The has Dollar stumbled into the new trading week with a nasty NFP hangover despite enjoying a holiday extended weekend.

There is a strong sense of optimism in the air despite rising coronavirus cases in the United States, and this risk-on mood is boosting appetite for equities at the expense of safe-haven assets like the Dollar.

Expect the Greenback to remain depressed over the next few days if economic data continues to improve and market players repeatedly shrug of rising coronavirus cases in the United States and some other countries.

Given how the migthy Dollar was treated without mercy by every single G10 currency on Monday, the week ahead could rough and rocky if the current themes remain intact.

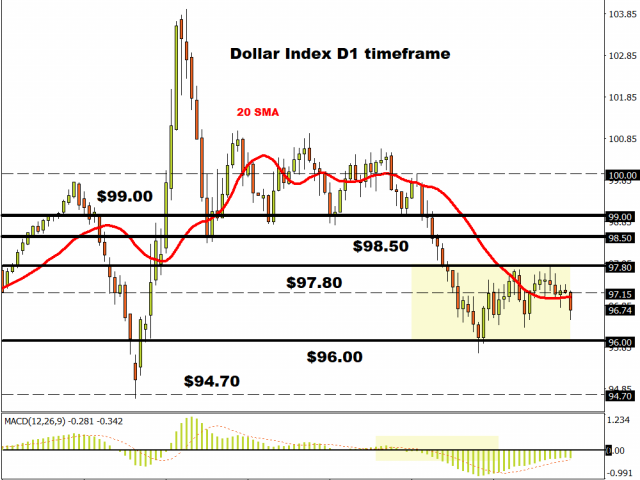

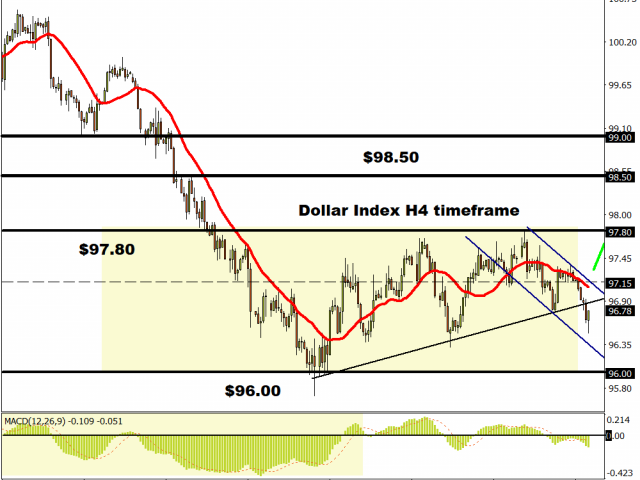

Technical traders will continue to observe how the Dollar Index (DXY) behaves below 97.15 on the daily timeframe. Prices are currently trading under the 20 Simple Moving Average while the MACD points to the downside. If the risk-on remains the name of the game this week, the Dollar Index may sink towards the 96.00 support level. A breakdown below this point could encourage a decline lower towards 94.70.

Dollar bulls can still regain some control above 97.15, which could re-open the gates towards 97.80 as illustrated on the four-hourly timeframe.

Euro enjoys Dollar induced sugar rush

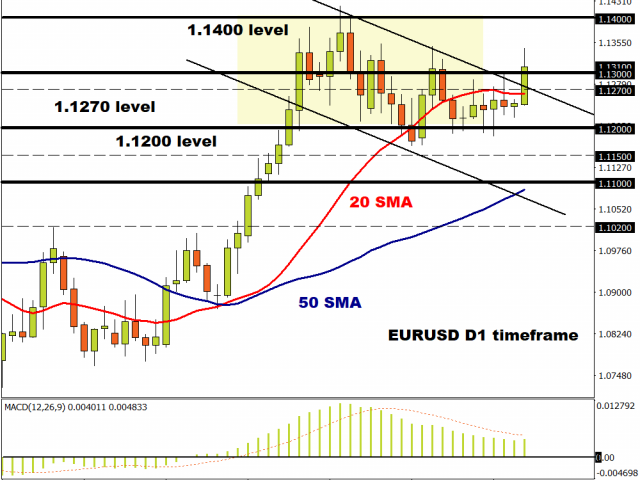

Over the past 18 hours, the EURUSD has jumped over 100 pips to hit a fresh two week high at 1.1340.

Given how the primary driver behind the Euro’s aggressive appreciation was based around a tired and vulnerable Dollar, the upside may face some obstacles down the road. Fundamentally, sentiment towards the European economy remains shaky thanks to rising coronavirus cases, mixed economic data and EU leaders being divided over the €750bn pandemic fiscal plan.

Technically, the EURUSD certainly has the potential to push higher…but that will depend on whether the upside momentum is sufficient enough to secure a solid daily close above 1.1300.

Should this level prove to be reliable resistance, the EURUSD is seen sinking back towards 1.1270 and 1.1200 with a longer-term target around 1.1100.

Gold welcomes weaker Greenback

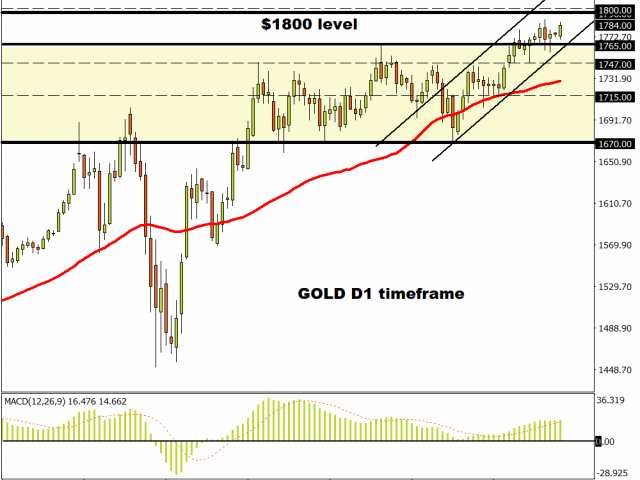

Can you believe Gold is trading only $16 away from $1800.

The precious metal remains bullish on the daily charts as there have been consistently higher highs and higher lows. For as long as $1765 proves to be reliable support, Gold has enough backing to attack $1800. Lagging technical indicators like the 20 Simple Moving Average and MACD support the bullish bias.

MyFxtops 邁投 (www.myfxtops.com) -Reliable Forex Copy Trade community, follow the master for free to trade!

Disclaimer: This article is reproduced from the Internet. If there is any infringement, please contact us to delete it immediately. In addition: This article only represents the personal opinion of the author and has nothing to do with Mato Finance The originality and the text and content stated in this article have not been confirmed by this site. The authenticity, completeness and timeliness of this article and all or part of the content and text are not guaranteed or promised. Please refer to it for reference only Verify the content yourself.

Copyright belongs to the author.

For commercial reprints, please contact the author for authorization. For non-commercial reprints, please indicate the source.