After several of the ‘FAANGs’ made fresh record highs to kick off the week, so the risk pendulum has swung back again with US stocks opening softer on the day so far. The call for a ‘healthy’ bull market in China was heeded in Shanghai as stocks eked out a small gain and much attention now focuses on the yuan’s appreciation and the authority’s tolerance for a stronger currency.

Volatility remains subdued across the G10 FX space with the dollar trading higher against its peers. Is this a classic ‘turnaround Tuesday’ move which bucks the trend just a single day? The taps for global monetary and fiscal policy are fully open so they should backstop risk assets and see the dollar soften in the week ahead.

As expected, the RBA kept its cash rate and 3-year yield target unchanged at 0.25% and stressed it will not raise rates until CPI is sustainably in target and there is progress to full employment.

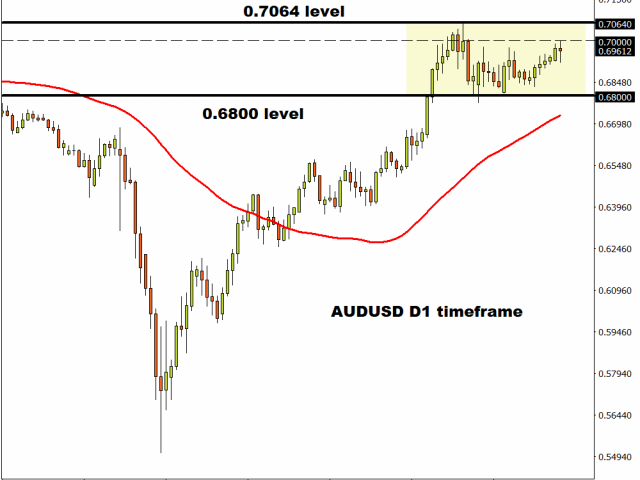

AUD/USD closing in on 0.70

The Aussie is clawing gains back after an initial sell-off during this morning’s RBA meeting. There was no mention of the currency in the policy statement, but the sense of caution was evident by the use of less supportive language.

The flare-up in cases in Australia is adding to that concern so any break above the cycle high at 0.7064 may be tough to sustain. That said, the June consolidation just below this high would generally mean prices should advance higher in line with the dominant trend. Support is at the lower end of the recent range around 0.68.

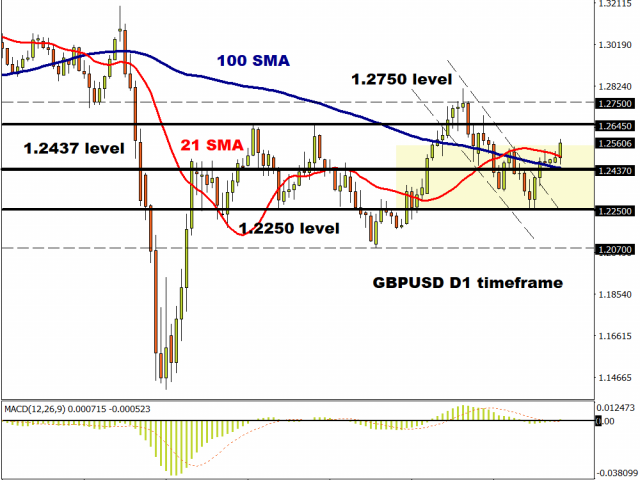

GBP/USD breaks above 1.2550

Markets are turning their attention to Chancellor Sunak’s summer economic update tomorrow where he is expected to announce additional and continued support for the jobs market. A variety of measures have been proposed so the devil will be in the detail.

Resistance around the 1.25 level has been broken today with prices also pushing up through the 21-day moving average. The next upside targets will be the April highs around 1.2645, with support at 1.2437.

MyFxtops 邁投 (www.myfxtops.com) -Reliable Forex Copy Trade community, follow the master for free to trade!

Disclaimer: This article is reproduced from the Internet. If there is any infringement, please contact us to delete it immediately. In addition: This article only represents the personal opinion of the author and has nothing to do with Mato Finance The originality and the text and content stated in this article have not been confirmed by this site. The authenticity, completeness and timeliness of this article and all or part of the content and text are not guaranteed or promised. Please refer to it for reference only Verify the content yourself.

Copyright belongs to the author.

For commercial reprints, please contact the author for authorization. For non-commercial reprints, please indicate the source.