The Dow Jones index is gaining by over 100 points at the open, after US President Donald Trump once again pushed for a reopening of the world’s largest economy. Investors are mulling the prospects of US economic activity being further restored, against the mixed earnings outlooks for US corporates.

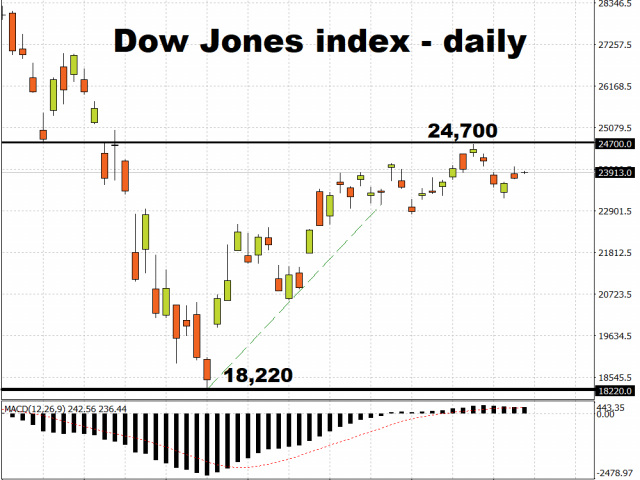

The conundrum appears to have stalled the Dow’s rebound, as the sharp upward momentum seen since March 23 appears to have plateaued. A burst of risk-on sentiment might just be the tonic for the Dow to continue its upward climb past the 24,700 resistance level.

However, the risk of a second wave of coronavirus cases which could potentially trigger another lockdown appears to be capping the upside for US equities. The outlook is further compounded by the dreary US consumption narrative, having been the primary growth driver for the US economy, with over 30 million Americans applying for jobless claims over the past six weeks. Such downside risks, set against the backdrop of a US recession, suggests that another market correction remains on the table. Until there is more clarity, risk assets may only manage to hobble higher, as opposed to soaring back to record highs.

Crude paring losses ahead of EIA data

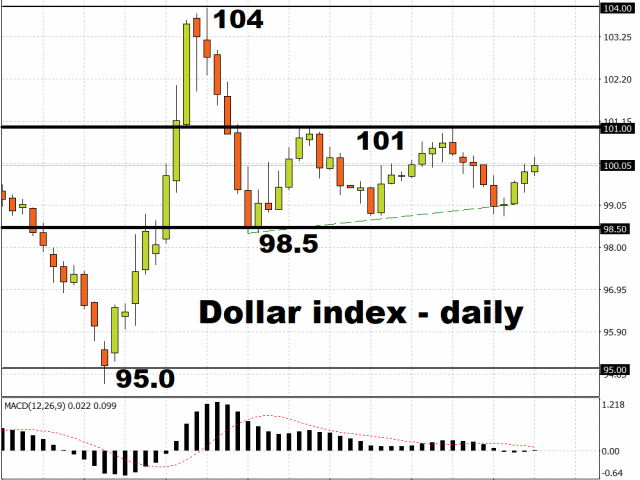

Crude Oil bounced off the $24/bbl mark after experiencing declines in the hours prior, as investors await the latest data from the US Energy Information Administration on crude inventory levels. US stockpiles are expected to rise at the slowest rate since the week ending March 20. Still, such expectations haven’t been enough to prevent crude prices to currently be about seven percent lower from today’s high, suppressed by the strengthening Greenback as the Dollar index (DXY) climbs back above the 100 psychological level.

Although global demand is expected to gradually recover as more of the global economy reopens, along with OPEC+ supply cuts kicking in and US output being curtailed by market forces, a second wave of coronavirus cases cannot yet be ruled out. Should these major economies be forced back into lockdown, then we could see Oil markets capitulating once more. As long as that risk remains on the table, then the downside for Oil prices is still very much exposed to the supply-demand equation, which remains highly fluid at this point in time.

MyFxtops 邁投 (www.myfxtops.com) -Reliable Forex Copy Trade community, follow the master for free to trade!

Disclaimer: This article is reproduced from the Internet. If there is any infringement, please contact us to delete it immediately. In addition: This article only represents the personal opinion of the author and has nothing to do with Mato Finance The originality and the text and content stated in this article have not been confirmed by this site. The authenticity, completeness and timeliness of this article and all or part of the content and text are not guaranteed or promised. Please refer to it for reference only Verify the content yourself.

Copyright belongs to the author.

For commercial reprints, please contact the author for authorization. For non-commercial reprints, please indicate the source.