Fed chair Jerome Powell poured cold water over stock markets during his latest press conference on Wednesday, as he expressed doubts whether the US economic recovery can persist at the same pace without more fiscal stimulus.

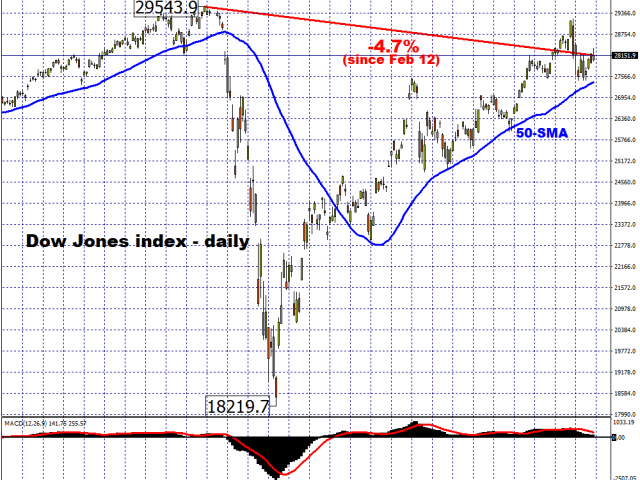

Asian equities are in a sea of red, after US stock indices posted declines on Wednesday. The Dow Jones index was the sole exception, as it eked out a 0.13 percent advance, aided by the climbs in the industrials and financials segments. The US central bank left interest rates unchanged at the record low during their meeting this week, and suggested that rates could be kept near zero until the year 2023, or at least until the US can return to maximum employment and reach the average two percent inflation. Such an ultra-accommodative interest rate environment should keep global equities well bid over the coming years. In technical terms, the Dow may be able to call upon its 50-day moving (MA) average to guide the index higher eventually. However, at the time of writing, the FXTM trader’s sentiment is short on the Wall Street 30 (Mini).

However, stocks bulls may not get the near-term boost that they desire, considering the stalemate in negotiations over the next round of US fiscal stimulus. Despite US President Donald Trump saying on Wednesday evening that he was more open to bridging the gap with Democrats, markets remain doubtful that the next support package can arrive before the elections on November 3. Global investors are also fearing a delayed outcome to the polls, with the political uncertainty further delaying the much-need financial support. Such a major event risk, if it happens, is then likely to trigger heightened volatility in global equities. At the time of writing, US stock futures are edging slightly lower.

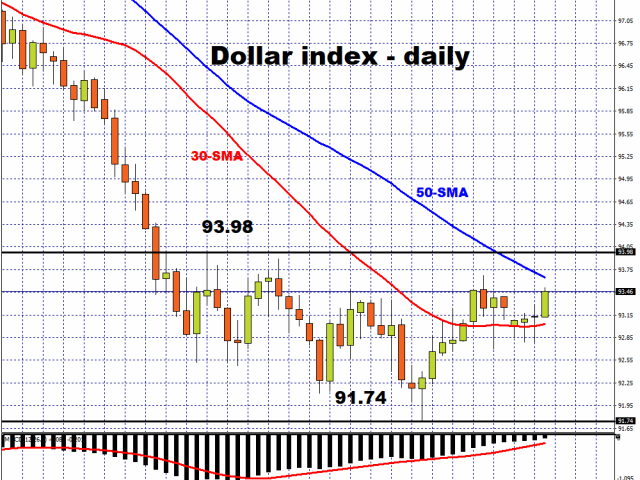

The concerns over the delayed US fiscal stimulus are also set to colour the jobless claim data due out later Thursday, with both initial claims as well as continuing claims expected to show slight declines. Yet, with about 13 million Americans still having to rely on unemployment benefits along with the more than 800,000 still being added to that list per week, such figures only underscore the need for more financial support for the vulnerable segments of the US economy. Further signs that the recovery in the US jobs market is stalling, even as the world’s largest economy presses on with its reopening, could trigger more risk aversion which may push the Dollar index closer to its 50-day MA.

MyFxtops 邁投 (www.myfxtops.com) -Reliable Forex Copy Trade community, follow the master for free to trade!

Disclaimer: This article is reproduced from the Internet. If there is any infringement, please contact us to delete it immediately. In addition: This article only represents the personal opinion of the author and has nothing to do with Mato Finance The originality and the text and content stated in this article have not been confirmed by this site. The authenticity, completeness and timeliness of this article and all or part of the content and text are not guaranteed or promised. Please refer to it for reference only Verify the content yourself.

Copyright belongs to the author.

For commercial reprints, please contact the author for authorization. For non-commercial reprints, please indicate the source.