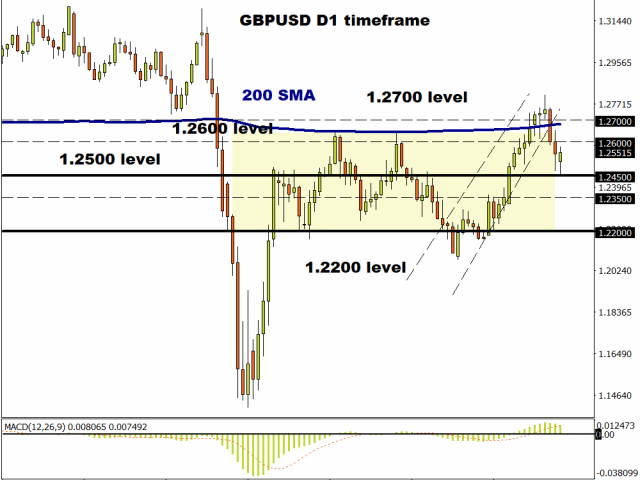

Sterling weakened against the Dollar and most G10 currencies on Monday as fears over a second wave of coronavirus drained risk sentiment.

The chronic uncertainty revolving around Brexit negotiations and the uncertain outlook for the UK economy added to the growing list of themes haunting investor attraction towards the Pound. With the GBPUSD tumbling to a two-week low below 1.2460, could further downside be on the cards over the coming weeks?

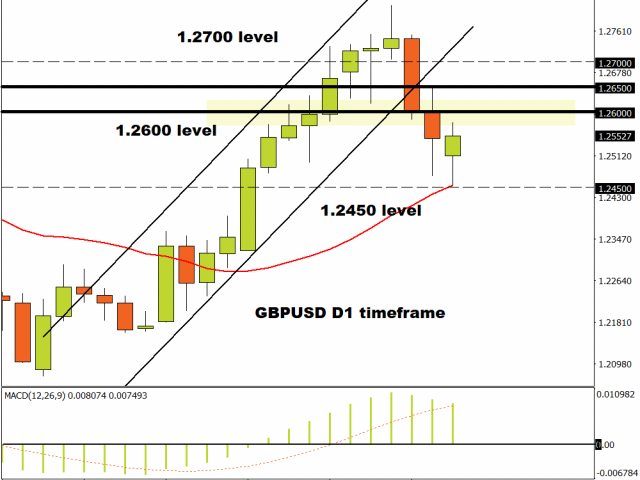

Looking at the daily charts, the GBPUSD is under pressure with prices struggling to break above the 1.2600 resistance level. Sustained weakness below this level may open a clean path back towards 1.2450. If 1.2600 proves to be unreliable resistance, prices may jump towards 1.2700.

Commodity spotlight – Gold

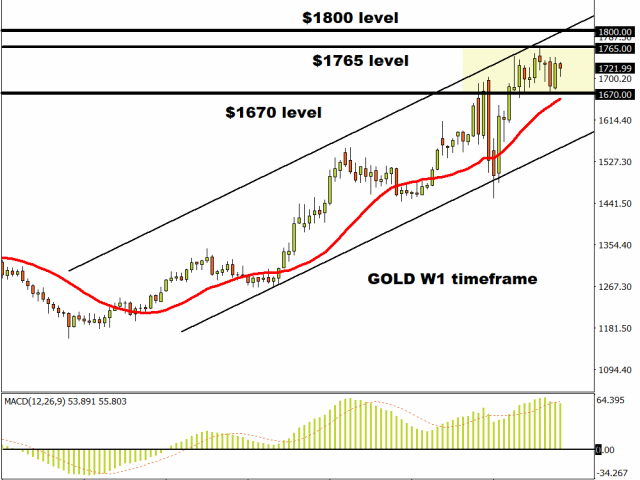

Gold entered the week on the wrong side of the bed, tumbling over 1% despite the resurgence of coronavirus cases in China and parts of the United States.

For those who may be wondering why Gold has depreciated despite the risk-off mood, the answer may be found in the Dollar’s performance. The Greenback seems to be back in fashion amid fears of a second wave of coronavirus destabilizing global growth and stability. If king Dollar continues to steal Gold’s safe-haven flows, the precious metal may become depressed and unloved in the short to medium term.

Prices have already tumbled over 1% on Monday with the downside momentum seen opening a path back towards $1700. If this psychological level proves to be unreliable support, Gold may test $1670.

All hope is not lost for bulls, especially when factoring how Gold remains in a very wide range with support at $1670 and resistance at $1747. A breakout above this resistance level could inspire an incline towards $176 and $1800, respectively.

MyFxtops 邁投 (www.myfxtops.com) -Reliable Forex Copy Trade community, follow the master for free to trade!

Disclaimer: This article is reproduced from the Internet. If there is any infringement, please contact us to delete it immediately. In addition: This article only represents the personal opinion of the author and has nothing to do with Mato Finance The originality and the text and content stated in this article have not been confirmed by this site. The authenticity, completeness and timeliness of this article and all or part of the content and text are not guaranteed or promised. Please refer to it for reference only Verify the content yourself.

Copyright belongs to the author.

For commercial reprints, please contact the author for authorization. For non-commercial reprints, please indicate the source.