The trading week kicked off on a risk-on note despite coronavirus cases rising across the globe.

Equity markets in Asia, Europe and the United States rallied, even as the World Health Organization (WHO) reported a one-day high for global coronavirus cases. Investors who were searching for a negative correlation between stock markets and Covid-19 infections were left empty handed after riskier assets gained across the board.

On our weekly technical outlook, we discussed the possibility of the Dollar extending losses, Euro gaining ground and Gold hitting $1800. As the mood improved on growth optimism, the Japanese Yen and other safe-haven assets came under fire.

Mid-week the Reserve Bank of Australia was under the spotlight, with the Australian Dollar weakening after the central bank left interest rates unchanged at the record low of 0.25%. Much attention was directed towards the Euro on Wednesday thanks to lacklustre economic data warnings from the European Commission.

The momentum witnessed across stock markets showed no signs slowing on Thursday despite a record daily increase in US COVID-19 infections and sharp rise in deaths. However, Gold found ample support from this negative development, surging to levels not seen in 9 years above $1800.

Given how US earnings season kicks off next week, more volatility across financial markets is certainly on the cards.

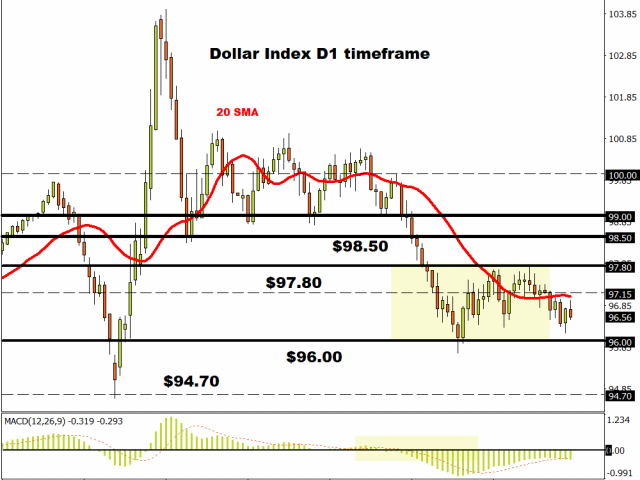

Dollar Index drifts lower.

King Dollar looks tired and slightly defeated on the daily charts. Prices are struggling to push back above 97.15. Sustained weakness below this point may open the doors towards 96.00.

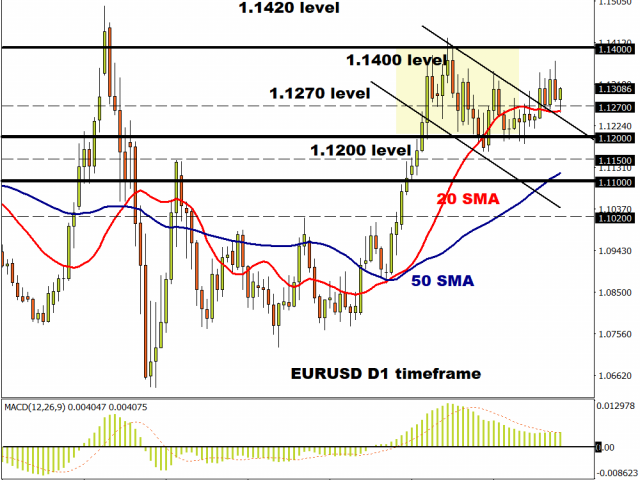

Euro remains choppy

The Euro’s movement against the Dollar was choppy, rough and rocky this week. A breakdown below 1.1270 could open the doors towards 1.1200. If 1.1270 proves to be reliable support, prices may rebound towards 1.1360.

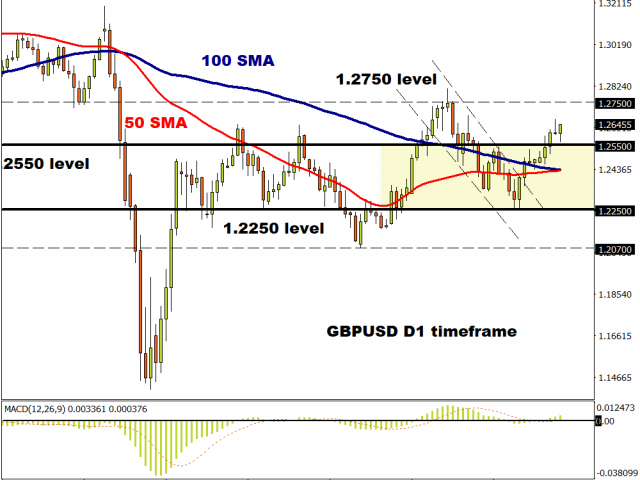

Pound pushes higher

Sterling has appreciated against every single G10 currency this week. GBPUSD bulls are greedily eying the 1.2750 level. With the 50 SMA on the cusp of crossing above the 100 SMA, the technical remain in favour of bulls.

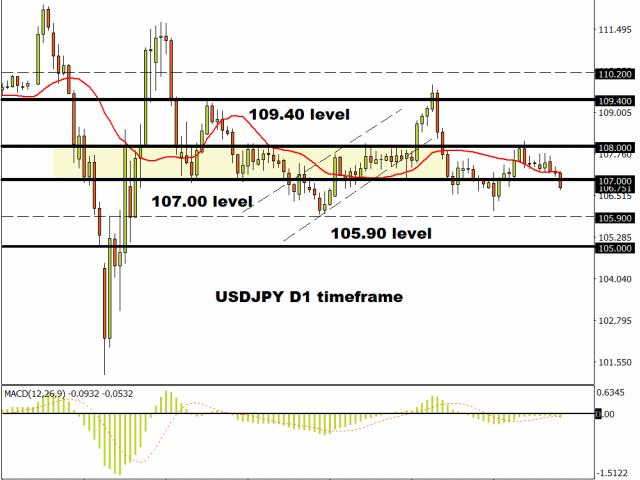

USDJPY breakdown setup in play

The USDJPY has broken below the 107.00 support level. A weekly close below this point may open a path towards 105.90.

Commodity spotlight – Gold

After charging to levels not seen in nine years, Gold may experience a technical correction back towards the $1780-$1765 regions before bulls gather fresh momentum. Although prices have cut through the psychological $1800 level like a hot knife through butter, a weekly close below this point could trigger a much-needed correction.

MyFxtops 邁投 (www.myfxtops.com) -Reliable Forex Copy Trade community, follow the master for free to trade!

Disclaimer: This article is reproduced from the Internet. If there is any infringement, please contact us to delete it immediately. In addition: This article only represents the personal opinion of the author and has nothing to do with Mato Finance The originality and the text and content stated in this article have not been confirmed by this site. The authenticity, completeness and timeliness of this article and all or part of the content and text are not guaranteed or promised. Please refer to it for reference only Verify the content yourself.

Copyright belongs to the author.

For commercial reprints, please contact the author for authorization. For non-commercial reprints, please indicate the source.