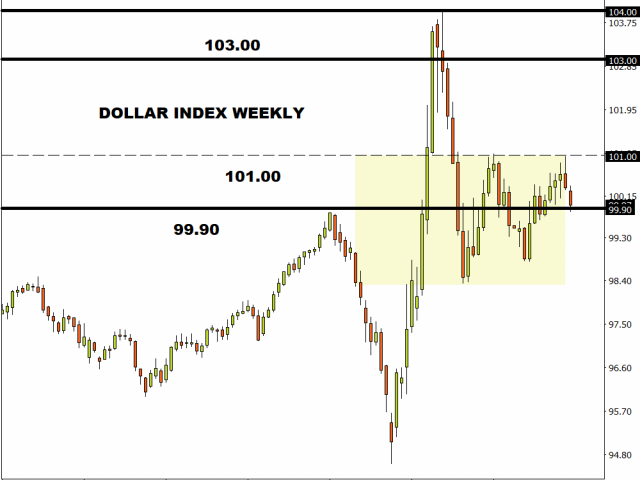

There was no love for king Dollar on Tuesday as investors became increasingly optimistic over countries across the globe easing coronavirus lockdown measures.

The noticeable jump in global sentiment and risk appetite is bad news for safe-haven assets with the Greenback likely to weaken further as market players rush to equities and emerging market currencies.

Technical traders will continue to observe how the Dollar Index behaves below 100.00. Sustained weakness under this point should open the doors towards 98.90.

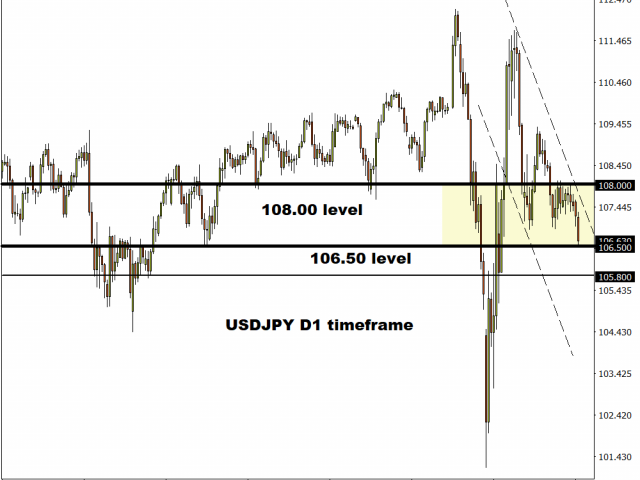

USDJPY tumbles towards 106.50

Over the past 24 hours, the Japanese Yen has appreciated against every single G10 currency excluding the Swedish Krona and Norwegian Krone.

As risk-on makes a return, investors are less inclined to purchase the Dollar but the same can also be said for the Japanese Yen. Expect the Yen to weaken further this week, especially if the market mood continues to brighten.

Looking at the techicals, the USDJPY is under pressure on the daily charts. A decisive breakdown below 106.50 could open the doors towards 105.80 and possibly lower. Alternatively, if 106.50 proves to be reliable support, prices may rebound towards 108.00.

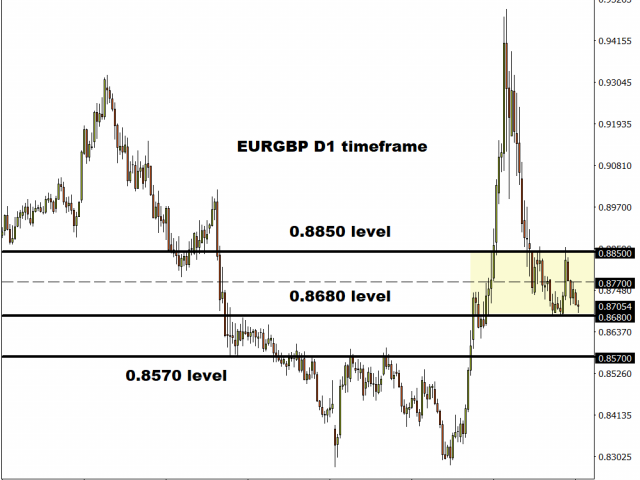

EURGBP breakout opportunity in play

Since the beginning of April 2020, the EURGBP has traded within a wide 160 pip range with support at 0.8680 and resistance at 0.8850.

Sustained weakness below 0.8770 could encourage a decline towards 0.8680 and 0.8570. Alternatively, a breakout above 0.8770 may open a path towards 0.8850.

Crude Oil depressed and unloved

US oil prices fell tumbled on Tuesday as concerns over storage capacity rekindled fears over WTI Crude descending back into negative territory.

The West Texas Intermediate contract for June delivery shed 20 per cent to a low of $10.07 a barrel in early London trading before clawing back some loses later in the afternoon. For as long as global recession fears and concerns over lack of storage capacity remain dominant themes, the path of least resistance for Oil remains south.

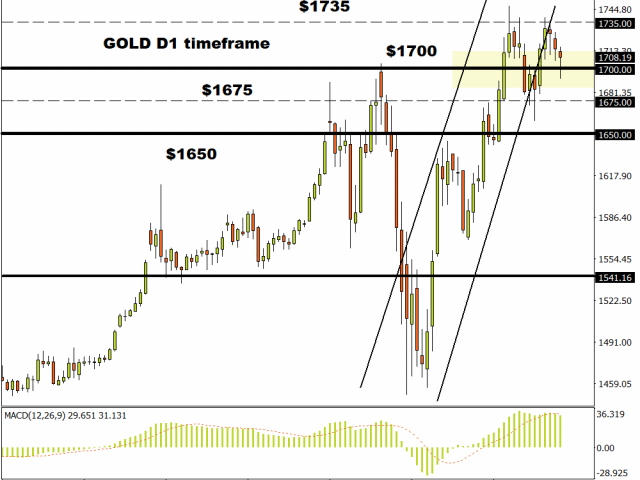

Commodity spotlight: Gold

Gold dropped below $1,700 on Tuesday as risk appetite made a return.

The easing of lockdown restrictions in several countries, coupled with rising stock markets exerted downside pressure on Gold. With optimism in the air over the coronavirus developments, Gold and other safe-haven assets are positioned to weaken in the short term.

Regardless of the recent dip in prices, the technical still remain positive and in favour of bulls. Should $1700 prove to be a solid support level, Gold may re-test $1735 and $1750, respectively. Alternatively, a breakdown and daily close below $1700 should open doors to $1675 and $1650.

MyFxtops 邁投 (www.myfxtops.com) -Reliable Forex Copy Trade community, follow the master for free to trade!

Disclaimer: This article is reproduced from the Internet. If there is any infringement, please contact us to delete it immediately. In addition: This article only represents the personal opinion of the author and has nothing to do with Mato Finance The originality and the text and content stated in this article have not been confirmed by this site. The authenticity, completeness and timeliness of this article and all or part of the content and text are not guaranteed or promised. Please refer to it for reference only Verify the content yourself.

Copyright belongs to the author.

For commercial reprints, please contact the author for authorization. For non-commercial reprints, please indicate the source.