For a third day in a row, global markets remain generally upbeat on the whole, although US stocks have creeped into the red after opening up in positive territory. Traders are shrugging off concerns about rising coronavirus cases and that much of Beijing is once again under lockdown.

Geopolitical tensions have popped up round the globe but in a world where only central bank liquidity matters, these concerns have been quickly forgotten. Sentiment has also been boosted after a cheap steroid, normally used to reduce inflammation in other diseases, was found to reduce death rates by around a third among the most severely illCovid-19 patients admitted to hospital.

The Dollar is up against the Euro for a second day as focus turn to the EU leader’s summit taking place on Friday. There have been reports that Chancellor Merkel does not expect an agreement to be reached on the EU’s proposed Recovery Fund and the future EU budget. She expects a decision to be made at the July summit.

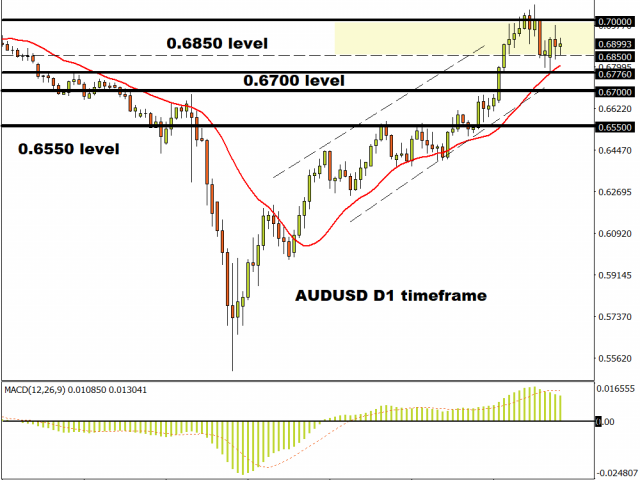

AUD Bullish trend channel

The Aussie is currently consolidating near the recent cycle highs just below 0.70. The trend channel from late-March is still in play with a series of higher highs and higher lows.

The market looks likely to print an ‘inside day’ today, which highlights the contraction in volatility. However, this is a continuation pattern so unless we move below Monday’s low at 0.6776, prices are expected to move higher once more and make another attempt on 0.70.

USD/CAD weak below breakout level

Last week’s retrace of the June 1st breakdown below the 1.3730 zone has not managed to reclaim that level. Gains have been capped at the 21-day MA so far, which should point to more pressure on the 1.35 area where the 200-day MA resides.

If the bears get the upper hand, selling is expected to pick up sharply below here and head for the recent lows around 1.33. Buyers need to recover that 1.3730 zone to arrest the downtrend.

MyFxtops 邁投 (www.myfxtops.com) -Reliable Forex Copy Trade community, follow the master for free to trade!

Disclaimer: This article is reproduced from the Internet. If there is any infringement, please contact us to delete it immediately. In addition: This article only represents the personal opinion of the author and has nothing to do with Mato Finance The originality and the text and content stated in this article have not been confirmed by this site. The authenticity, completeness and timeliness of this article and all or part of the content and text are not guaranteed or promised. Please refer to it for reference only Verify the content yourself.

Copyright belongs to the author.

For commercial reprints, please contact the author for authorization. For non-commercial reprints, please indicate the source.