US stocks are set to pare some of Friday’s declines, with futures edging into positive territory at the start of the week. Asian stocks are however lower at the time of writing, despite China’s May industrial profits posting a positive surprise with a six percent year-on-year growth.

Fears over the global coronavirus pandemic are retaining their place as the primary driver of global market sentiment. Over the weekend, the number of cases worldwide exceeded 10 million, with the death toll now more than 500,000.

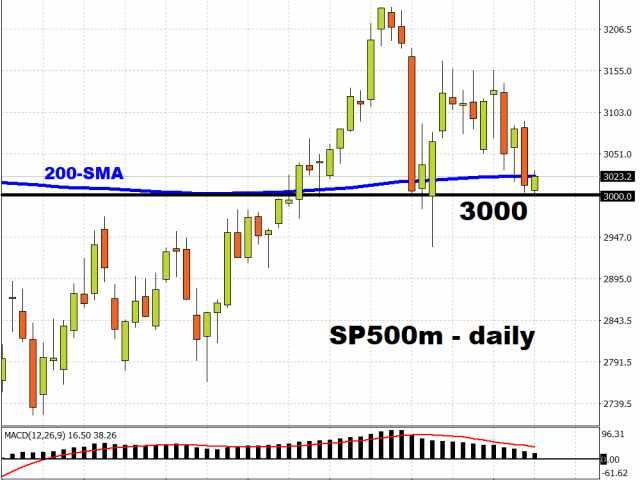

The figures call into question the optimism that has been priced into global stocks, which had seen a stunning surge since March. Yet amid such doubts, S&P 500 minis are attempting to break back above its 200-day simple moving average, or risk sinking back into the sub-3000 domain.

With the average number of cases per day standing at 150,000 as of mid-June, such alarming figures are denting optimism that the worst of the pandemic is over. Concerns are now mounting that the US economic recovery will prove to be a longer-than-expected slog, with some US states reversing their respective reopening plans.

Any further stumbles in America’s quest to overcome the pandemic could chip away at the gains seen in equities over recent months. Another violent capitulation in equities cannot yet be ruled out, more so if the global pandemic takes a sharp turn for the worse and markets swiftly adopt a risk-averse stance. Global investors would do well to tread carefully amid such uncertain times, especially seeing that the upward momentum in risk assets has waned and near-term gains are not guaranteed.

Brexit negotiations could sway Sterling

The Pound is coming face-to-face with a familiar foe once more, as Brexit negotiations resume this week. Over the weekend, UK Prime Minister Boris Johnson reiterated his willingness to walk away from the negotiations if insufficient progress is made on reaching an agreement.

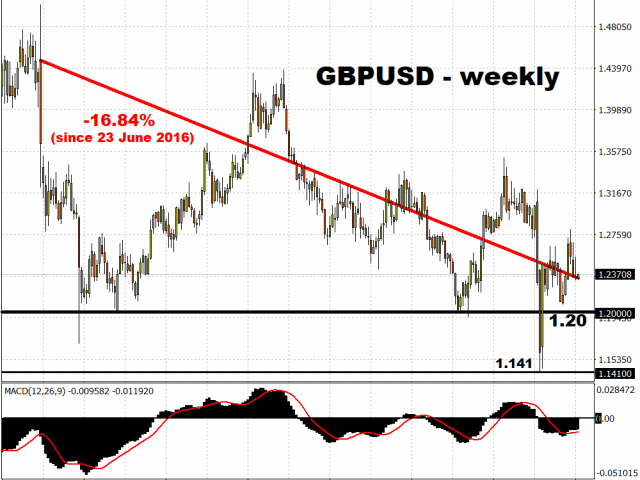

Four years since the referendum, and the currency still cannot shake off the woes that have accompanied the UK’s plans to leave the European Union. Having already tumbled by nearly 17 percent since the Brexit referendum on 23 June 2016, GBPUSD could carve a path back towards the psychologically-important 1.20 level, if investors get the sense that it is likelier that the UK will leave the EU without a deal.

Pound traders are expecting a pickup in volatility as talks intensify over the next few weeks, leaving the currency susceptible to Brexit-related woes throughout the second half of the year in the absence of a trade deal. Such concerns would only compound fears over the UK’s pandemic response as well as the prospects of the BOE adopting negative interest rates, with all the mentioned factors potentially combining to exert sustained downward pressure on Sterling.

MyFxtops 邁投 (www.myfxtops.com) -Reliable Forex Copy Trade community, follow the master for free to trade!

Disclaimer: This article is reproduced from the Internet. If there is any infringement, please contact us to delete it immediately. In addition: This article only represents the personal opinion of the author and has nothing to do with Mato Finance The originality and the text and content stated in this article have not been confirmed by this site. The authenticity, completeness and timeliness of this article and all or part of the content and text are not guaranteed or promised. Please refer to it for reference only Verify the content yourself.

Copyright belongs to the author.

For commercial reprints, please contact the author for authorization. For non-commercial reprints, please indicate the source.