Global stocks flashed bright red on Monday as coronavirus cases spike outside of China, raising concerns about the prospects of a pandemic.

Asian and European stocks crumbled while the Dow Jones plunged over 900 points amid the risk aversion. Investors have clearly entered the trading week with a mission to avoid riskier assets with safe-haven instruments like the Dollar, Japanese Yen and Gold poised to shine through the market chaos.

Dow Jones plunges over 3%…

US equity bears shifted into a higher gear today with the Dow Jones collapsing like a house of cards as coronavirus cases grew.

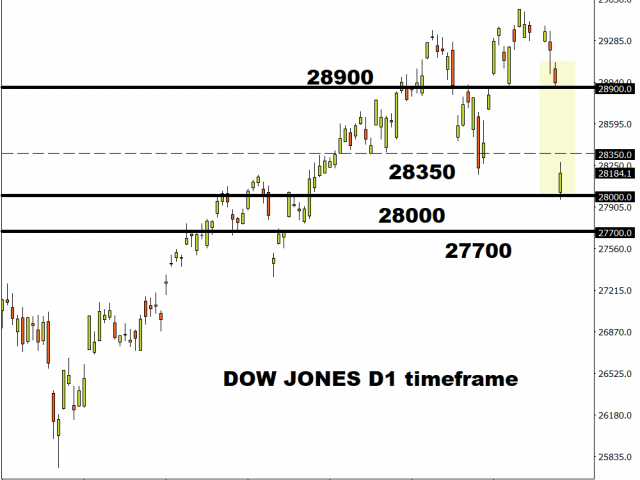

The technical picture is shifting in favour of bears on the daily charts with prices trading around 28190 as of writing. A solid daily close below 28000 could signal further downside with 27700 acting as the new key level of interest. Should 28000 prove to be a reliable support, the Dow Jones could attempt to close the gap by rebounding towards 28350 and 28900, respectively.

S&P 500 wobbles above 3230

The S&P 500 has entered the week on the wrong side of the bed.

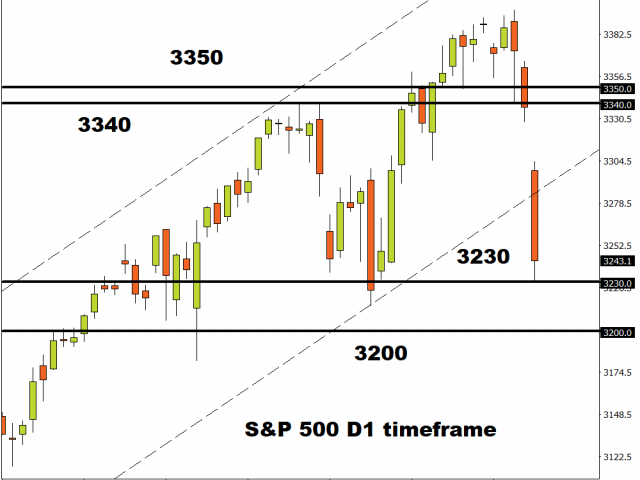

Prices have gapped down on risk aversion and could extend losses in the week ahead. A breakdown below 3230 could signal a drop towards 3200. If 3230 proves to be a strong support, the S&P 500 could rebound back towards 3300 and 3340, respectively.

Gold aims for the stars and beyond

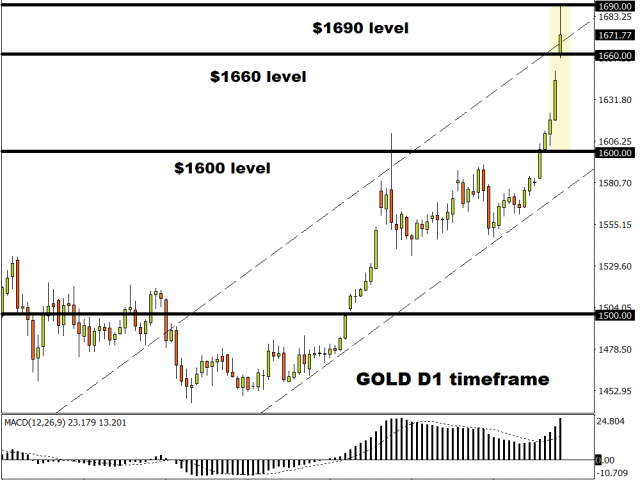

Gold aimed for the stars today, jumping over 2% to hit a fresh 7 year high above $1685 as investors sprinted towards hot-spots of safety.

The precious metal is heavily bullish on the daily charts as there have been consistently higher highs and higher lows. A solid daily close above $1660 should seal the deal for a move towards the psychological $1700 level. If Gold bulls run of steam and prices end up sinking back below $1660, the next level of interest will be around $1620.

Currency spotlight – GBPUSD

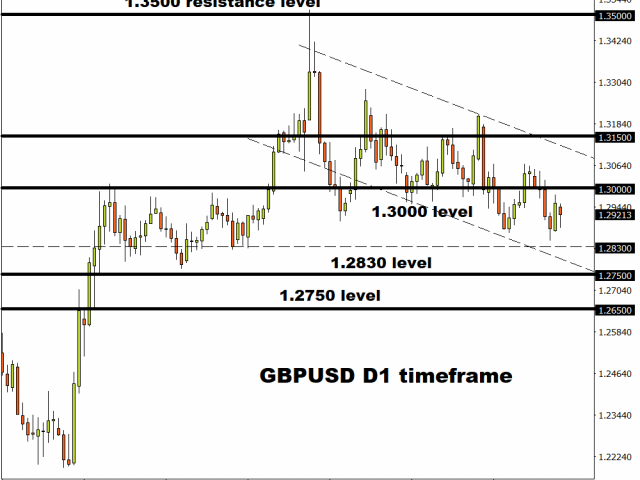

The Pound seems to be experiencing a period of calm ahead of the storm known as Brexit. With post-Brexit talks officially kicking off in early March, the GBPUSD could turn volatile. In regards to the technical picture, prices are trending lower on the daily charts. A breakdown below 1.2830 could inspire a move towards 1.2750 and 1.2650.

Altenratively, a breakout above 1.3000 should signal a rebound towards 1.3070 and 1.3150.

MyFxtops 邁投 (www.myfxtops.com) -Reliable Forex Copy Trade community, follow the master for free to trade!

Disclaimer: This article is reproduced from the Internet. If there is any infringement, please contact us to delete it immediately. In addition: This article only represents the personal opinion of the author and has nothing to do with Mato Finance The originality and the text and content stated in this article have not been confirmed by this site. The authenticity, completeness and timeliness of this article and all or part of the content and text are not guaranteed or promised. Please refer to it for reference only Verify the content yourself.

Copyright belongs to the author.

For commercial reprints, please contact the author for authorization. For non-commercial reprints, please indicate the source.