After being dragged across the concrete last week, the battered Pound could be instore for more punishment over the next few days amid Brexit related anxieties.

Concerns remain elevated over the United Kingdom ending the transition period without a Brexit deal after the EU’s ultimatum for Boris Johnson to make significant changes to his controversial Internal Market bill within three weeks. Although Parliament is set to debate the bill today any sort of breakthrough is unlikely given the constant back and forth seen over the past four years. The Pound is in trouble and any fresh signs of UK-EU relations deteriorating may haunt investor attraction towards the currency even further.

Before we sink our teeth into the technicals, there are a couple of fundamental events that may influence the Pounds performance this week.

On Tuesday, the UK unemployment rate will be released for August which is projected to jump 4.1% compared to the 3.9% seen in July. Weakness in the labour market despite the government’s furlough scheme may sour sentiment towards the British Pound and UK economy.

Inflation figures will be published on Wednesday morning. Markets expect inflation to accelerate by 0.2% in August versus the 1.0% seen in July.

Super Thursday is unlikely to offer any super surprises as the Bank of England (BoE) is expected to leave interest rates unchanged at 0.1%. However, any dovishness about the UK economy could result in the Pound weakening against the Euro and other major counterparts.

The week ends with the latest retail sales figures which seen rising only 0.5% month-on-month compared to the 3.6% in July. Given how consumption remains an engine for growth in the United Kingdom, disappointing retail sales may compound to the Pound’s woes while raising speculation over the BoE cutting interest rates to 0% in the future.

Pound still nursing deep wounds

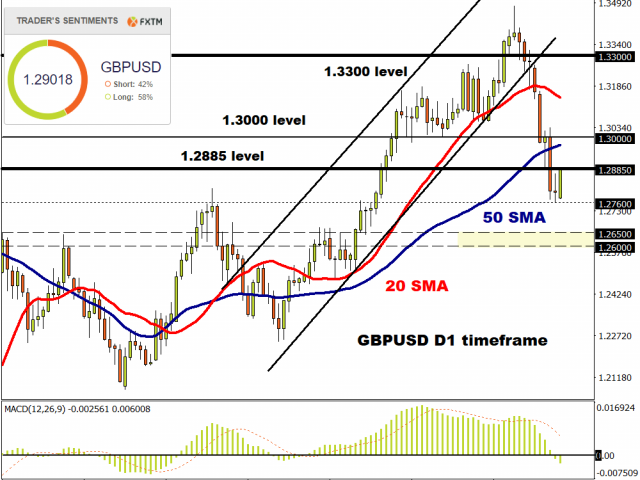

The GBPUSD tumbled almost 4% last week, hitting a 6-week low under 1.2770. It looks like the currency pair is staging a minor rebound today with prices trading towards 1.2880 as of writing. Interestingly, FXTM’s trader’s overall sentiment is long on the currency pair this afternoon.

A technical breakout above the 1.2885 resistance level may encourage an incline towards 1.3000 and potentially 1.3050.

However, prices are trading below the 20 and 50 Simple Moving Average while the MACD points to the downside. If 1.2885 proves to be reliable resistance, prices could decline back towards 1.2760 and 1.2650, respectively.

MyFxtops 邁投 (www.myfxtops.com) -Reliable Forex Copy Trade community, follow the master for free to trade!

Disclaimer: This article is reproduced from the Internet. If there is any infringement, please contact us to delete it immediately. In addition: This article only represents the personal opinion of the author and has nothing to do with Mato Finance The originality and the text and content stated in this article have not been confirmed by this site. The authenticity, completeness and timeliness of this article and all or part of the content and text are not guaranteed or promised. Please refer to it for reference only Verify the content yourself.

Copyright belongs to the author.

For commercial reprints, please contact the author for authorization. For non-commercial reprints, please indicate the source.