As we take stock of what has transpired in global markets this quarter, risk sentiment has certainly made a remarkable comeback despite the coronavirus pandemic having yet to fully leave our shores. There’s a tremendous amount of liquidity in the markets, thanks to the broad swaths of support measures rolled out by central banks around the world, which are sending various asset classes onto elevated levels.

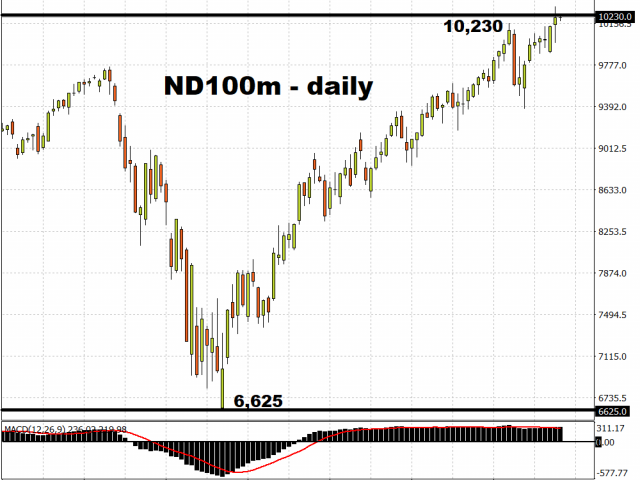

Given the forward-looking nature of the markets, the optimism surrounding the global economic recovery has also sent equity benchmarks on a tear. US stocks advanced further overnight, with the Nasdaq hitting a new record high.

Even the beleaguered Hang Seng index has pared its losses since the March lows and climbed back above its 50-day simple moving average.

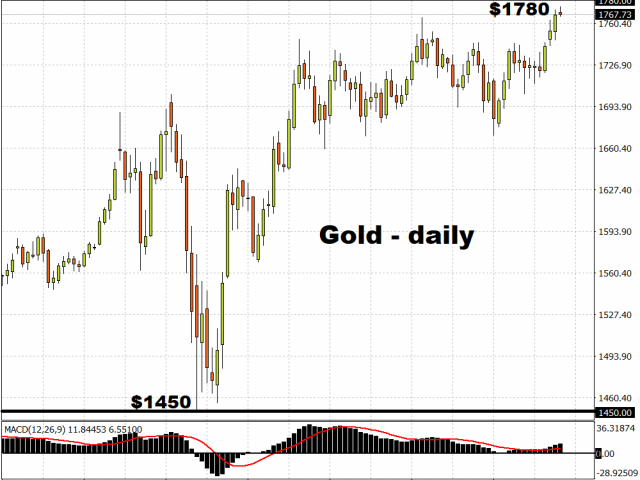

Riskier assets tend to climb higher at the expense of safe haven assets. Yet, even Gold has managed to maintain its upward trajectory, trading around its highest levels since 2012 while edging its way closer to the $1800 psychologically-important handle.

Bullion’s climb has been supported by near-zero US interest rates, as well as lingering concerns over the state of the global economy. Still, Gold’s rise in tandem in equities speaks more to the elevated liquidity levels in the markets which are lifting multiple asset classes simultaneously, despite its traditionally inverse relationship with risk assets.

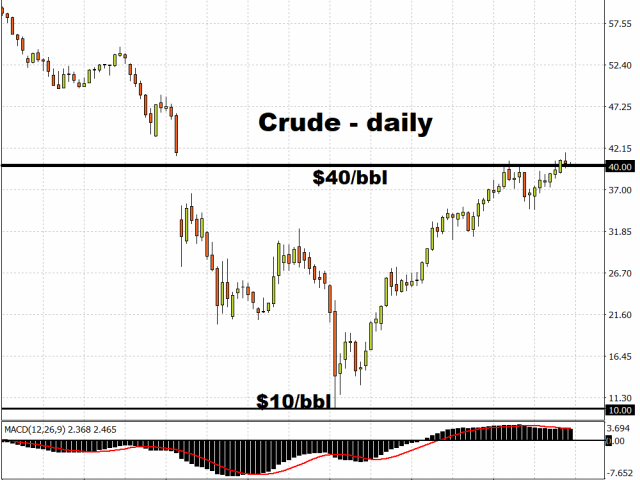

Even Crude Oil has pared most of its losses since OPEC+ talks broke down in March and a price war broke out amid the pandemic. Since then, with OPEC+ having made amends and rolled out supply cuts, coupled with the fledgling recovery in global demand conditions, Crude prices are now laying claim to the $40/bbl handle, a psychologically-important level that was far from investors’ minds just a couple of months ago.

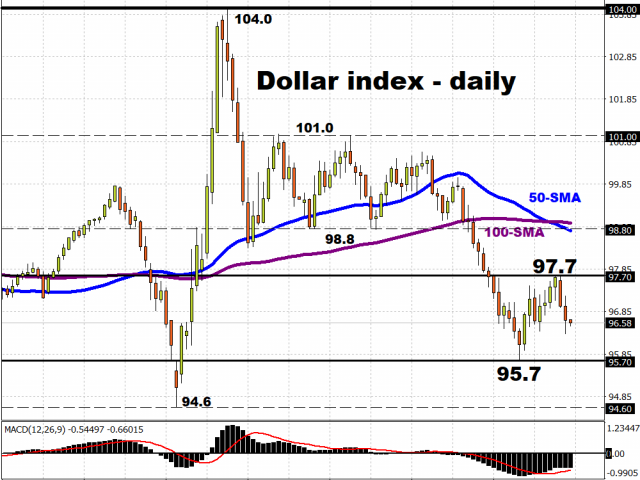

However, the Dollar index (DXY) has taken a leg down, breaking to the downside of the 98.8 – 101 range that it adhered to over the past two months. The DXY’s downward trend is confirmed with the 50-day simple moving average crossing below its 100-SMA, with Dollar traders apparently now more comfortable keeping DXY within the 95.7 – 97.7 range for the time being.

Although the Greenback is expected to remain relatively support amid safe haven bids, the softer Dollar can help improve the world economy’s chances of a recovery. For example, a weaker Dollar would boost corporate America’s profits, and also alleviate the pressures on emerging markets that have to pay back debt that are denominated in Dollars.

Still, King Dollar could be swiftly restored to its throne if the optimistic narrative in global markets is upended by a major risk-off event.

MyFxtops 邁投 (www.myfxtops.com) -Reliable Forex Copy Trade community, follow the master for free to trade!

Disclaimer: This article is reproduced from the Internet. If there is any infringement, please contact us to delete it immediately. In addition: This article only represents the personal opinion of the author and has nothing to do with Mato Finance The originality and the text and content stated in this article have not been confirmed by this site. The authenticity, completeness and timeliness of this article and all or part of the content and text are not guaranteed or promised. Please refer to it for reference only Verify the content yourself.

Copyright belongs to the author.

For commercial reprints, please contact the author for authorization. For non-commercial reprints, please indicate the source.