please indicate the source.