It is shaping up to be yet another rough and rocky trading week for the battered Dollar as investors attack the currency at any given opportunity!

The king of the currency markets has been kicked off the throne, weakening against every single G10 and most Asian currencies since the start of August.

Buying sentiment towards the Greenback remains heavily bruised by crumbling U.S yields, uncertainty over the latest coronavirus relief package, shaky economic fundamentals and jitters ahead of the presidential elections in November. Expect the Dollar to be dragged lower by not only rising coronavirus cases in the United States but tensions between Washington and Beijing.

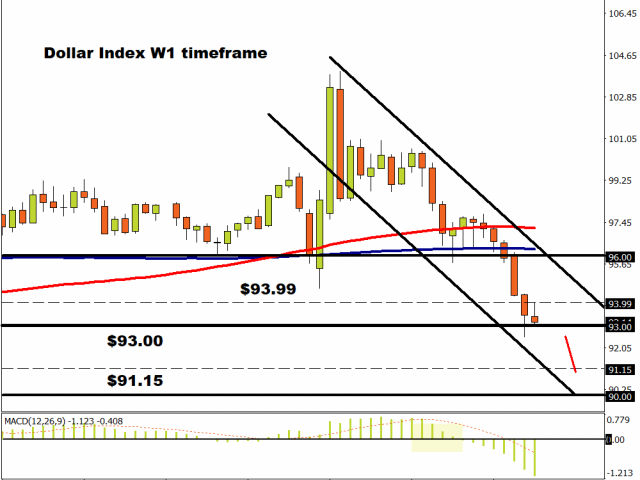

Looking at the technical picture, the Dollar Index (DXY) remains under intense pressure on the weekly timeframe. Prices are trading marginally above the 93.00 support as of writing with a breakdown below this level opening a path towards 91.15 and 90.00, respectively.

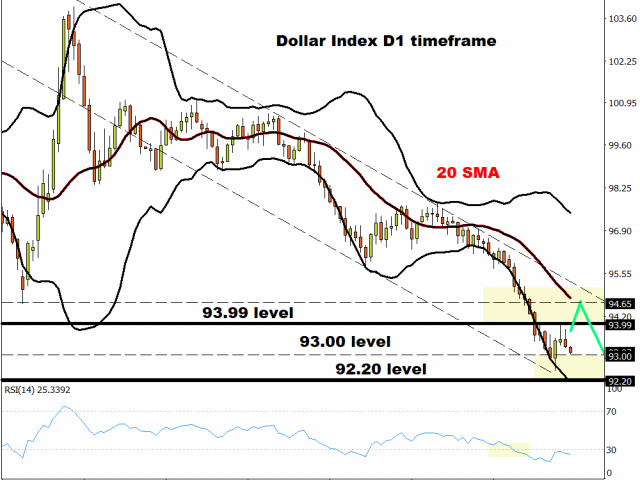

However, a rebound could be on the cards before prices descend deeper into the abyss. The DXY seems to be heavily oversold on the daily charts as confirmed with the Relative Strength Index (RSI) and Bollinger Bands. Should the 93.00 – 92.20 regions prove reliable support, prices could rebound back towards 94.65 before tumbling lower.

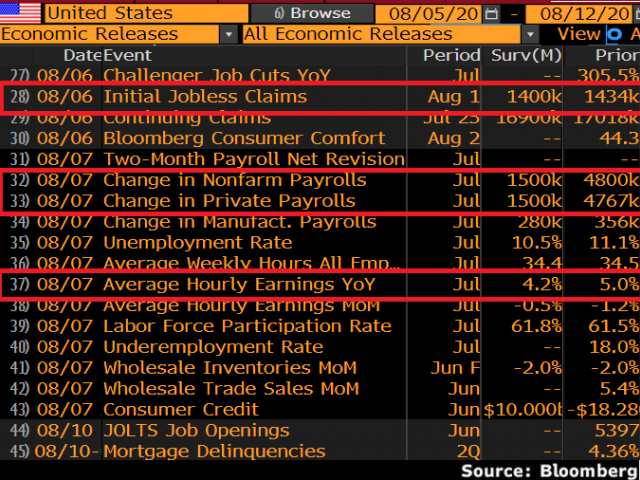

Where the Dollar concludes this week will be influenced by the initial jobless claims data and Non-Farm payrolls report scheduled for release on Friday afternoon. Investors expect the NFP to increase by roughly 1.5 million in July. A figure that meets expectations could inject some life back into the tired Dollar.

