It’s Tuesday, so that appeared to mean a turnaround in markets as stocks made a comeback from the sharp selloff yesterday, in Europe at least. However, the S&P500 has currently just gone red and is not bouncing back from the 1.2% fall on Monday, while the tech-heavy Nasdaq is flat on the day so far.

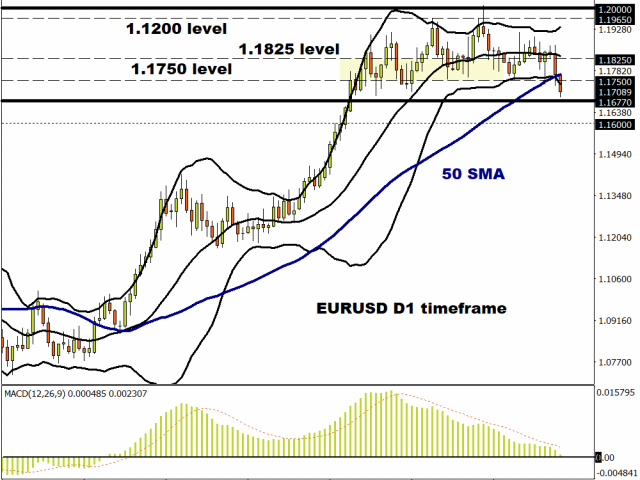

The Dollar is building on its gains this week and trying to break out of its recent range stretching back to the end of July, with the Euro now hitting a fresh six-week low around 1.17. The market mood remains cautious ahead of a turbulent few months, with US politics and Covid contagions leading to more stringent lockdowns sullying the V-shaped recoveries of many economists.

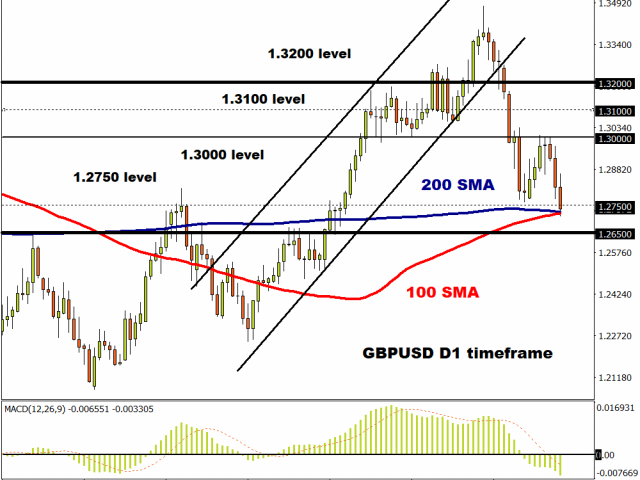

Sterling is the weakest major among its G10 peers today, even though it has recovered some ground after the Governor of the Bank of England made it clear that the Bank did not plan to push rates below zero in the near future. But new lockdown measures announced by Boris this afternoon are not helping GBP bulls.

BoE walks back guidance

Markets are reigning in UK interest rate cut bets after Governor Bailey noted that the Bank’s look into implementation of negative rates…is just that! It is not a direct signal that slicing rates into negative territory is impending and money market traders have reacted accordingly, by pushing back on a rate cut to May from March next year.

One other bit of interesting news on the wires today was that the EU’s Barnier is reportedly travelling to London tomorrow for informal trade talks. As Michael Gove is travelling in the other direction for a Joint Committee meeting, this has got trader’s tongues wagging about the possibility of a trade deal…

Cable is currently trading bang on where the 100- and 200-day Moving Average converge at 1.2723 and 1.2726 respectively. It goes without saying this is very strong support, but if this gives way then the big figure at 1.27 and the 1.2650 area may come quickly.

MyFxtops 邁投 (www.myfxtops.com) -Reliable Forex Copy Trade community, follow the master for free to trade!

Disclaimer: This article is reproduced from the Internet. If there is any infringement, please contact us to delete it immediately. In addition: This article only represents the personal opinion of the author and has nothing to do with Mato Finance The originality and the text and content stated in this article have not been confirmed by this site. The authenticity, completeness and timeliness of this article and all or part of the content and text are not guaranteed or promised. Please refer to it for reference only Verify the content yourself.

Copyright belongs to the author.

For commercial reprints, please contact the author for authorization. For non-commercial reprints, please indicate the source.