It is official, the UK economy has entered a recession for the first time in 11 years!

Economic growth during the second quarter of 2020 was a horror show, plunging 20.4% after a 2.2% fall in the first three months of 2020. This was the worst GDP seen in western Europe and clearly illustrated the damaging impacts of coronavirus to the UK economy. To rub salt into the wound, it was only yesterday that data revealed an estimated one million jobs had already been erased during the coronavirus induced lockdown.

Surprisingly, the British Pound offered a fairly muted reaction despite the UK stumbling into the largest recession on record. The currency slightly gained against the Dollar and held its ground against other G10 currencies on Wednesday morning. It looks like the disappointing GDP report was already priced in with investors now evaluating how quickly the UK economy can bounce back. Expect the Pound to become highly sensitive to economic data over the next few weeks as investors access if a V-shaped bounce back could still be on the cards. After today, market players may start questioning whether looser monetary policy and handsome fiscal packages have the ability to revive the UK economy.

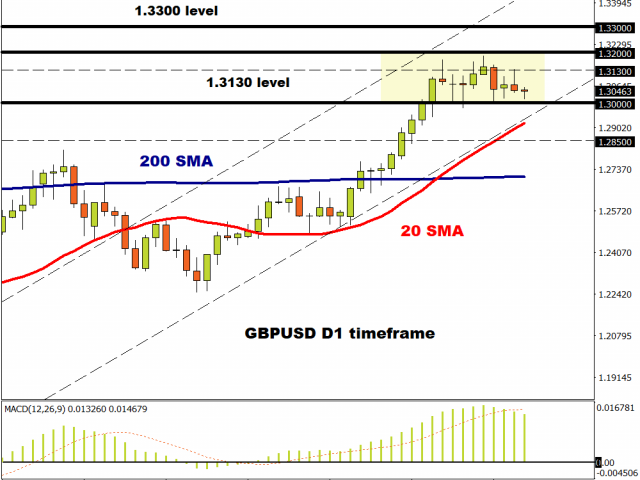

Looking at the technical picture, the GBPUSD remains in a wide range on the daily timeframe with support at 1.3000 and resistance at 1.3200. Prices are trading above 20 & 200 Simple Moving Average while the MACD trades to the upside. The trend is bullish but some fatigue looks to be kicking in with bears eyeing the 1.3000 support. It is worth keeping in mind that the GBPUSD has been stuck between these level’s for the past two weeks with bears constantly pressing against 1.3000.

A solid breakdown below 1.3000 could encourage a decline towards 1.2850. Alternatively, if this level proves to be a tough nut to crack, then a rebound towards 1.3130 could be on the cards.

MyFxtops 邁投 (www.myfxtops.com) -Reliable Forex Copy Trade community, follow the master for free to trade!

Disclaimer: This article is reproduced from the Internet. If there is any infringement, please contact us to delete it immediately. In addition: This article only represents the personal opinion of the author and has nothing to do with Mato Finance The originality and the text and content stated in this article have not been confirmed by this site. The authenticity, completeness and timeliness of this article and all or part of the content and text are not guaranteed or promised. Please refer to it for reference only Verify the content yourself.

Copyright belongs to the author.

For commercial reprints, please contact the author for authorization. For non-commercial reprints, please indicate the source.