USDJPY to resume downtrend?

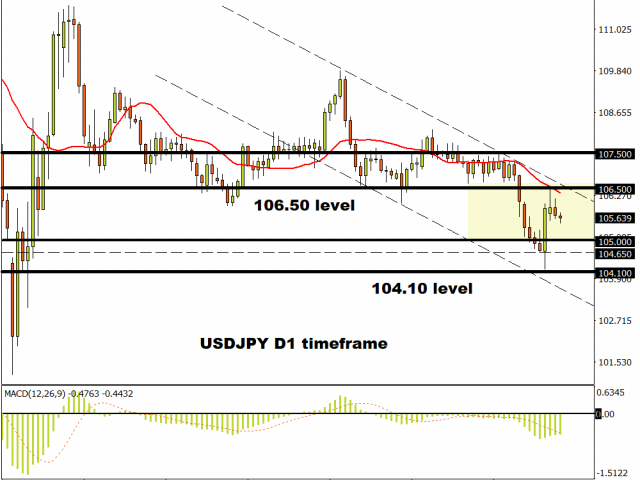

After staging an incredible rebound last Friday, it looks like the USDJPY bears are ready to jump back into the game.

A broadly weaker Dollar is likely to drag the currency back towards the 105.00 level in the short to medium term. Looking at the technicals, there have been consistently lower lows and lower highs while prices ate trading below the 20 Simple Moving Average. A solid breakdown below 105.00 could trigger a move towards 104.650 and 104.10, respectively.

If 106.50 proves to be unreliable resistance, the USDJPY could challenge 107.50.

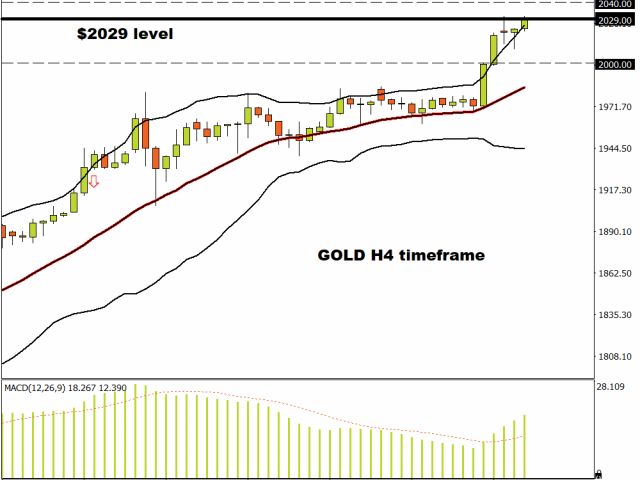

Commodity spotlight – Gold

Everybody is talking about Gold yet again after the precious metal smashed through the psychological $2000 level yesterday evening.

Golds explosive momentum mirrors a train reaching full velocity with fundamentals keeping the engines running at maximum capacity! A broadly weaker Dollar, crumbling U.S yields, pre-election jitters and rising coronavirus cases in the United States among other themes have boosted Gold’s allure.

The precious metal has gained over 33% since the start of 2020 and is trading at an all-time high above $2029 as of writing.

Will bulls have enough energy to challenge $2040 and beyond by Friday or will there be a retracement back towards the psychological $2000 level? Time will tell.

MyFxtops 邁投 (www.myfxtops.com) -Reliable Forex Copy Trade community, follow the master for free to trade!

Disclaimer: This article is reproduced from the Internet. If there is any infringement, please contact us to delete it immediately. In addition: This article only represents the personal opinion of the author and has nothing to do with Mato Finance The originality and the text and content stated in this article have not been confirmed by this site. The authenticity, completeness and timeliness of this article and all or part of the content and text are not guaranteed or promised. Please refer to it for reference only Verify the content yourself.

Copyright belongs to the author.

For commercial reprints, please contact the author for authorization. For non-commercial reprints, please indicate the source.