European stocks have hit three-month lows as worries about the prolonged economic damage from coronavirus will not go away, while US markets are volatile, with the Nasdaq on course for its worst month since March. The tech-heavy index touched official ‘correction’ territory just after the open, but this comes after a rampant 65% gain from April to the August highs. It certainly seems like markets are working it out now that fiscal action in the US will be limited to damage control rather than any significant spending package if it comes before the Presidential elections.

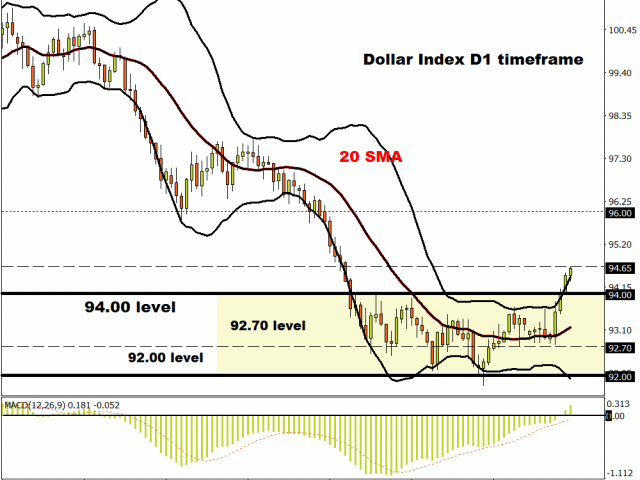

One asset which is liking all this uncertainty and disappointment from a Fed waving the white flag in the last few days, is the Dollar. The greenback has added to its gains through the week as it sits on track for its strongest weekly performance since early-April. The shorts are definitely trimming their positions and running to the ‘close position’ door in quick fashion ahead of the depressing increases in virus contagions.

Fed speakers are again on tap this afternoon after yesterday’s continued line that they will remain on hold for a long time and are unwilling to go the extra mile. While they are not able or willing to inject more momentum into the reflation trade, pushing the onus increasingly on to the fiscal policymakers and Government, markets are in a sombre mood.

Sunak giving a boost to Sterling

The pound is the top performing major currency today, as it makes back some of the 4.5% drop it has suffered since the start of September. The UK Chancellor unveiled support measures this afternoon for jobs and businesses, as the Government strives to ‘protect jobs though the winter’. Unemployment would have risen sharply in the coming months as the furlough scheme ends in October, but the new scheme is less generous. More importantly for the Treasury, it will cost alot less which matters when the size of UK public debt was equivalent to UK GDP at the end of July.

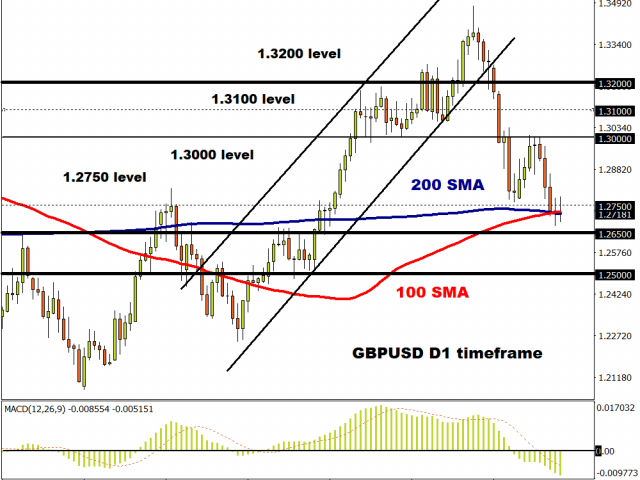

Cable is just about bouncing off the crossing of the 100- and 200-day Moving Averages at 1.2703 and 1.2722 respectively. Prices need to get back above the mid-September lows around 1.2762 to have a chance of building any bullish momentum. Allowing for the current pause in recent selling, indicators looks quite bearish with 1.2650 opening up, if the Moving Averages prove to be feeble in their support.

MyFxtops 邁投 (www.myfxtops.com) -Reliable Forex Copy Trade community, follow the master for free to trade!

Disclaimer: This article is reproduced from the Internet. If there is any infringement, please contact us to delete it immediately. In addition: This article only represents the personal opinion of the author and has nothing to do with Mato Finance The originality and the text and content stated in this article have not been confirmed by this site. The authenticity, completeness and timeliness of this article and all or part of the content and text are not guaranteed or promised. Please refer to it for reference only Verify the content yourself.

Copyright belongs to the author.

For commercial reprints, please contact the author for authorization. For non-commercial reprints, please indicate the source.