The week kicked off with a bang as Gold charged through the 2011 record high of $1921 on Monday amid Dollar weakness, negative real yields and US-China tensions.

Interestingly, global equities pushed higher despite Gold prices making history as investors weighed expectations for another U.S stimulus package against the coronavirus menace.

King Dollar was beaten black and blue this week, depreciating against every single G10 currency and experiencing its worst monthly decline in 10 years! As doubts mount over the pace of US economic recovery in the face of rising coronavirus cases and pre-election jitters kick in, the Dollar could remain unloved and depressed.

In our mid-week technical outlook, we discussed the possibility of the Dollar Index (DXY) slipping below the 93.00 support level. Prices are trading around 92.80 as of writing.

As widely expected, the Federal Reserve held interest rates steady in July. However, the central bank left investors feeling uneasy after warning about the fate of the economy depending ‘significantly on the course of the virus’. To worsen matters, the US economy shrunk the most in post-war history by contracting by 32.9% in the second quarter of 2020.

On the bright side, four of the largest US technology companies announced colossal earnings, against the backdrop of slowing global growth and instability caused by COVID-19.

Apple’s revenues defied expectations, rising 11% to a new record in Q2 despite the disruptions and store closures. Amazon’s revenues were breath-taking, increasing by a whopping 40% as consumers across the globe turned to the online retail giant during lockdown. Even Facebook’s revenues increased by 11% despite the advertising boycott over hate speech in July.

Overall, corporate earnings have not been as bad as initially feared with S&P 500 companies beating expectations at a steady pace. However, it is still early to come to any meaningful conclusions.

As we head into the August, markets may remain volatile and highly sensitive to not only coronavirus related developments but US election uncertainty.

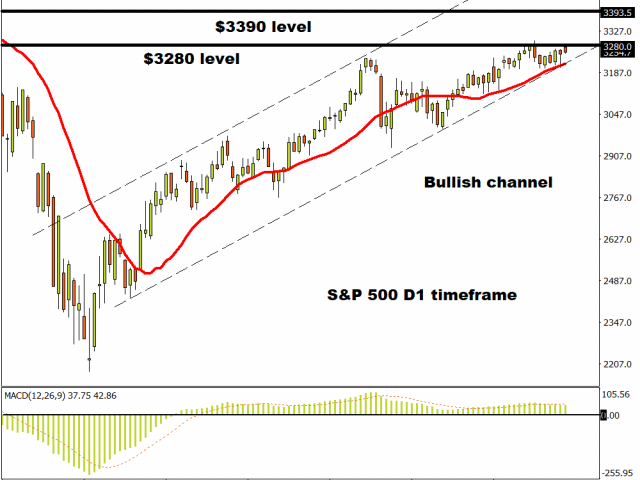

S&P 500 challenges 3280

After experiencing gut-wrenching losses all the way back in Q1, the S&P 500 has clawed back those losses and is currently trading 0.5% higher year-to-date.

Looking at the technical, the Index is bullish on the daily timeframe as there have been consistently higher highs and higher lows since April 2020. A solid breakout above 3820 could encourage an incline towards the yearly high at 3393.52.

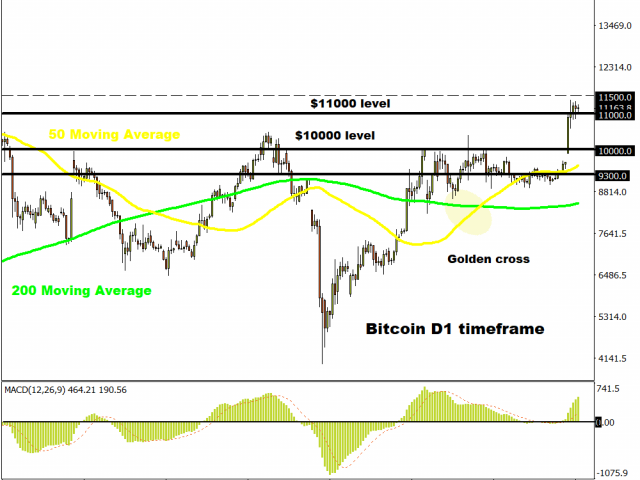

Bitcoin finds comfort above $11000

Bitcoin has spent most the trading week above the $11000 resistance level. If bulls can secure a weekly close above this level, this could signal a move higher towards $11500. Technical lagging indicators such as the moving averages and MACD favour the bullish outlook.

However, a decline back under $11000 may inspire bears to attack $10000.

MyFxtops 邁投 (www.myfxtops.com) -Reliable Forex Copy Trade community, follow the master for free to trade!

Disclaimer: This article is reproduced from the Internet. If there is any infringement, please contact us to delete it immediately. In addition: This article only represents the personal opinion of the author and has nothing to do with Mato Finance The originality and the text and content stated in this article have not been confirmed by this site. The authenticity, completeness and timeliness of this article and all or part of the content and text are not guaranteed or promised. Please refer to it for reference only Verify the content yourself.

Copyright belongs to the author.

For commercial reprints, please contact the author for authorization. For non-commercial reprints, please indicate the source.