The Reserve Bank of Australia (RBA) is set to make its policy decision in just a few hours, and is expected to leave interest rates unchanged at the record low of 0.25 percent. And the Aussie Dollar’s strength over recent months could weigh on the RBA’s discussions today.

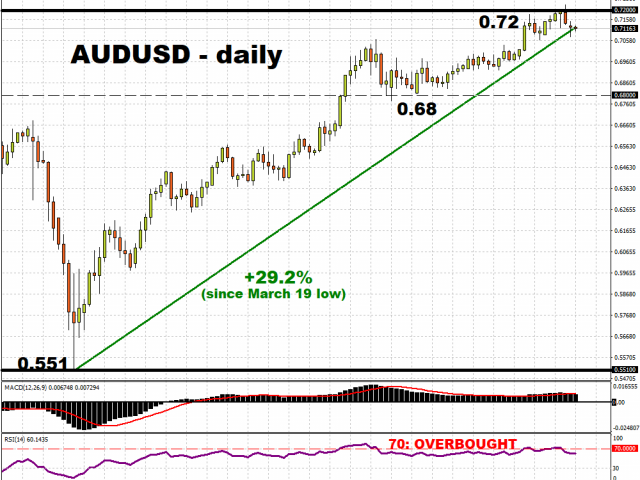

The Australian Dollar has been on a remarkable rise, having strengthened against all of its G10 peers since March 31. AUDUSD has surged over 29 percent since its March 19 low, with the Australian Dollar taking advantage of the weaker Greenback while riding the optimism around China’s post-pandemic recovery.

However, in the days leading up to the central bank’s meeting, AUDUSD has fallen away from the 0.72 psychological level. Aussie traders now stand ready to use any cues out of the RBA to determine how this G10 currency will fare for the rest of this week.

Investors will assess Australia’s monetary policy outlook in light of Victoria state having declared a state of disaster amid a resurgence in coronavirus cases. Victoria is home to about 20 percent of the nation’s population and accounts for about a quarter of Australia’s GDP. With residents of the city of Melbourne now subject to a curfew between 8:00PM and 5:00AM, every day until at least September 13, such lockdown measures are expected to have a major impact on the Australian economy.

The RBA’s previous optimism after the country’s swifter-than-expected reopening following the first wave of Covid-19 cases could be dampened by the realities unfolding in Victoria state. It remains to be seen how the RBA will factor this latest lockdown into its quarterly economic projections due Friday, or if it would make any more policy adjustments to offset the economic effects.

A surprise rate cut today, or any dovish tones out of the central bank this week, could heap more downward pressure on AUD. Still, policymakers might welcome a weaker currency as it helps alleviate Australia’s economic pressures. However, should the RBA stick to its wait-and-see approach, then AUDUSD could resume its upward trajectory, with the recent drop being interpreted perhaps as nothing more than a technical pullback since reaching overbought conditions last week.

MyFxtops 邁投 (www.myfxtops.com) -Reliable Forex Copy Trade community, follow the master for free to trade!

Disclaimer: This article is reproduced from the Internet. If there is any infringement, please contact us to delete it immediately. In addition: This article only represents the personal opinion of the author and has nothing to do with Mato Finance The originality and the text and content stated in this article have not been confirmed by this site. The authenticity, completeness and timeliness of this article and all or part of the content and text are not guaranteed or promised. Please refer to it for reference only Verify the content yourself.

Copyright belongs to the author.

For commercial reprints, please contact the author for authorization. For non-commercial reprints, please indicate the source.